The crisis is likely to produce a severe recession in Northern Ireland. Previous experience suggests that the recovery phase could be rather shallow. Indeed, strictly speaking, the region’s economy had not completed its recovery from the last recession before Covid-19 struck.

History suggests that Northern Ireland’s economy may take many years to return to the level of output attained in 2019.

The recovery in Northern Ireland is likely to be slower than in the rest of the UK – what economists refer to as more U-, L- or even W-shaped recovery than a recovery that is V-shaped with a quick bounceback from the severe downturn.

A massive increase in public spending will help to maintain levels of demand and may shield some businesses and jobs.

Northern Ireland has a long history of subsidies to the private sector. One threat to recovery is that the response to the crisis might add to the historical problems of overreliance on the UK Treasury, which blunts the incentive to make appropriate but tough policy decisions to improve the region’s competitiveness.

This could be a good opportunity to design and implement better policy in Northern Ireland.

A very large recession

The crisis is likely to produce a severe recession in Northern Ireland, as in the rest of the UK. Northern Ireland’s GDP could decline by at least 8-10% in 2020. That projection is based on two methods, both assuming a lockdown of three months:

- First, by considering how far demand might fall. Estimates suggest that consumer spending on non-essentials will fall, and there will be a reduction in private sector investment that will be partly compensated by increases in government spending (Hetherington et al, 2020).

- Second, by applying the estimates used by the Office for Budget Responsibility (2020) relating average declines in output across the UK.

Early indications are that the pace of relaxation of social distancing restriction will be slower in Northern Ireland than in England, making a decline of even more than 8-10% a real possibility. Based on the sectoral and skills composition of the workforce in Northern Ireland, McKinsey (2020) judge that Northern Ireland, along with parts of the Scottish Highlands and parts of north and south Wales as well as Yorkshire, would probably experience a deeper recession than the UK average.

Will the recovery be as sharp as the contraction?

Economists talk about the shape of a recession. In a V-shaped recession, there is a sharp fall in GDP but then a similarly steep increase – so, for example, a decline in GDP of 10% in 2020 might be followed by growth of more than 10% in 2021. That would imply that within less than two years, output would be more or less at the same level as it would have been on the pre-virus trend line.

It is very uncertain, but there are grounds for believing a V-shaped recession is not likely for Northern Ireland. Alternatively, a U-shaped recession has a longer period before GDP starts to increase or an L-shaped profile, where GDP does not return to previous growth rates. This is why:

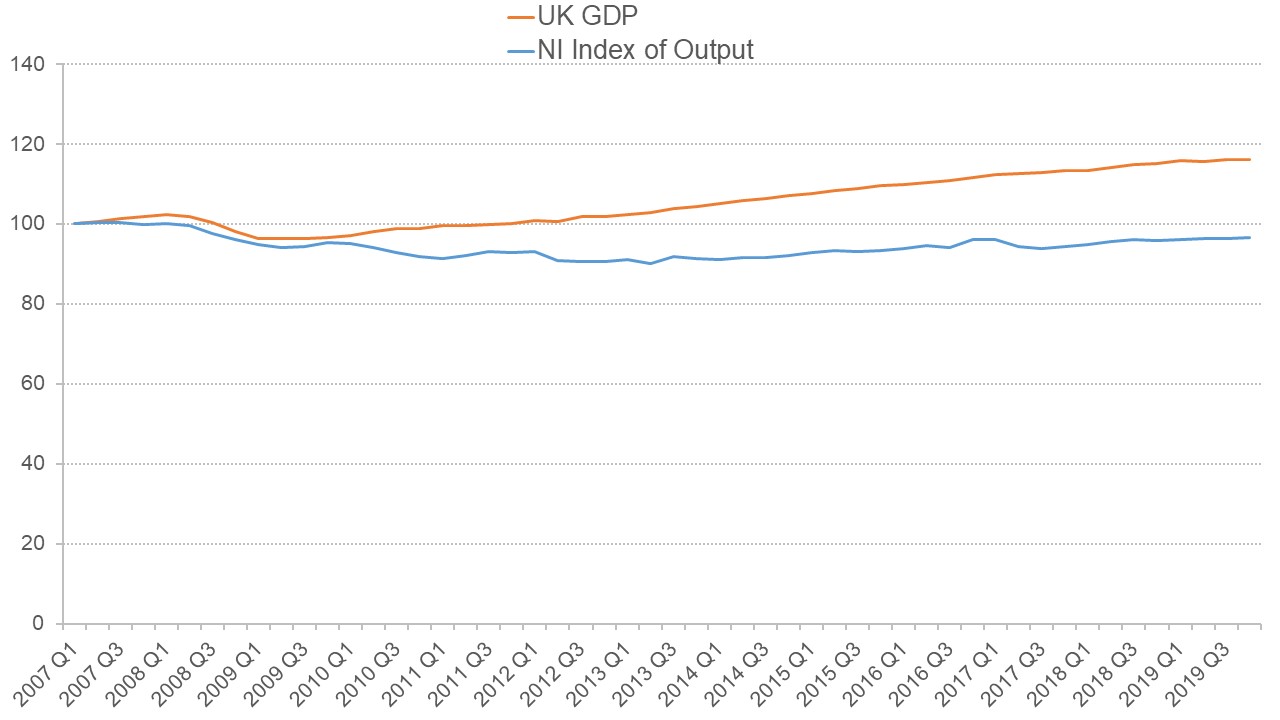

- The last recession in Northern Ireland after the 2008/09 global financial crisis was extremely long-lasting. According to the official measure of the volume of regional output, output peaked in the second quarter (April to June) 2007 and then declined all the way through to the second quarter of 2013 (see Figure 1). This recession could be different, but there aren't many reasons to believe that the regional economy is going to deliver a lot more dynamism this time.

