There were big falls in share prices well before we grasped the likely severity of the pandemic and the economic impact of coronavirus. So what are the interactions between asset prices and economic activity – and what might price changes imply for future output growth?

Macroeconomic data tend to lag events, which means there is usually a delay in research output to provide support to policy-makers. In normal times, this would largely be inconsequential, but we are not in normal times. Governments and other policy-makers must make rapid but well-informed decisions.

This provides a crucial role for understanding asset price data, which are available in real time, to understand the consequences of the pandemic and give a view on the likely impact on the economy. After all, developments in asset prices will have implications for the evolution of the economy.

Related question: What explains stock market reactions to the pandemic?

Asset prices and economic activity

An asset is any possession or resource that has value in an exchange. A more sophisticated definition is that it is a claim on future cash flows, which then means that the value of an asset depends on the present value of those cash flows.

The pricing of an asset is important for the allocation of financial resources and to avoid inefficiencies in investment and consumption in the real economy. An asset’s price should equal the expected discounted value of the asset’s payoff (Cochrane, 2009).

In general, the main channels through which asset prices affect real economic activity are consumption and investment. The impact on consumption arises via the ‘wealth effect’, which typically complements the standard income effect. The wealth effect follows directly from the ‘permanent income hypothesis’, which implies that the flow of consumption is chosen based on expectations of permanent income (that is, we consume the annuity value of our wealth). This usually takes effect through changes in asset prices such as shares and properties.

