New business creation is a key part of any economy, notably for generating new job opportunities. The sharp decline in start-up activity in the UK during lockdown is likely to have a strongly negative impact on aggregate employment in the future, regardless of the shape of the recovery.

Firms create and sustain employment; they also affect productivity, which determines the wages that workers receive. This is why the UK government has provided unprecedented levels of support for firms as well as households during the Covid-19 crisis. But to be eligible for support, firms need to exist already – and that doesn't apply to new ‘start-ups’.

The significant decline in UK start-up activity since lockdown will lower employment for workers and weaken long-run productivity growth, which will reduce wage growth.

How did lockdown affect business creation in the UK economy?

New company registrations in the UK from the start of lockdown (23 March) to 31 May, decomposed by industry and region, provide a measure of business creation, which is an indicator of start-up activity.

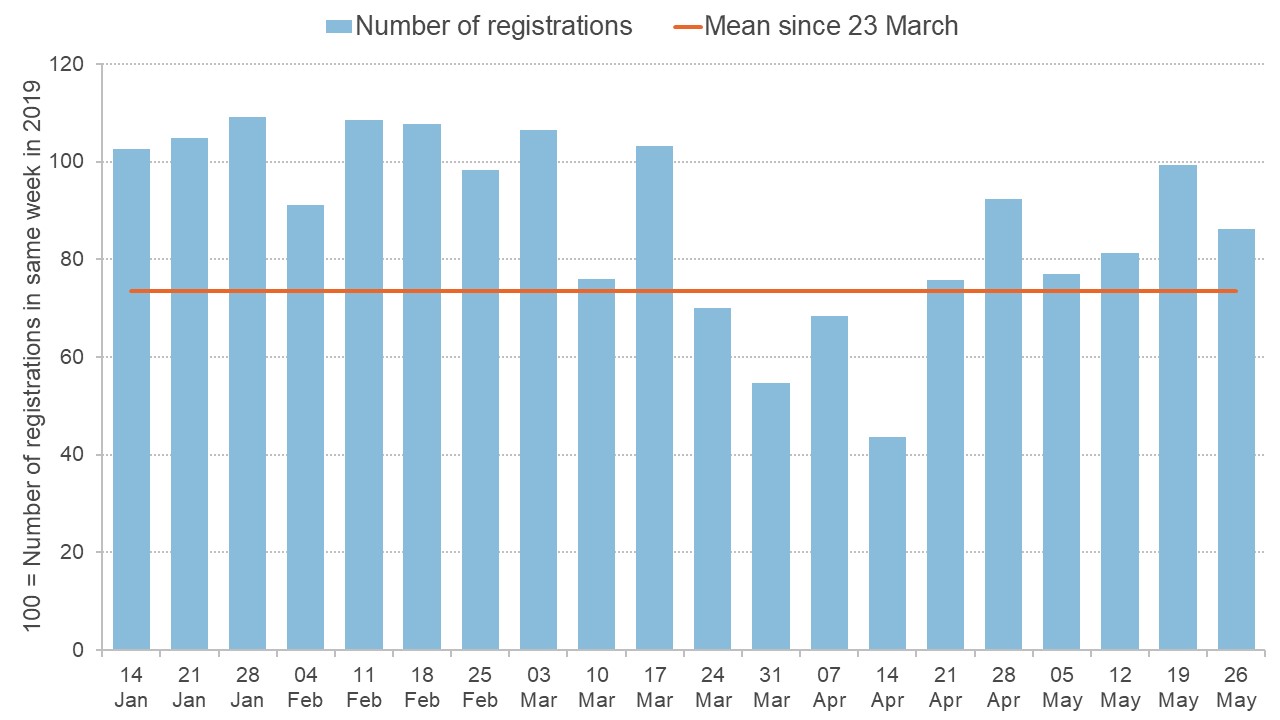

Figure 1: Company registrations per week in 2020

Source: Companies House and authors' calculations

Figure 1 shows weekly company registrations in the UK since January 2020 relative to the same week in 2019. The orange line shows that since lockdown began, average business creation is 25% lower than in the same period in 2019. The four weeks following lockdown are most affected, with business creation down 40% on average. Some of the fluctuations over April are caused by different dates for the Easter holiday.

