The UK’s financial services sector is facing falling investment, posing a risk to this vital part of the country’s economy. In response, regulators must balance consumer protection with growth, by ensuring proportionate oversight, clear rules and targeted support.

The UK’s financial services sector is vital to the wider economy. London remains a global financial hub, second only to New York, underpinned by a long-standing reputation for balanced regulation.

But research shows that regulation is a double-edged sword for the sector. With equity fundraising falling to decade lows, policy-makers face the challenge of fostering regulatory clarity and growth-friendly frameworks without compromising consumer protections.

To ensure financial services remain both competitive globally and central to Britain’s economic future, regulators should adopt an approach with proportionate oversight, streamlined approvals and targeted sub-sector support packages.

Capital gains

The UK financial services sector is a powerful economic force. Firms in this sector generate a combined annual turnover of £1.08 trillion, manage more than £27 trillion in assets, and employ around one in ten workers nationally.

Finance also remains one of the few areas of the economy that runs a sizeable export surplus. In 2022/23, UK financial services exports were valued at close to £100 billion – more than Switzerland, France, Germany, Ireland, Spain and Luxembourg combined. The sector contributes £200 billion annually to GDP and 9% of government tax receipts.

Much of the financial activity is concentrated in the City of London. With a pedigree stretching back centuries, London remains one of the world’s leading financial hubs. It currently ranks just behind New York in the Global Financial Centre Index, consistently outperforming European peers such as Paris, Frankfurt and Geneva, even in the post-Brexit period.

A key reason for this enduring strength is regulation. The UK has built a reputation for balancing innovation with consumer protection. After the 2007/08 financial crisis, the pendulum swung towards safety, with successive governments erring on the side of tighter oversight. The challenge today is whether the regulatory framework still strikes the right balance.

Regulation nation

Earlier this year, Beauhurst – a company specialising in private sector data – collaborated with the Financial Conduct Authority (FCA) to measure how firms and investors have responded to regulatory change since 2013. Beauhurst’s findings underline a complex picture: some rules have provided clarity and boosted confidence, while others appear to have raised costs and dampened investment.

