To design and implement appropriate policy, it is important to understand what is going on in the economy now and in the recent past. That is one of the reasons why there has been such focus on more timely indicators of economic activity during the coronavirus crisis.

Economists have developed a toolbox of analytical approaches to produce estimates of what is happening in the economy now and in the recent past (as well as forming a view of where it is going in the near future). This is typically referred to as ‘nowcasting’ – a contraction of ‘now’ and ‘forecasting’, building on a long history of economic forecasting.

These methods are widely used by governments, central banks and the private sector – but how useful are they in the current context?

In short, they could be very useful, providing the first insights into how changes in a huge range of available economic indicators translate into changes in GDP. Such methods can potentially be applied to other important variables, such as inflation and unemployment. But there are some caveats.

What does evidence from these models tell us about the economy at the moment?

In the context of measuring the current state of the economy, we define ‘nowcasts’ as estimates of current quarter growth produced in the very same quarter.

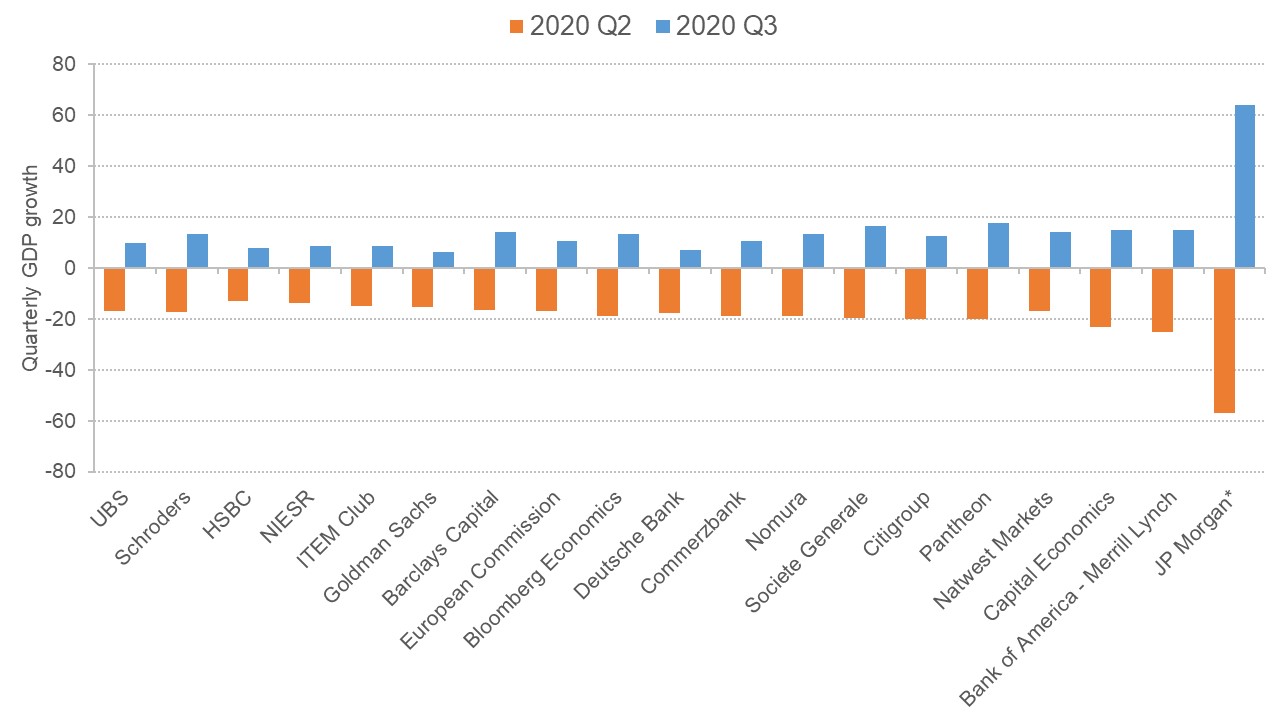

The Treasury summarises the estimates from a series of key forecasters in its regular ‘Forecasts for the UK economy: a comparison of independent forecasts’ publication. We can see in Figure 1, using data published on 17 June, that there is a consensus that the UK economy got smaller in the second quarter of 2020 (April to June), with most estimates falling somewhere in the range from –15% to –20%. The expectation is that the UK economy will return to growth in Q3 (July – September), with estimates typically in the range 8–15%.