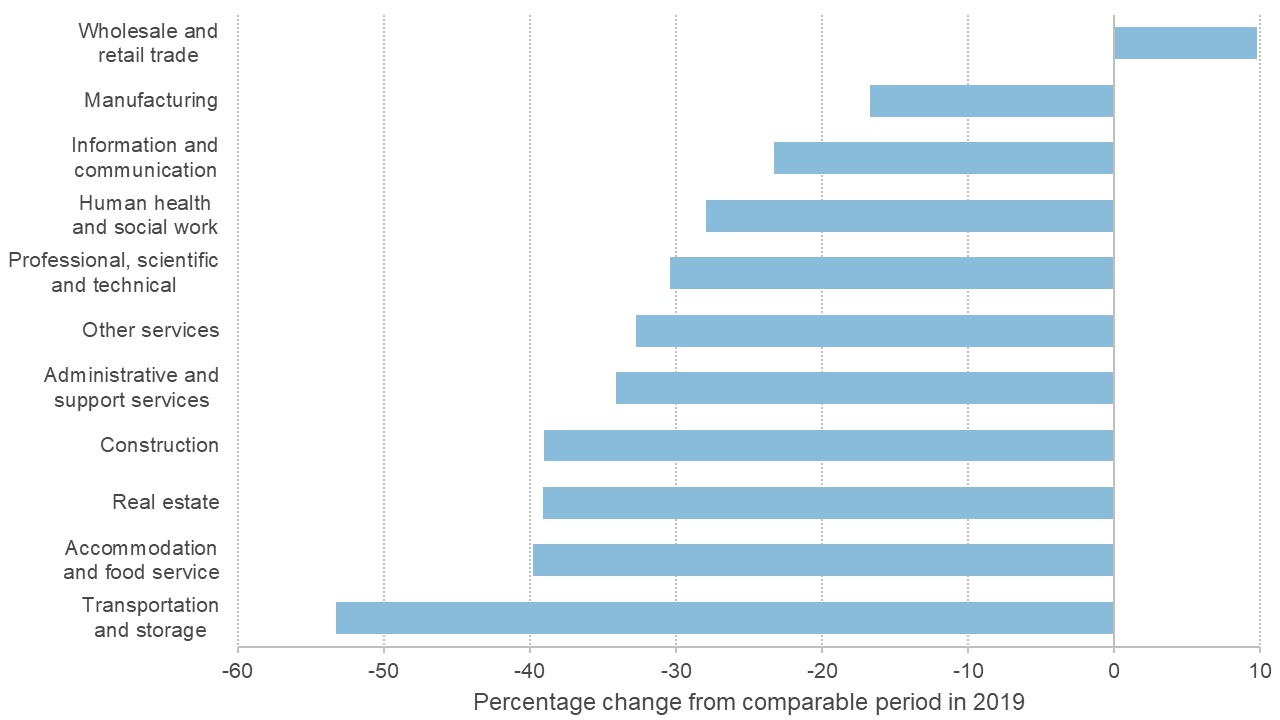

Figure 2: Company registrations per week by sector, 23 March to 31 May 2020

Source: Companies House and authors' calculations

Figure 2 shows the effect of lockdown on business creation across industries (focusing on the largest 11 industries by number of registrations in 2019). It shows the percentage change in weekly average registrations against the same period in 2019.

Non-essential sectors, such as Accommodation and Food Service, and Real Estate, performed worse than essential sectors, such as Manufacturing, and Wholesale and Retail Trade. Construction performed among the worst over the weeks to 30 April, but the sector has since recovered with the easing of sector-specific restrictions (Duncan et al, 2020).