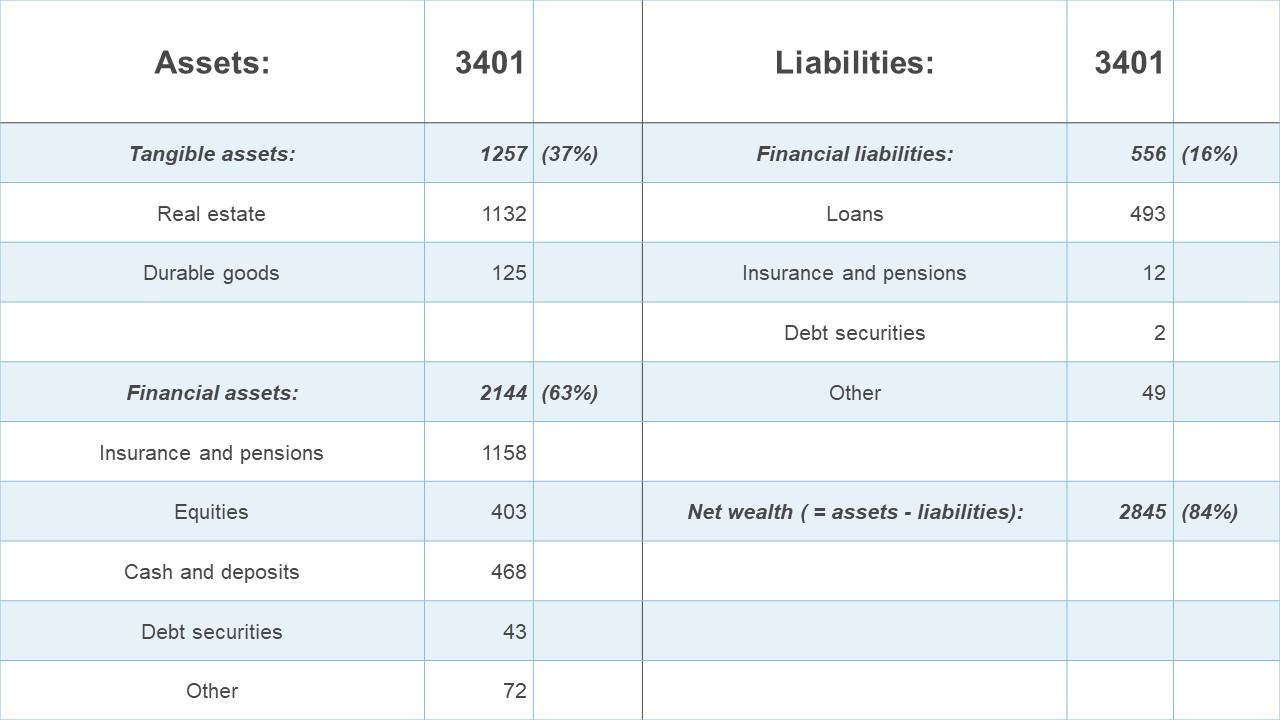

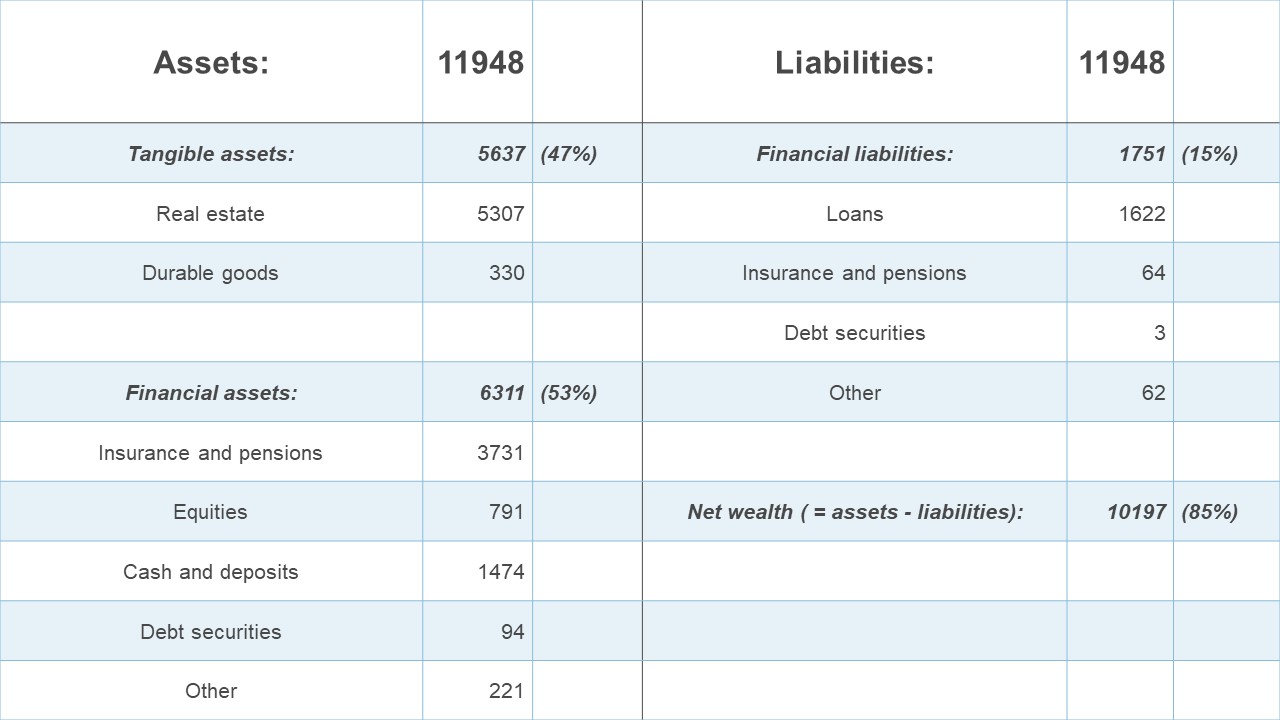

Net wealth is possibly the most accurate indicator of households’ balance sheet position, which ultimately affects consumption choices. As an illustration, Tables 1 and 2 show the balance sheet position of the household sectors of the UK in 1995 and 2015, respectively (Chadha, 2017). See also the body of research on balance sheet recessions (for example, Mishkin et al, 1977).

Table 1: Balance sheet of the household sector, 1995 (£bn)

Table 2: Balance sheet of the household sector, 2015 (£bn)

Source: ONS, National balance sheet: households and non-profit institutions serving households (NPISH), £ billions, 1995.

Day-to-day fluctuations in asset prices typically capture the volatile movements in current expectations of current and future risk-adjusted returns. Furthermore, asset price innovations help us to understand the accumulation of financial and non-financial wealth.

What does evidence from economic research tell us?

A number of studies suggest that there are strong links between asset prices and real economic activity. At the same time, the views on this relationship can differ widely in economic research.

At one end of the spectrum, it has been argued that observed correlations between asset prices and consumption are primarily driven by the role of asset prices as a leading indicator of future economic activity (for example, Poterba and Samwick, 1995). This view suggests that expectations of future output growth are reflected in current asset prices, and it is this that explains the correlation with current consumption expenditure.

At the other end of the spectrum, the argument is that the observed correlation is simply the result of wealth effects, where wealth is permanent income and so drives consumption.

The development of the so-called wealth effect on consumption can be credited to the seminal work of Nobel laureate Franco Modigliani (1971). He suggested that a dollar increase in wealth leads to an increase in consumer expenditure of about five cents.

Since then, this phenomenon has increasingly grown to prominence in research and policy discussions of the economy. For example, one study finds that both financial and housing wealth exert a positive and significant impact on aggregate consumption in the UK (Barrell et al, 2015). That research shows that the marginal propensities to consume (MPC) out of total, financial and housing wealth are 0.03, 0.02 and 0.03, respectively.

But this view has since been challenged. For example, one study finds that only a small fraction (less than 5%) of the variation in household net worth is related to changes in aggregate consumer spending (Lettau and Ludvigson, 2004). The analysis shows that most of the quarterly fluctuations in assets’ values are attributable to transitory dynamics that display almost no association with consumption, whether contemporaneously or future dates.

The key here is that consumption responds differently to temporary changes in wealth than to permanent changes. So, although for a permanent $1 change in asset value, we can anticipate some 5% change in aggregate consumption of households, the authors find that most movements in wealth are transitory and unrelated to consume spending.

Similarly, a later study (Altissimo et al, 2005) argues that the transmission of asset price changes to consumption expenditure is largely determined by whether the changes are permanent or transitory. The evidence suggests that transitory changes have less effect on consumption – linked to the predictability of equity market returns.