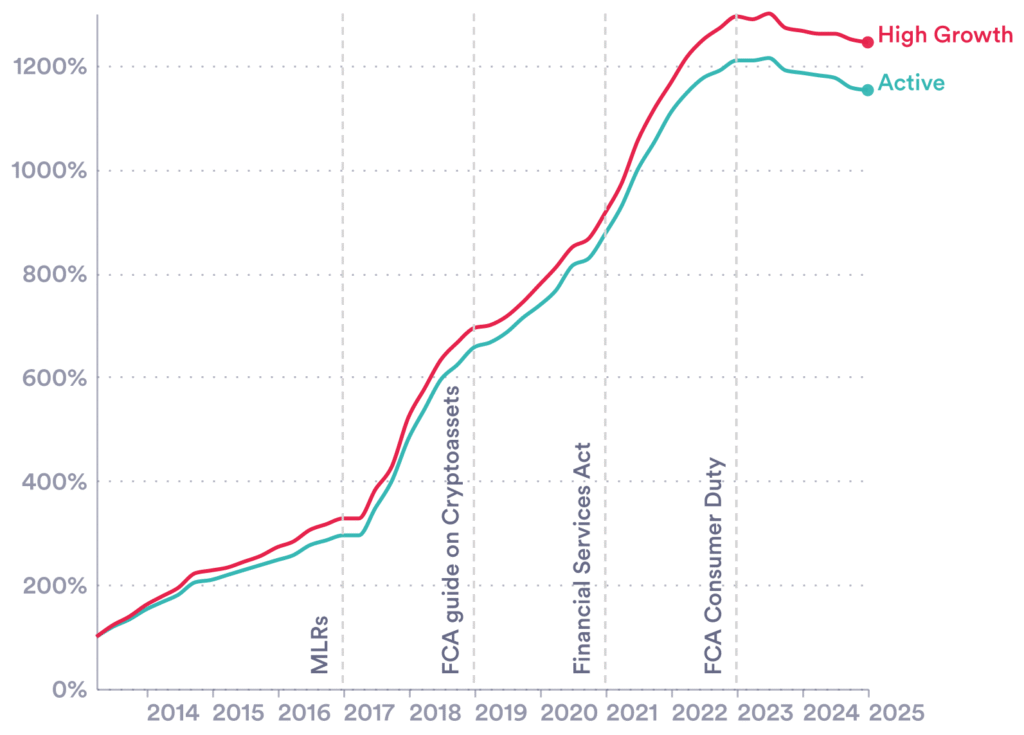

One clear example is ‘cryptoassets’. The number of UK crypto-businesses almost doubled following the FCA’s Money Laundering Regulations in 2017. Growth accelerated again after the FCA’s 2019 Guidance on Cryptoassets and the passage of the Financial Services Act in 2021 (Figure 1). Clearer rules gave legitimacy to a nascent sector, reassuring investors and encouraging market entry.

Figure 1: Change in the number of ‘active’ and ‘high growth’ cryptocurrency companies, 2013- 2025

Source: Beauhurst (2025)

FinTech is a similar story. While the FCA has not issued FinTech-specific regulations, founders and investors have responded positively to adjacent frameworks such as the Payment Services Regulation (2017) and the Cryptoasset Guidance (2019).

In Beauhurst’s research, the Research & Consultancy team highlight examples like Laka and Currensea, which joined the FCA Digital Sandbox and subsequently secured multi-million-pound equity investments. Regulatory initiatives that offered clarity and legitimacy boosted confidence in these fast-growing businesses.

Warning signs: when regulation slows the market

Not all rules have been so beneficial to the market. Beauhurst collect financial and fundraising data on over 4.8 million active private companies operating across the UK. Beauhurst’s Research & Consultancy team were recently commissioned to undertake an analysis of financial and fundraising trends across the sector since the establishment of the FCA in 2013. This found that in some high-growth segments, new regulatory layers have coincided with a rise in company exits and a slowdown in equity fundraising across the UK’s financial services sector.

