Just like everywhere else, Scotland’s economy is facing unprecedented stress from the Covid-19 crisis. How it performs in the months ahead will depend on the policy choices of Scottish ministers – and how these differ, complement or cut across UK-wide policies.

Covid-19 threatens to put the UK economy into a deep recession. Might Scotland, the most devolved part of the UK, be in line for a tougher time than elsewhere? Coming on the back of a period in which Scotland has lagged behind the UK, there are undoubtedly major challenges facing the Scottish economy. But there are also opportunities. How might the Scottish government respond? And what might be the political implications and questions for constitutional reform?

Background

Out of all the devolved nations of the UK, Scotland’s economy is arguably the one that mirrors that of the UK as a whole the closest.

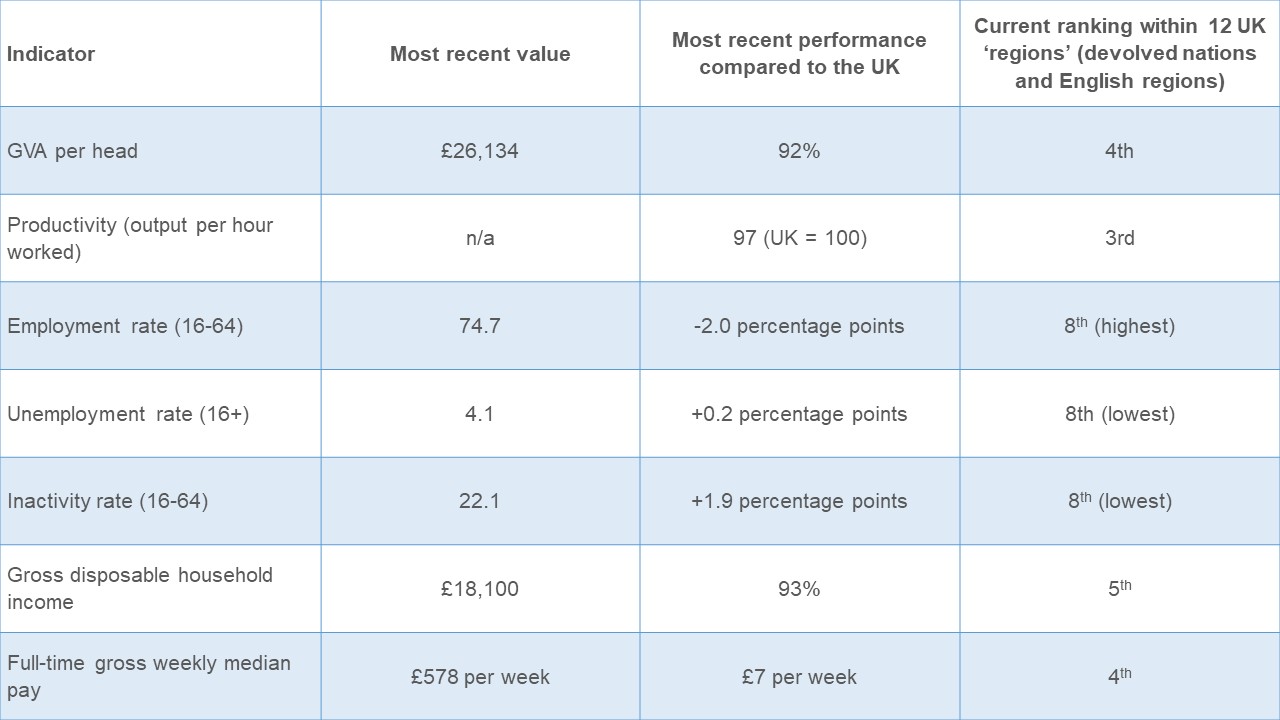

Scotland’s onshore gross value added per head (ONS) – a useful albeit imperfect measure of relative economic activity – is the fourth highest in the UK (behind London, the South East and the East of England) and around 92% of the UK average (this rises to 98% when a geographical share of oil and gas activity is included).

The Scottish economy has strengths both in terms of its workforce – with one of the highest proportion of graduates in its labour market of any region in Europe (Eurostat) – and its industrial mix, particularly in sectors such as financial services and energy.

Like the UK, prior to the Covid-19 pandemic, employment had been at near record levels, while the productivity gap between Scotland and the UK had closed in recent years (ONS) – although this reflects weak productivity growth in the UK rather than stellar performance north of the border. But in other indicators, such as the labour market, Scotland’s relative performance has slipped back in recent times.

Table 1: Economic indicators: Scotland (onshore) vis-à-vis the UK

Source: Office for National Statistics

But there are noticeable differences – and also some unique challenges.

The sunset years for the oil and gas industry are here. Scotland’s population is older, and ageing more rapidly. Indeed, and in contrast to the UK as a whole, Scotland’s working age population is on track to shrink over the next 25 years (National Records of Scotland).