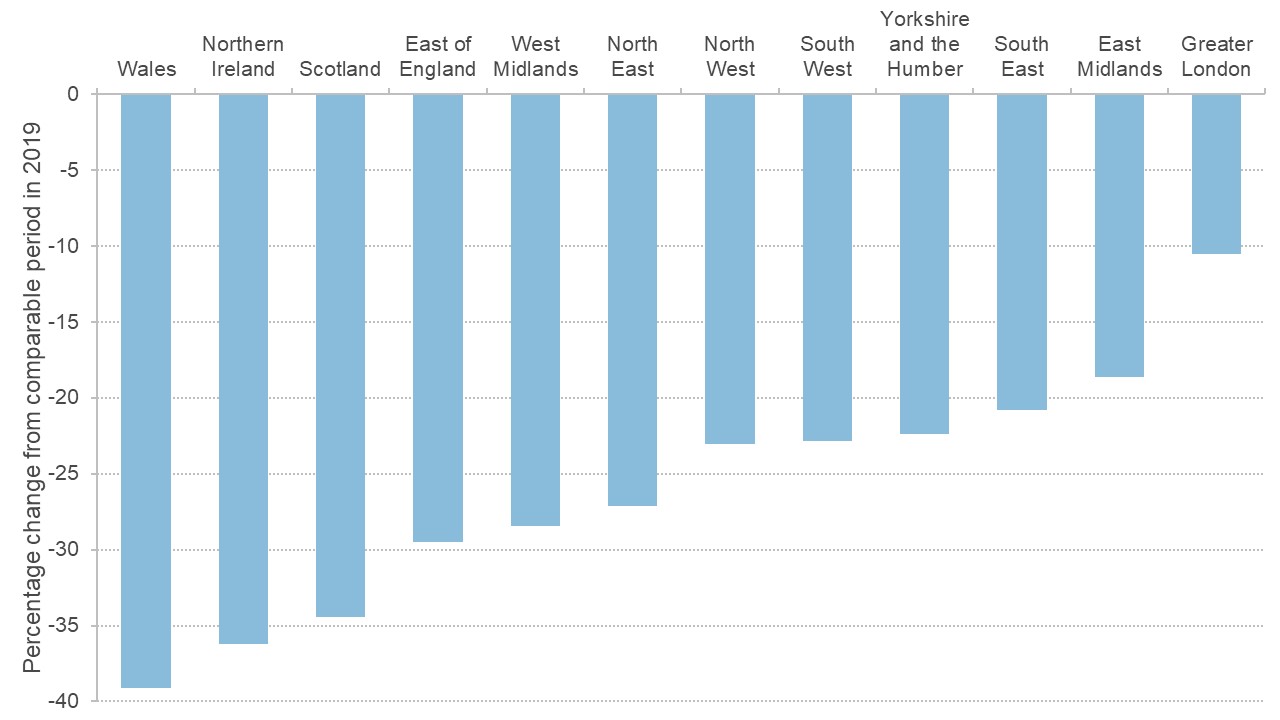

Figure 3: Change in company registrations by region, 23 March to 31 May 2020

Source: UK business register, Companies House

Figure 3 shows that Wales, Northern Ireland and Scotland have suffered the largest declines in business creation relative to the same period last year, while Greater London is the most resilient. All regions of England perform better than the three countries under devolved administrations.

Related question: How hard will coronavirus hit Scotland's economy?

How reliable is the evidence?

The data are constructed from the UK business register, which is available from Companies House (data here). The register records every company in the UK with its birth date, post code and industry. This makes it possible to measure daily company registrations.

The main advantage of these data is that they are timely and cover the entire UK. A disadvantage is that it is not possible to distinguish between firms created for accountancy purposes and firms that will employ workers. Comparable research for the United States, which uses the Census Bureau’s Business Formation Statistics (BFS), measures ‘business applications with planned wages’, which overcomes the weakness (Haltiwanger, 2020). The disadvantage with UK data restricts analysis to studying percentage changes in firm creation, rather than absolute numbers.

What are the implications of low business creation for the economy?

The UK is not alone in experiencing a sharp decline in start-up activity. In the United States, new business applications have declined even more (Haltiwanger, 2020), and the decline in applications is largest in states more affected by the pandemic (Sedlá?ek and Sterk, 2020).

In the United States, there are comprehensive data that make it possible to study job creation more carefully and the importance of business formation for those jobs. These data show that an average of 16.3 million jobs are created and 14.9 million jobs are destroyed every year. This means that annually a third of all US jobs are either new or destroyed.