Figure 1: Nowcasts of 2020 Q2 and Q3 growth estimates from a range of providers

Note: JP Morgan forecast is the seasonally adjusted annual rate (SAAR).

Source: HM Treasury

The UK went into lockdown in the final week of March – and we know from preliminary data from the Office for National Statistics (ONS) that the economy contracted by -5.8% in March alone, with large parts of the economy beginning to shut down. Subsequent survey data have suggested that economic activity dropped substantially in April and continued to do so in May – for more detail, see the latest ONS business survey data here and a summary of the latest economic data (published 27 May) here.

The National Institute of Economic and Social Research (NIESR) started producing nowcasts of monthly GDP in 2004 and continues to produce monthly GDP estimates and current quarter projections.

The Bank of England produces nowcasts of the UK economy (see Bell et al, 2014; and Anesti, 2017) and it has developed similar nowcasting capacity for the world economy (see Kindberg-Hanlon and Sokol, 2018), but it does not routinely publish these. Nonetheless, the estimates for the second quarter in Figure 1 are consistent with modelled scenarios of the effect of the lockdown on the UK economy in the second quarter produced by the Office for Budget Responsibility and the Bank of England.

Technically, these are not forecasts though: instead, they consider the effect of an immediate three-month lockdown followed by a return to normal over the following three months. NIESR produces a full-blown forecast every quarter that provides a density forecast of the economy for May 2020.

There are also a number of nowcasts available from commercial services, such as Now-Casting.com, the Federal Reserve Bank of Atlanta’s GDP Now and the NY Federal Reserve’s GDP Nowcast (see Bok et al, 2018).

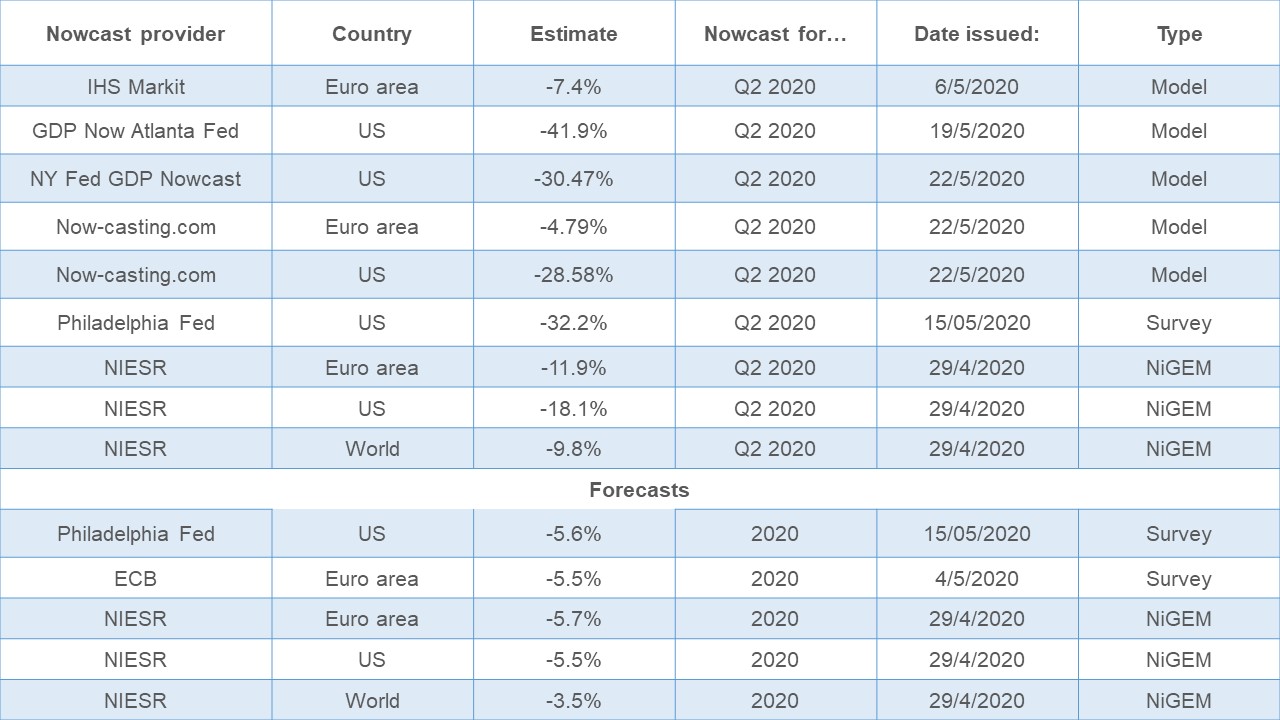

The table below highlights some other nowcast estimates, including those based on surveys of professional forecasters.