In some quarters, it is argued that even in a liberalised financial system, a strong impact of housing wealth on consumption is unlikely, largely because both could jointly be affected by other factors, most notably income expectations. Further, because housing acts both as a store of wealth and a source of housing services, it will affect nominal, but not necessarily real consumption (Davey, 2001).

Evidence for the UK from the study also suggests a decline in the importance of housing wealth relative to financial wealth (falling from 60% of total wealth in 1970s to about 40% in the early 2000s). Nonetheless, other studies find a large effect of housing wealth on household consumption in the United States (for example, Case et al, 2005), and Barrell et al (2015) for the UK (see MPCs above).

How reliable is the evidence?

The studies mentioned above are primarily published in high-quality international peer-reviewed journals or working papers from experts in the field. They are evidence-based and largely consistent with economic theory. Furthermore, the empirical studies mentioned are cross-country, which reflects a certain level of robustness in the results.

What else do we need to know?

A lot of research on asset pricing concentrates on the relationship between asset prices and consumption, so ignoring how consumption is determined in relation to investment and production. This approach has largely been criticised and studies have argued that asset pricing should emphasise firms’ investment decisions (for example, Cochrane, 1991 and Cochrane, 1996).

Similarly, others argue that while the existence of wealth effects on consumption is largely uncontested, there is sparse evidence of the impact on investment (Davis, 2010). There is also an argument about whether different effects should hold between countries and across assets.

The shortage of research evidence on investment was partly put down to shortcomings in the results historically for Tobin’s Q, user cost and the financial accelerator. That is, studies have found these variables wrongly signed (for example, Oliner et al, 1995) or statistically insignificant (for example, Robertson and Wright, 2002). In fact, one particular study shows that that Q has a stronger relationship with other variables such as bond yields and the growth in debt and stock returns than with investment per se (Lettau and Ludvigson, 2002).

Notwithstanding, others argue that an increase in stock prices raises output via both the wealth and Tobin’s Q effects and by increasing the net worth of potential borrowers. Borrowers become wealthier, the expected deadweight losses of external finance decline, therefore increasing investment and output (Bernanke and Gertler, 2001).

Further, there is pronounced evidence of significant effects arising from asset prices via the financial accelerator, credit channel and Tobin’s Q in G7 countries, and uncertainty (proxied by asset price volatility) particularly in smaller OECD countries (Davis, 2011). Other studies implying that uncertainty and balance sheet effects on investment do exist include, for example, Price and Schleicher (2007), Assarsson et al (2004), and Davis and Stone (2004).

If nothing else, the 2008/09 global financial crisis has taught (or reminded) us that the real and financial sectors of the economy are inextricably linked. As such, it also worth noting research linking asset prices to banking distress. One key piece of work on this shows that deviations of credit and asset prices from prior trends were useful indicators of future banking downturns (Borio and Lowe, 2002).

Finally, the question of whether consumption responses differ according to the cause of the shock to equity prices is also worth exploring. There is very little empirical evidence on this.

Where can I find out more?

The body of economic research on asset prices and its association with the economy is broad and can be found in most economics and finance journals. But a number of studies have been published in light of the current crisis:

Coronavirus: impact on stock prices and growth expectations: This study uses aggregate equity market and dividend futures to quantify the term structure of investors’ expectations about economic growth.

Aggregate and firm-level stock returns during pandemics, in real time: This study shows that daily aggregate and firm-level stock returns respond to unexpected daily changes in the trajectory of the coronavirus.

Feverish stock price reactions to Covid-19: Using stock market data, this study illustrates how the health crisis transformed into an economic crisis amplified via financial channels.

Other early important work includes:

A consumption?based explanation of aggregate stock market behavior: This study provides evidence suggesting that finance can identify fundamental risk factors that explain time-series behaviour and aggregate stock returns; and that habit formation is an important element for producing macroeconomic models that capture asset price movements as well as quantity dynamics.

Consumption and portfolio choice over the life cycle: This study solves a ‘lifecycle’ model of consumption and portfolio choice with non-tradable labour income and borrowing constraints – finding that ignoring labour income generates large utility costs.

Some UK-specific work:

The wealth and saving of UK families on the eve of the crisis: Thomas Crossley uses the British Household Panel Survey and the Expenditure and Food Survey to study household wealth and household savings, respectively. The evidence suggest that wealth is predominantly held in illiquid form.

Household wealth in Great Britain: distribution, composition and changes 2006–12: This study uses the Wealth Assets Survey to document some important features of the distribution of household wealth in Great Britain over the period 2006-2012. One key finding is that total wealth on average increased in real terms for working-age households but fell for retirement-age households.

Who are UK experts on this question?

- Thorsten Beck, Professor of Banking and Finance, Cass Business School

- Harjoat Bhamra, Associate Professor of Finance, Imperial College London

- Jagjit Chadha, Director, NIESR

- E. Philip Davis, Professor at Brunel University and NIESR Fellow