Strikingly, start-ups create 2.9 million more jobs than they destroy per year, so they are large contributors to net job creation. In addition to job creation, start-ups are also important for aggregate productivity growth (Bartelsman and Doms, 2000; Foster et al, 2001).

Covid-19, non-start-ups and the jobs that never were: simulations from a calculator

To assess the implications of the Covid-19 pandemic for aggregate employment, one study considers simulations from a ‘start-up calculator’ for the United States using Business Formation Statistics (Sedlá?ek and Sterk, 2020). The calculator (available here) allows users to compute employment losses under different crisis scenarios.

Users of the calculator can vary three margins affecting start-ups that have long-run effects on employment:

- The number of start-ups. A fall in this number reduces new jobs created by start-ups. This ‘lost generation’ of firms, similar to the loss of start-ups in the UK during the pandemic, creates a persistent dent in aggregate employment as subsequent years have a lower number of young firms (Gourio et al, 2016 and Sedlá?ek, 2019).

- The growth potential of start-ups. Sedlá?ek and Sterk (2017) show that firms born during recessions not only start smaller but also tend to stay smaller in future years even when the aggregate economy recovers. These movements in growth potential are attributed to changes in the composition of the type of start-ups. In the current situation, it seems particularly difficult to start a highly scalable businesses, since supply chains are heavily distorted, credit conditions are poor and customer demand is difficult to acquire during a lockdown.

- The survival rate of young businesses. Start-ups and young firms have much higher exit rates than older firms, and during downturns these exit rates increase (Haltiwanger et al, 2013).

The calculator only considers changes to firms younger than ten years of age. In other words, any scenarios explored leave 40% of all businesses unaffected in the calculations. As this is a conservative stance, the results may be taken as lower bounds on the overall effects.

Since the nature of recovery from the Covid-19 recession is highly uncertain, the study compares two main scenarios: a first one in which economic conditions return to average after one year; and a second one in which economic conditions return to above-average levels after one year (a bounceback scenario).

Both scenarios assume that in 2020 the start-up rate, the growth potential and the survival rate drop to their lowest levels since 1977 (the beginning of the data sample) and the duration of the contraction is set to one year. (For more details, see Sedlá?ek and Sterk, 2020).

What happens to employment if there is a recovery to average levels of economic activity in one year?