Increased market concentration has led to the loss of many key headquarter functions. Remoteness poses a challenge for many communities. And despite numerous programmes, social deprivation and poverty remain high in parts of the country.

All of these issues matter much more than in the past. Since 1999, Scotland has been on a journey of enhanced devolution. The Scottish Parliament is now responsible for around two thirds of all public expenditure spent for the benefit of the people of Scotland, with powers over health, education, transport, economic development and the environment (GERS).

Over the next few years, it will take on new responsibility for over £3 billion of social security powers (Eiser, 2020). Tax powers have also been devolved including – from 2016 – key parts of income tax. Soon around half of Holyrood’s budget will be determined by revenues raised in Scotland.

Under the unique way that Scottish devolution is funded, what matters is no longer just the level of block grant received from Westminster, but also the relative performance of the Scottish economy compared to the UK economy (Audit Scotland).

Of course, these issues matter not just for devolution. All major policy and economic trends continue to be viewed through the prism of the independence debate, and Covid-19 will be no different.

Will the Scottish economy be affected more or less than the UK as a whole?

Like other economies, the Scottish economy is currently going through unprecedented stress from the Covid-19 shutdown.

Latest indications (Fraser of Allander, 2020) are that anything up to a quarter of activity is currently mothballed, either with firms having ceased operating or working at much reduced capacity.

Given the importance of Scotland’s relative performance for the way in which the Scottish budget is now funded, might Scotland be affected more or less than the UK as a whole?

On the one hand, there is evidence to suggest that it might be affected more:

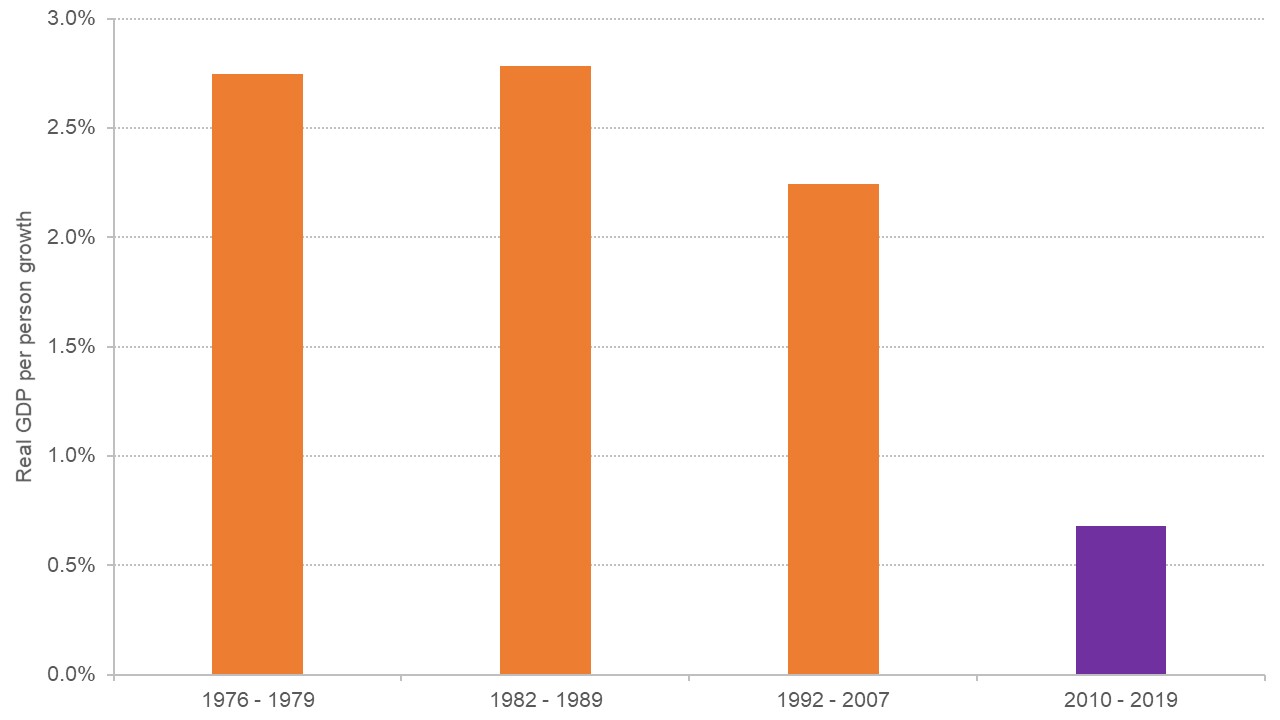

- The Scottish economy has been lagging behind for a number of years. Growth has been below trend, both by historical standards (see chart) and compared to the UK (Scottish Government GDP statistics).