Table 1: Nowcast estimates (as available at 24/05/2020)

All of these estimates are for a sharp contraction in activity in Q2 2020.

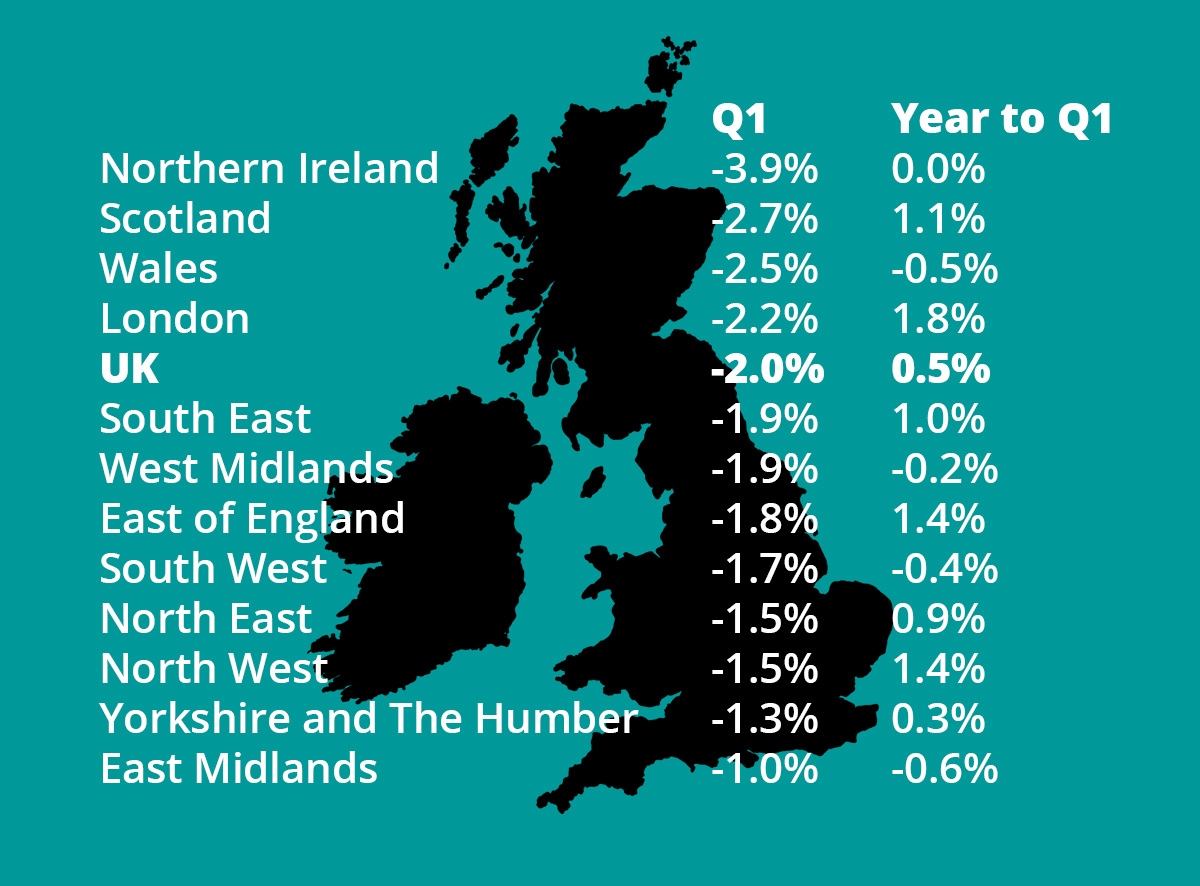

A variation of nowcasting has been some work by a team at the Economic Statistics Centre of Excellence (ESCoE, which is funded by the ONS and based at NIESR), which models GDP growth in the regions and nations of the UK. The researchers use nowcasting methods to explore how UK GDP growth in a given quarter could be allocated across the UK. You can read about their model here and get their data here.