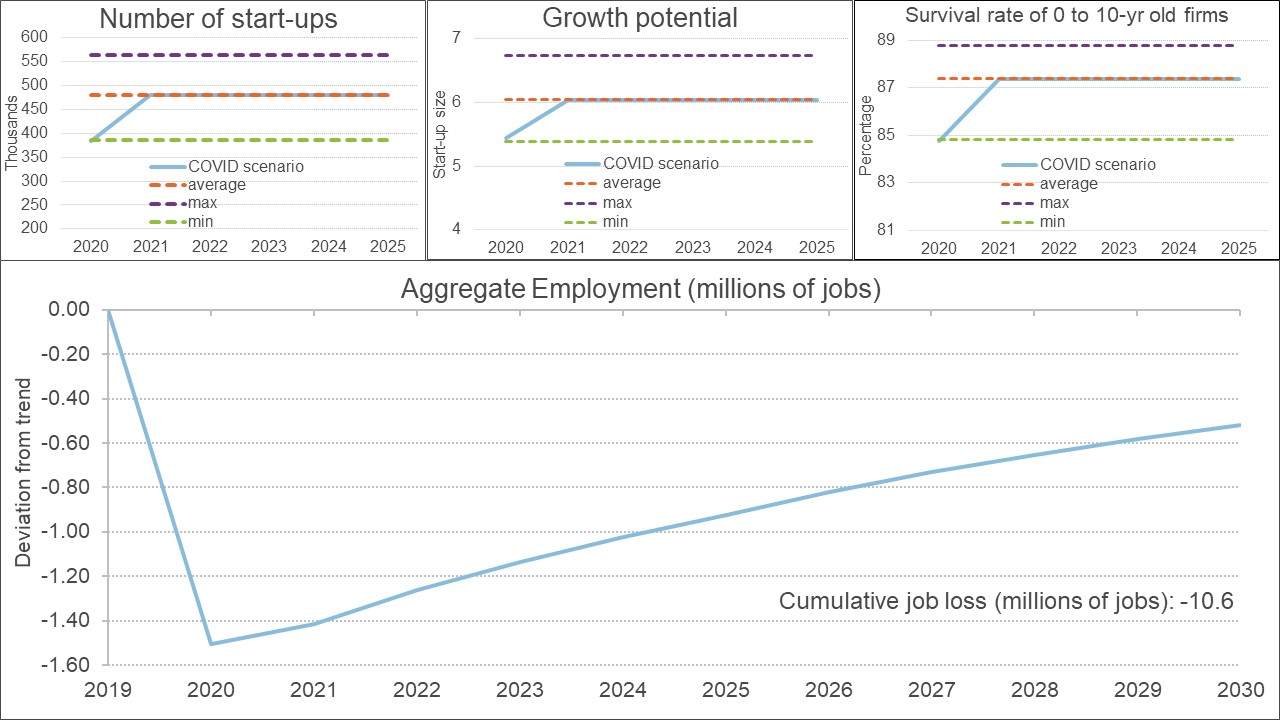

Figure 4 plots the effects on aggregate employment if number of start-ups, growth potential and survival rate return to average after one year. Two observations stand out.

First, the decline in start-up activity has large aggregate effects. In the first year, 1.5 million jobs are lost relative to a scenario without the pandemic. This loss is 6% of employment by firms aged below ten and 1.1% of aggregate employment.

Second, the macroeconomic effects are very persistent, even though the shock only lasts one year. Cumulated from 2020 until 2030, there are losses of 10.6 million job years. Each of the three margins plays a substantial role. The decline in the number of start-ups accounts for 4.6 million of the cumulated job year losses, the decline in growth potential accounts for two million, and the decline in survival accounts for 3.5 million. The remaining 0.5 million is due to interactions between the three margins.

Figure 4: Baseline scenario in the calculator

Source: Startups and Employment Following the COVID Pandemic: A Calculator

What happens to employment if there is a recovery to above average levels of economic activity in one year?