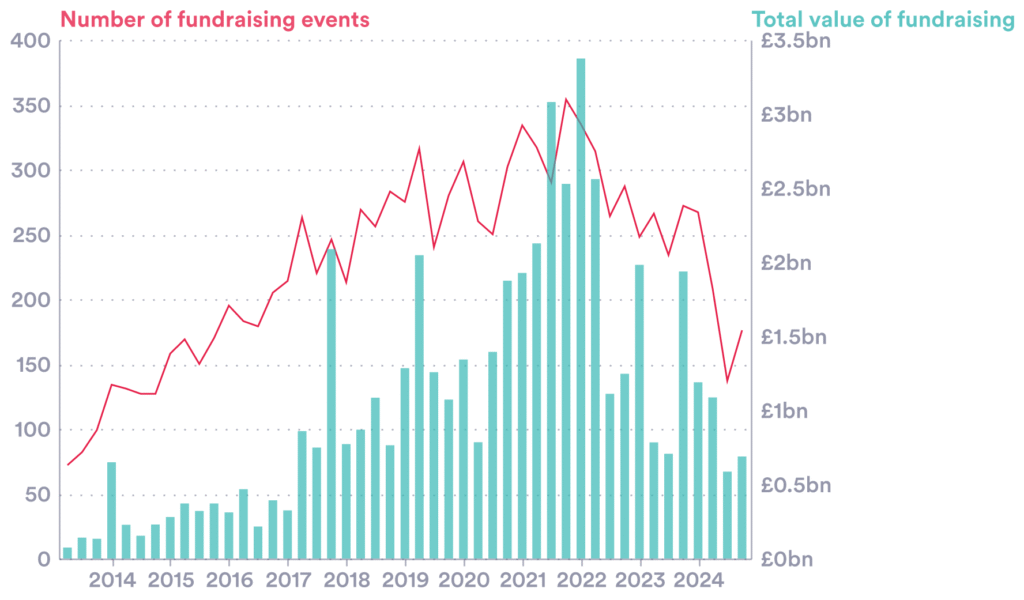

Although the sector succeeded in attracting large levels of investment following the Covid-19 pandemic, a key turning point appears to have been the introduction of the FCA’s Consumer Duty standard (Figure 2). Launched in 2023, the duty requires firms to deliver good outcomes for retail customers, raising standards on product value, transparency and communications. While welcomed by consumer advocates, the regulation significantly raised compliance requirements. Firms must evidence outcomes, redesign processes and overhaul governance, ultimately driving up costs.

Figure 2: Equity investment into private UK financial services companies, 2013Q2 - 2024Q4

Source: Beauhurst (2025)

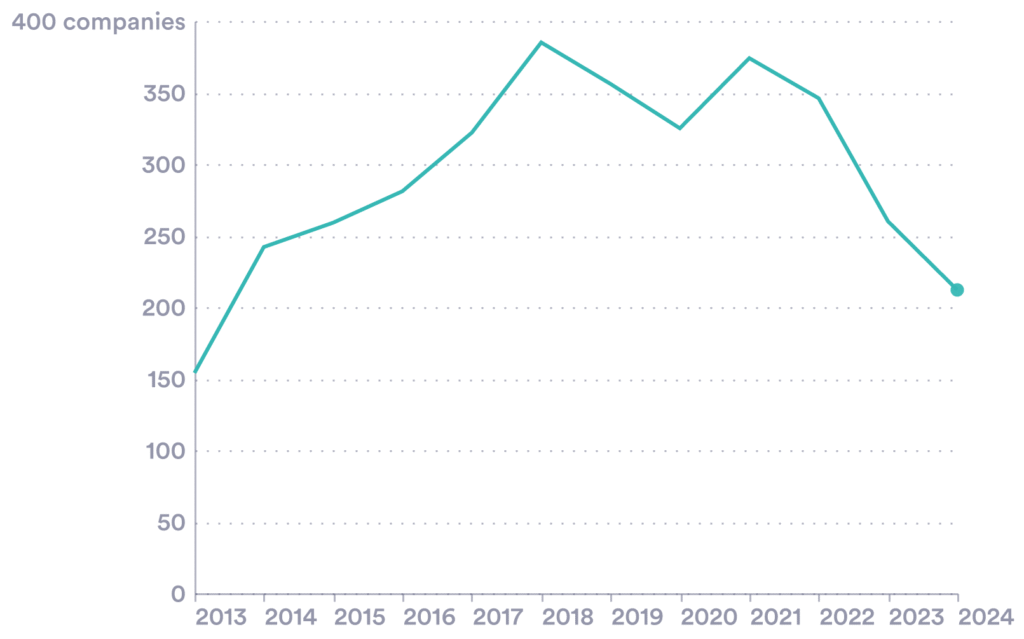

Beauhurst’s analysis shows FinTech company growth plateauing after the duty came into force. For the first time in a decade, exits outpaced new company formations. Equity fundraising also fell back to levels last seen in 2017, after peaking immediately prior to the introduction of the legislation. As shown in Figure 3, early-stage activity has been particularly hit: first-round fundraising events dropped from over 350 in 2021 to just above 200 in 2024 – the lowest in a decade.

Figure 3: First-round fundraising for UK financial services companies, 2013-2024

Source: Beauhurst (2025)

The slowdown has not been confined to FinTech. Cryptoassets, banking and other regulated segments all show weaker growth trajectories in the wake of new compliance demands. What had been a broad-based boom through the late 2010s and early 2020s now looks more fragile.

The market moves with its feet

Investor sentiment mirrors this shift. For much of the past decade, the financial services sector has attracted strong equity inflows, with FinTech leading the charge. But since the arrival of the Consumer Duty standard, fundraising events and total investment have both declined sharply.