Table 2: Regional GDP growth: Q1 2020 and year to Q1 2020

Source: Economic Statistics Centre of Excellence

What does the evidence tell us about nowcasting and short-term forecasting models?

Most economic forecasts come from one of two broad families of approaches: first, detailed models attempting to explain the operation of the economy (known as ‘structural models’); and second, (‘reduced form’) statistical models, which perform well in forecasting but do not have the same ability to provide an economic narrative alongside their forecasts.

Here we focus on the statistical models as these have become popular in recent years. The models have particularly benefited from methodological advances that now enable them to incorporate a huge array of variables and data.

The 2008/09 global financial crisis provides a useful test case for many of these models. Replicating the real-time flow of information through that period sheds light on how these models would have performed at the time. From these studies, we have learned that:

- The accuracy of nowcasting models varies across the business cycle: sophisticated models typically perform better in recessions, with simple models doing just as well in ‘normal’ times (Chauvet and Potter, 2013). This suggests that different models might be best used in these different parts of the business cycle (Jansen et al, 2016; and Siliverstovs, 2020).

- Monthly information was particularly important in nowcasting quarterly GDP growth through the financial crisis (Schorfheide and Song, 2015; Jansen et al, 2016) and reduces uncertainty (Marcellino et al, 2016).

- Forecasts by professional forecasters (such as the Survey of Professional Forecasters) have generally performed better than statistical models, except in times of crisis (Jansen et al, 2016).

Today’s economy is not in a ‘normal recession’ and therefore the applicability of these messages will only be tested in time, but we know from previous research that:

- Many predictors do not necessarily outperform a smaller number of handpicked predictors, and combining estimates from a number of models can outperform any single model (Carriero et al, 2019).

- Survey indicators, for example of consumer and business confidence, retail activity and construction sector activity, can be important in improving nowcasts accuracy (Ba?bura and Rünstler, 2011).

- GDP data are revised as more information and data are received, and taking this revisions process into account when nowcasting can improve the accuracy of the estimates (Strohsal and Wolf, 2020). In forecasting the initial revisions to GDP, the use of more timely data from different economic indicators is useful (Anesti et al, 2018).

- Information about key trading partners can improve some nowcasts (Bragoli and Modugno, 2017; and Caruso, 2018).

- Combining insights from different models can outperform alternatives (Aastveit et al, 2018), with evidence that the best combinations might vary over time and the business cycle (Proietti and Giovannelli, 2020).

- One approach is to weight across different estimates with the weights based on the performance of each model in recent nowcasts – better-performing models getting a higher weight. Some studies have developed formal statistical test of changes in forecast accuracy (for example, Chiu et al, 2019).

- Conditioning on short-term forecasts from other sources can improve accuracy (Krüger et al, 2017).

How reliable is the evidence – and how applicable is it to the current crisis?

Estimates from all econometric models are subject to uncertainty and error – but as the old adage goes, ‘all forecasts are wrong, but some are useful’. What is clear is that there is not a single approach that dominates all others, all of the time. For an assessment of what forecasting tries to achieve, see Why Forecast (Chadha, 2017), in which it is explained that predictive accuracy is not all the story by any means.

It is difficult to know how these models will perform during this crisis. Our understanding of how well they perform may also be different between the initial and revised release of GDP data – particularly given the challenges in actually measuring GDP at this time.

One challenge is that model-based nowcasts use a dataset that does not include an economic crisis of this nature. This means that, by definition, any nowcast model is seeking to understand what the emerging data mean based on how these emerging data have helped to explain changes in the past.

By extension, it also means that as the economy begins to emerge from the lockdown and data on the period itself begin to feed into these models, our understanding of how different indicators (such as survey data) help us to predict GDP may change. While any changes should improve our nowcasts of the initial lockdown, they will also feed through and affect the nowcasts for the recovery phase – by how much we do not yet know.