Figure 1: Average annual per capita Scottish growth rates between previous UK recessions

Source: Fraser of Allander

- Covid-19 has led to a sharp drop in the global oil price as demand has ground to a halt. North Sea oil and gas continues to make an important contribution to the Scottish economy, not just via the industry itself but its supply chain and the wider spillover effects it generates – most notably, wages far in excess of many other sectors.

- Tourism plays a crucial role in the Scottish economy, particularly in rural areas. This sector faces unprecedented challenges, which could accentuate many of the structural challenges that fragile communities face (such as attracting young families and retaining skilled workers).

On the other hand, there are reasons why the impact on Scotland might be less:

- Past evidence suggests that Scotland’s economy is relatively more resilient to recessions than the UK as a whole – in part due to the slightly larger public sector. In the 2008/09 global financial crisis, for example, Scotland experienced a peak to trough GDP decline of around 4%, compared with 6% in the UK (Quarterly National Accounts for Scotland).

- As highlighted above, Scotland’s economy shares many similarities with the UK economy as a whole. This suggests that while there might be differences at the margin, the overall impact of Covid-19, at least at a macroeconomic level, is likely to be similar. Early indications suggest that Scottish businesses are faring no better or at least no worse than the UK average (ONS).

- There has been a lot of discussion about the potential to ‘build-back-better’, through investing in a green recovery. Should this be the case, Scotland’s renewable energy and low carbon economy could be well placed – providing something of a comparative advantage – with just under 75% of electricity consumption in Scotland already met by renewables (Annual Compendium of Energy Statistics).

Of course, only time will tell.

Much will depend on how policy-makers in both the UK and Scotland respond.

- Public health is a devolved matter. So far, Scottish ministers have taken a more cautious approach – for example, schools in Scotland will not return until August and construction activity is only just starting back (Scottish government).

- The Scottish government is also responsible for economic development, and many of the long-term drivers of economic growth, such as education & skills, transport and enterprise support.

What do we know so far and where are the gaps?

A picture is beginning to emerge of the Scottish economy after the Covid-19 lockdown.

The Office for National Statistics has provided a breakdown by nation of the UK as part of its faster indicators response to Covid-19. The latest figures up to 3 May (released on 21 May) show that:

- 80% of businesses in Scotland were continuing to trade at that time (suggesting that up to one in five were mothballed).

- Of businesses continuing to trade, 65% of businesses reported a decrease in turnover outside of their normal range.

- 40% of businesses in Scotland responding to the survey have under six months of cash reserves.

The Scottish government has published a new Monthly Business Turnover index and is scheduled to publish new monthly GDP estimates from mid-June.

The latest ONS Labour Force Survey shows that unemployment increased by 16,000 over the three-month period to March 2020 (a rise of 0.6% points).

New regional Universal Credit data shows that an additional 100,000 people claimed support in April 2020 compared with March 2020 in Scotland (DWP).

Like in many other countries, there is a growth in non-official data sources seeking to provide a more up-to-date assessment of economic performance. (Fraser of Allander)

But there are important gaps. For example, data on social security take-up are not published with the same regularity as for the UK as a whole. There is little in the way of detailed official information on the health of the Scottish business base. There is also only limited information on take-up of government schemes.

What else do we need to know?

A key factor in how Scotland performs in the months to come will depend on the policy choices that Scottish ministers make, and how these differ, complement or cut across UK-wide policies.

The Scottish government has established an Economic Recovery Group to help shape its future thinking. The group is due to report by June.

Finally, like all aspects of economic policy in Scotland, in time, there will undoubtedly be discussions about what all this might mean for the debate on further constitutional reform.

The current Scottish government had planned to push for a second independence referendum in 2020. This has been shelved. But a referendum is likely to be a key topic of debate in next year’s Scottish parliamentary elections.

On the one hand, some will argue that the current crisis provides an illustration of the benefits of Scotland taking a different approach to the rest of the UK. On the other, some will argue that the fiscal measures provided in response would have been unaffordable under independence. As always, there is likely to be a lot more heat than light in this debate.

Where can I find out more?

20 years of devolution: Fraser of Allander Economic Commentary, June 2019

Coronavirus (Covid-19) and Scotland’s economy: Scottish Parliament Information Centre Briefing, May 2020

For general updates on the Scottish economy and Covid-19 (including webinars, podcasts and articles) see www.fraserofallander.org

Latest data and analysis on coronavirus (Covid-19) in the UK and its effect on the economy and society: Office for National Statistics

Labour market profile for Scotland: NOMIS

Scottish economic statistics: Scottish government

Who are UK experts on this question?

- David Bell, University of Stirling

- Emma Congreve, Fraser of Allander Institute, University of Strathclyde

- Stuart McIntyre, Fraser of Allander Institute, University of Strathclyde

- David Phillips, Institute for Fiscal Studies

- Graeme Roy, Fraser of Allander Institute, University of Strathclyde

- Mairi Spowage, Fraser of Allander Institute, University of Strathclyde