The British Business Bank’s Small Business Equity Tracker confirms the wider picture: in 2024 equity investment fell to £10.8 billion, with deal numbers down 15% to just over 2,000 – the lowest since 2018 and a third below the 2021 peak.

Investors appear to be waiting for regulatory stability before committing fresh capital. The contrast is stark: Beauhurst’s recent report shows UK financial services sector (or FSS) deal flow (e.g. value and number of deals) surging from 2015 to 2021, only to flatten afterwards, while investment into traditional financial services remains subdued. As a result, investors are now holding back – especially on later-stage funding which has dropped faster than early-stage investment. This could be a sign that investors are waiting for clearer rules before putting their money into scaling FSS businesses. The message is clear: uncertainty and rising compliance costs weigh on confidence, even in sectors that had previously been engines of growth.

A shifting regulatory landscape

The story is not all negative. Both policy-makers and regulators are signalling a shift towards growth-friendly reform. Chancellor Rachel Reeves has announced measures to stimulate retail investment. For example, banks will prompt customers towards share ownership, risk warnings will be revised and capital requirements trimmed. Mortgage access is also set to be eased and approval processes for smaller firms simplified.

At the same time, the FCA is updating how it supervises firms – aiming to make oversight more proportionate and supportive. Compliant firms will see lighter oversight, application processes are being streamlined and pre-application support is being expanded. Pilot initiatives in areas like digital securities and capital markets also hint at a more flexible stance.

Balancing act: regulation for growth

The evidence points to regulation as a double-edged sword. When clear, proportionate and innovation-friendly, it can accelerate growth – as seen with crypto and FinTech sandboxes. But when burdensome or poorly timed, it risks chilling investment and prompting exits, as illustrated by the FCA’s Consumer Duty standard.

Policy-makers face a delicate balancing act. Beauhurst’s study shows that regulation is not just about consumer protection: it also shapes the incentives and confidence of entrepreneurs and investors. For a sector that underpins 9% of tax receipts and exports more than £100 billion annually, the stakes could not be higher.

A more growth-friendly regulatory regime should begin by prioritising clarity and predictability. Uncertainty heightens investment risk, while consistent and transparent rules reduce hesitation. At the same time, regulators need to embrace innovation-friendly tools such as sandboxes, fast-track approvals and tailored guidance. These mechanisms allow firms to test new products and business models under supervision, nurturing growth while maintaining oversight.

Burdensome regulation should be targeted more strategically. Expanding pre-application support for FinTech and token platforms, while scaling back requirements in areas where risks are lower, would help the UK’s financial watchdog strike a better balance. Just as importantly, policy-makers must actively monitor for unintended consequences – such as regulation suppressing growth or driving up exit rates in high-growth sub-sectors.

Finally, when equity markets are fragile, regulators and government can play a supporting role. With deal volumes already falling back to levels not seen in a decade, there is a strong case for public or regional investors to step in and fill capital gaps, ensuring that promising businesses do not falter simply because of cyclical shifts in investor confidence.

Conclusion

Regulation is neither a panacea nor a performance brake. Research (including Beauhurst’s recent analysis) shows that when struck well, rules can ignite innovation and confidence. But when misaligned or mis-timed, they can stall investment and push businesses out of the market.

As the UK looks to financial services as a driver of growth, the regulatory community must tread carefully: bold where clarity is needed, cautious where burdens risk outweighs benefits and always transparent. Get this balance right and the sector can sustain its global leadership while supporting the next wave of growth in the UK.

Where can I find out more?

- ‘The Growth Gap: A Literature Review of Regulation and Growth’, Financial Conduct Authority (October 2024).

- ‘Improving productivity measurement in the UK financial services sector’, LSE Growth Lab (June 2025).

- ‘Can reforms of financial regulation encourage economic growth?’, Economics Observatory (March 2025).

Who are experts on this question?

- David Stallibrass (FCA, Co-Deputy Chief Economist)

- Professor Richard Davies (LSE Growth Lab, Director)

- John Gathergood (University of Nottingham)

- Sarah Hall (University of Cambridge)