In summary, we do not yet know how ‘best’ to handle this episode (in the sense of which approach produces the most accurate nowcasts). In the coming weeks, as more data emerge, researchers will be assessing how different their estimates are based on alternative ways of modelling this episode. In time, we will have a better understanding of how best to nowcast this sort of pandemic in both the initial phases and the recovery.

What does this imply for policy?

This pandemic has underlined one of the weaknesses of some high-level survey measures. While these are useful as early indicators of economic downturn (or predicting the ‘turning point’ in the economic cycle), in this pandemic, where much of the economy was deliberately shut down very quickly, most reflected what we already knew.

At the same time, more detailed data from surveys – including surveys bespoke to this crisis – have shed light on how firms are reacting to this crisis – and in turn the economic conditions within firms as we prepare to restart the economy.

In the weeks ahead, these are likely to prove extremely useful to the government (and others) tracking the economy. But with some of these data being very new and hence having limited historical coverage, it will be difficult for statistical models of the kind discussed above to incorporate these insights. Some of these survey data are discussed in more detail in a related contribution on his site.

Related question: Can textual analysis be used to track the economy during the pandemic?

We will see updated estimates from statistical models of the economic impact of this pandemic on GDP growth emerge as new data on what is happening in different parts of the economy are released. These nowcasts will help us to translate the emerging data into updated estimates of GDP growth well in advance of official estimates.

As discussed, nowcasting the recovery will not be without its challenges and only in time will we fully understand how to nowcast this sort of pandemic more effectively.

Where can I find out more?

As well as the institutions listed above for their nowcast updates, there are a series of accessible ‘commentary’ articles that explain in more detail what we are seeing in the economy now:

- Forecasting recoveries is difficult: evidence from past recessions: Zidong An and Prakash Loungani.

- COVID-19 crisis in the euro area: recession or ‘double-peak’ expansion? Philippe Weil, Refet Gürkaynak, John Fernald, Evi Pappa and Antonella Trigari

- Viral recessions: lack of demand during the coronavirus crisis: Veronica Guerrieri, Guido Lorenzoni, Ludwig Straub and Iván Werning

- Real-time labour market estimates during the 2020 coronavirus outbreak: Alexander Bick and Adam Blandin

- News sentiment in the time of COVID-19: Shelby Buckman, Adam Hale Shapiro, Moritz Sudhof and Daniel Wilson

- COVID-induced economic uncertainty and its consequences: Scott Baker, Nicholas Bloom, Steven Davis and Stephen Terry

- Long haul lockdown: three scenarios for the impact of coronavirus on the UK economy: Jack Leslie, Richard Hughes, Charlie McCurdy, Cara Pacitti, James Smith and Daniel Tomlinson

For readers looking for more technical papers on these methods, reviews include the excellent recent survey by Carriero et al (2019). See also Kapetanios and Papailias (2018). For more on ‘big data’ and ‘machine learning’ methods, Buono et al (2017) provide a review for nowcasting and Koop (2017) reviews Bayesian methods.

Readers may also be interested in some studies looking at characterising and communicating the uncertainty around these estimates. This includes research to develop density nowcasts rather than simply point estimates. Density nowcasts provide the likelihood that a model attaches to different values of the outcome variable (for example, GDP growth) occurring (see Mazzi et al, 2014, for more on this).

Who are UK experts on this issue?

On methods of forecasting and nowcasting:

- Andrea Carriero, Professor of Economics, Queen Mary, University of London

- George Kapetanios, Professor of Finance and Econometrics, Kings College London

- Gary Koop, Professor of Economics, University of Strathclyde

- Lucrezia Reichlin, Professor of Economics, London Business School.

- Giovanni Ricco, Assistant Professor, University of Warwick

On incorporating and communicating data uncertainty and GDP data revisions:

- James Mitchell, Professor of Economic Modelling and Forecasting, Warwick Business School

- Ana Galvão, Professor of Economic Modelling and Forecasting, Warwick Business School

On the latest nowcast releases and the outlook for the economy:

- Garry Young, Deputy Director, NIESR

- Stuart McIntyre, Head of Research, Fraser of Allander Institute

Author: Stuart McIntyre

Updates:

- 3/7/20: Figure 1 was updated to include Q3 data, and the text describing the figure was also updated.