Figure 1: Total volume of UK GDP between 2007-2019 compared with the index of output in Northern Ireland (2007 Quarter 1=100)

Sources: NISRA (2019) and ONS (2019)

- Previous experience suggests that the recovery phase could be rather shallow. According to the index of output in Northern Ireland, the most recent measure of output (the final three months of 2019) remained about 4% below the level in mid-2007 – the pre-crisis peak. Strictly speaking, in terms of output, Northern Ireland’s economy had not completed its recovery from the last recession before Covid-19 struck, albeit performance in terms of jobs was better.

- Before the virus, Northern Ireland’s economy was characterised by relatively low levels of competitiveness (especially in terms of labour productivity levels) compared with the rest of the UK or various standards of best practice (Birnie et al, 2019). The concern is that the economy lacks the flexibility and ability to adapt that will be required to recover from this crisis.

- ‘Scarring’ damage produced as a result of the Covid-19 recession is very likely to be concentrated in the labour market. Northern Ireland starts from a position of disadvantage. During the period 2010-20, the rate of economic inactivity (NISRA, 2020), relating to those who are neither in work or actively seeking work, was generally five or six percentage points higher than the UK average: in December 2019-February 2020, 25.6% compared with 20.2%

A W-shaped recovery?

In a W-shaped recovery, there is a period of weak recovery followed by a second dip in output growth. This is also likely in a regional economy that is two-thirds consumption-based and also overwhelmingly service-orientated.

Many of these service activities – including, retail, hairdressing or hospitality and leisure – require face-to-face contact. Lockdown has deprived people of haircuts, foreign holidays, going to the cinema or grabbing a cappuccino. Human psychology being what it is, consumers will want to satisfy these wants at the earliest opportunity.

A return to semi-normality could prompt a release of the pent-up demand, but this sugar rush of spending may not last for long and at that point, the recovery from the Covid-19 recession could be put into reverse. This could be reinforced if there is a second wave of the virus.

The ambivalent consequences of increased public spending

Across the UK and the global economy, the immediate response to Covid-19 produced an enormous increase in public spending. Before the pandemic levels of public spending per head in Northern Ireland were about 20% higher than those in England. Levels of public spending have been high by UK standards since the 1970s. The policy response to the crisis will amplify that position.

The short-term effects could have long-term consequences as an emergency-led increase in public expenditure is not fully reversed once the crisis is over (Peacock and Wiseman, 1961). Reliance on a relatively large public sector part-funded by a substantial fiscal transfer from HM Treasury might be interpreted as the ultimate safety net mitigating the social impact of lockdown. But it is not clear whether this position helps or hinders the longer-term performance of Northern Ireland’s economy to the extent that fiscal subsidy blunts the incentive to improve either policy or competitive performance.

It appears that policy-makers in Northern Ireland will be relaxing the lockdown of the economy at a slower pace than their counterparts in England (Northern Ireland Executive, 2020). That may be a prudent response to the science, but it may reflect the fact that the government benefits from a safety net that is part-financed by the UK Treasury.

Can public policy make a more rapid economic recovery more likely?

The following considerations are relevant:

- Increased government investment: it is unlikely the private sector will pick up spending at pre-crisis levels. Could government to take up the slack? Among other infrastructure weaknesses, there is a lack of digital connectivity in rural areas (DotEcon, 2018). This could benefit productivity, but is unlikely to generate many jobs directly.

- Foreign direct investment opportunities from near-shoring: the virus has big implications for global supply chains (Stiglitz et al, 2020). If businesses choose to pull supply chains closer to home – more ‘near-shoring’ – there may be an opportunity for Invest Northern Ireland, the regional development agency, to re-position Northern Ireland as a safer location for Great Britain and European inward investment.

- Sectoral change: manufacturing could gain from UK policy aimed at re-balancing (equalising) activity across the UK. There may be policy opportunities to build better and restart the economy on a different trajectory, for example, using the planning system to promote change of use, including city centre living.

- Adapting to changing tourism patterns: much reduced international travel has created significant challenges for local tourism. Significant promotional effort will be needed to maintain the momentum achieved prior to the crisis. But other opportunities could also emerge such as a preference towards ‘staycations’: in 2019, about three-quarters of tourism spending in Northern Ireland came from UK and Republic of Ireland visitors.

- Re-skilling during ‘furlough’: large amounts of public money are being committed to protect earnings during the lockdown. Rather than have people inactive at home for an extended period of time, policy could encourage re-skilling.

- The normal business of government must continue: as in the rest of the UK, focusing on addressing the urgent could easily take up the entire bandwidth of government. If the economy is to recover successfully, the next Programme for Government for Northern Ireland, which is a framework of desired long-term outcomes and performance indicators for the multi-party coalition, must be developed carefully to include policy to improve, among many other things, productivity and competitiveness.

- Not forgetting Brexit and competitiveness: the virus coincided with a time of great uncertainty as to how the UK’s Withdrawal Agreement from the European Union, including the Northern Ireland Protocol, will be implemented, particularly in terms of the trade flows between Northern Ireland and the Republic of Ireland and between Northern Ireland and Great Britain. But it is important to remember that pre-virus, a lack of competitiveness, not Brexit, was the key challenge facing the Northern Ireland economy. It will become so again as we move further into the 2020s.

Where can I find out more?

The Ulster University Economic Policy Centre website contains a large number of reports about the region’s economy and policy options.

Rebalancing regional economic performance: Northern Ireland in a Nordic mirror: Graham Brownlow and Esmond Birnie argue that there are no silver bullets to address the performance of the NI economy.

Who are UK experts on this question?

- Esmond Birnie, Ulster University

- Graham Brownlow, Queen’s University Belfast