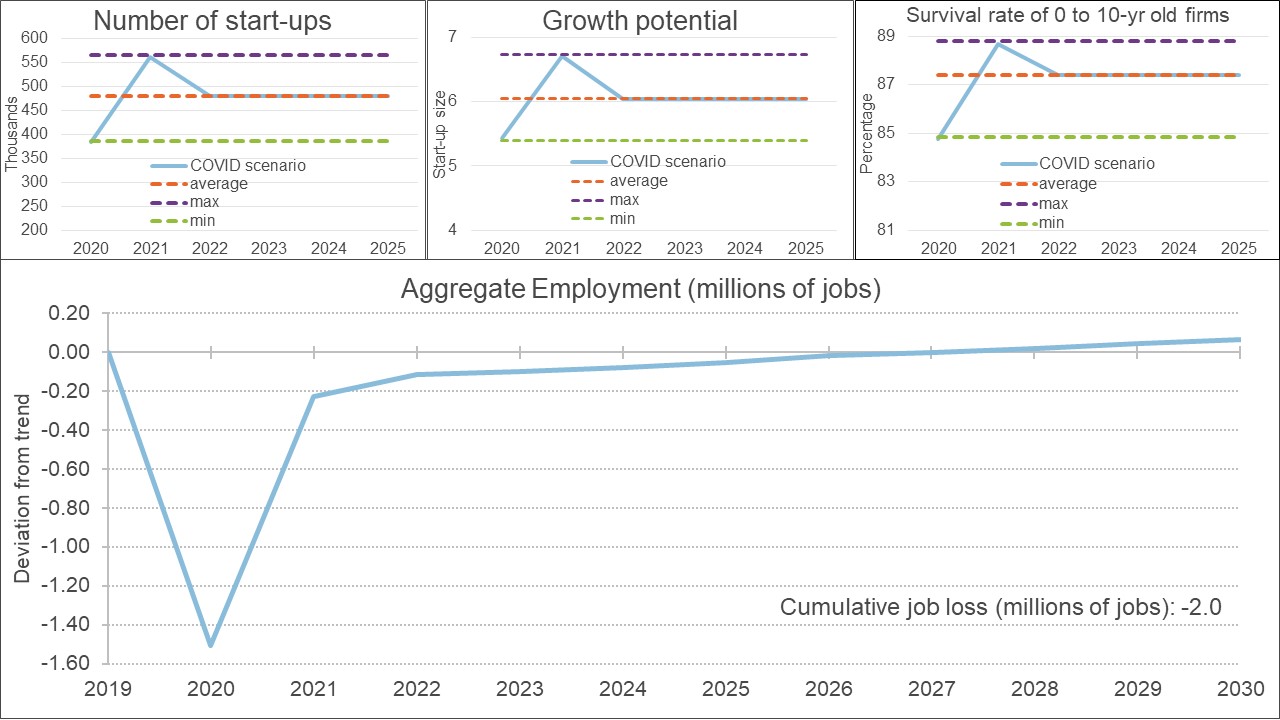

Figure 5 shows a scenario in which one year after the pandemic, all three margins reach the highest levels observed since 1977 (the beginning of the data sample). In this case, aggregate employment losses are much shorter-lived, but some effects persist. The cumulative job loss from 2020 to 2030 is two million and it takes until 2028 for aggregate employment to reach its initial trajectory. Therefore, even a short-lived crisis with a booming recovery will have a big negative impact on the aggregate economy for the next decade.

Figure 5: Bounceback scenario in the calculator

Source: Startups and Employment Following the COVID Pandemic: A Calculator

What happens to employment if the negative shock persists for more than one year?

Based on the return-to-average scenario, the cumulative employment loss between 2020 and 2030 is proportional to the duration of the shock. If the crisis lasts for one year, ten million jobs are lost. If it lasts for two years, 20 million jobs are lost. And so on.

Can older firms cover the employment lost from start-ups?

A possibility is that older firms will hire more, compensating for employment losses from start-ups. In the return-to-average scenario, older firms would need to create an additional 1.5 million jobs in 2020 to offset the start-up job losses. For comparison, net job creation by firms older than ten typically stands at around half a million jobs.

Policy takeaway: the importance of supporting firm start-up

Supporting firms is vital because they provide employment in an economy. An important group of firms is start-ups because they account for a significant amount of aggregate employment and also tend to boost productivity. UK new firm registrations, which are a proxy for start-ups, are down sharply since lockdown. US evidence teaches us that the employment consequences of this fall in business creation will be significant over the next decade, regardless of the shape of the recovery.

Related question: Which firms and industries have been most affected by Covid-19?

Where can I find out more?

Start-ups and employment following the Covid-19 pandemic: A calculator: Petr Sedlá?ek and Vincent Sterk explain more details behind the start-up calculator and the channels through which new firm creation affects the economy.

Missing firm creation in the UK during the Covid-19 lockdown (May 2020) (April Version with code): Alfred Duncan, Miguel León-Ledesma and Anthony Savagar provide more descriptive statistics on the effect of Covid-19 on business creation in the UK.

Applications for new businesses contract sharply in recent weeks: a first look at the weekly Business Formation Statistics: John Haltiwanger analyses the effect of Covid-19 on business start-ups in the United States.

Covid-19 and Brexit: contrasting sectoral impacts on the UK: Swati Dhingra and Josh De Lyon show the effect of Covid-19 on UK firms’ business volume using survey data.

Rescuing the labour market in times of COVID-19: don’t forget new hires!: Christian Merkl and E. Weber illustrate the consequences of a hiring stall on unemployment in Germany and propose hiring subsidies to firms as a solution.

Start-ups in the time of COVID-19: facing the challenges, seizing the opportunities: OECD economists conclude that policies to reduce barriers to entrepreneurship, provide incentives for start-ups, and boost entrepreneurial potential could help speed up the recovery and preserve aggregate employment in the long term.