Borrowing by the UK government has hit peacetime highs this year. Often such increases in public debt rest on borrowing from abroad – but in this crisis, a sharp rise in domestic saving by households has offset public spending. In effect, the government has borrowed from taxpayers.

According to the Office for National Statistics (ONS), public sector net debt has risen by £276.3 billion since April and reached 100.8% of GDP at the end of October 2020, the highest level since the early 1960s (ONS, 2020).

Three things have driven this surge in the UK’s debt ratios. First, increased spending due to government support schemes such as the Coronavirus Job Retention Scheme (CJRS); second, a fall in tax receipts, in particular income tax and VAT; and third, the sharp fall in GDP as lockdown measures clamped down on economic activity.

Do we need to worry about the higher public sector borrowing requirement?

Thanks to continued support from monetary policy, government borrowing costs have stayed low despite the extraordinary levels of new borrowing. Following the outbreak of Covid-19, the Bank of England cut its interest rate from 0.75% to 0.1% and increased the size of its quantitative easing (QE) programme by ?450 billion to ?895 billion, almost doubling the size of its balance sheet (Bank of England, 2020) and contributing to lowering rates on government bonds.

Related question: Quantitative easing and monetary financing: what’s the difference?

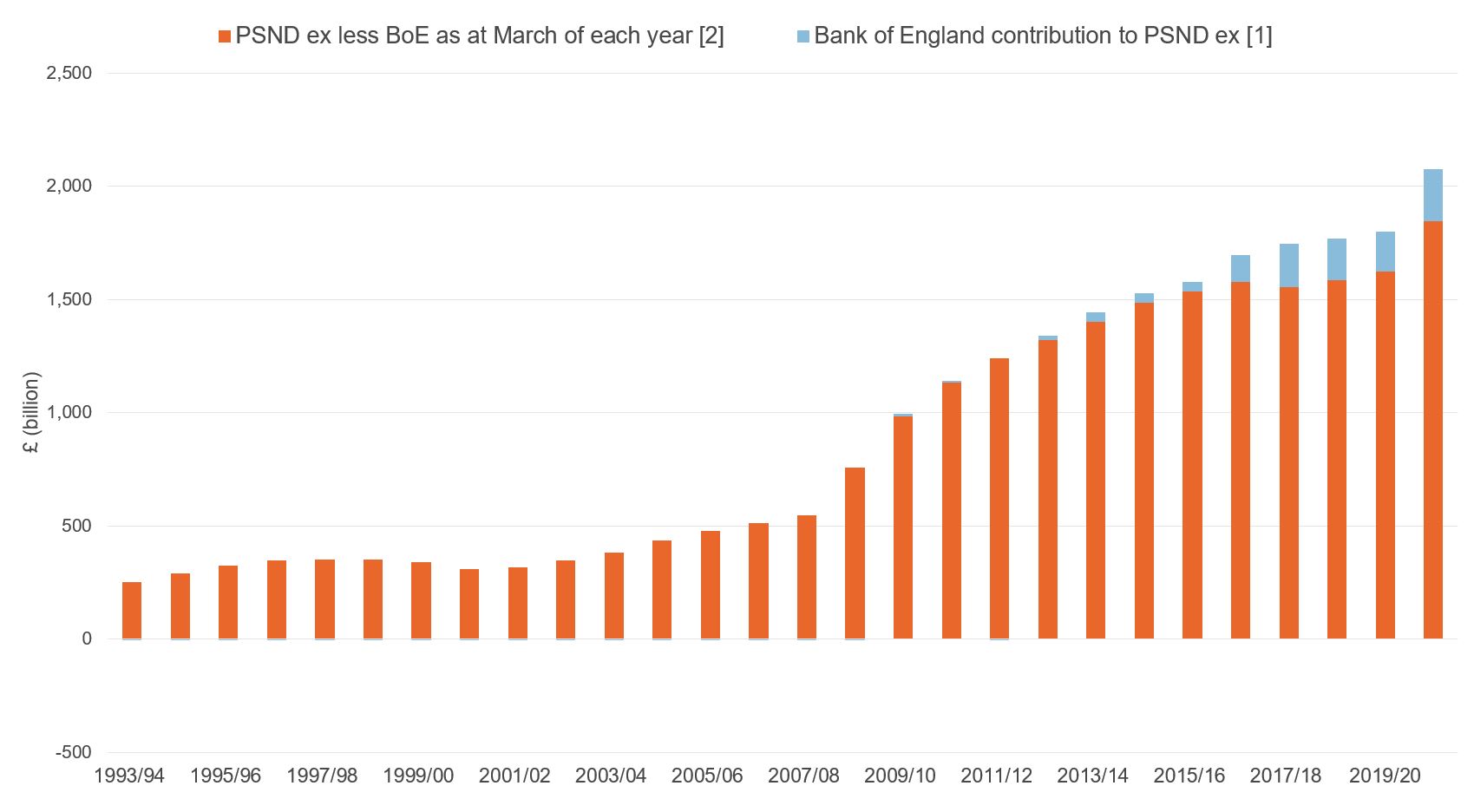

At the end of October 2020, the Bank of England held just under ?233 billion of the UK’s public sector debt. This is 12.6% of the total and is largely a result of its quantitative easing activities (see Figure 1 and ONS Public Sector Finances, 2020). Given weak recovery prospects and low inflation, interest rates are likely to remain low: the National Institute of Economic and Social Research (NIESR) projects the policy rate to remain at 0.1% until 2024 (NIESR, 2020).

Figure 1: Public sector net debt (PSND) excluding public sector banks, UK, March 1994 to the end of October 2020

Source: ONS, Public Sector Finances, October 2020.

Notes: [1] Includes Asset Purchase Facility (APF), which includes the Term Funding Scheme (TFS) and TFS incentives for small- and medium-sized enterprises (TFS SME).

[2] Public sector net debt excluding public sector banks (PSND ex) is the combination of PSND ex Bank of England (BoE) plus the BoE’s contribution to PSND ex.

[3] Public sector net debt excluding public sector banks (PSND ex) shown at the end of each financial year (March), unless otherwise stated.

Higher savings rates are playing an important role. While the UK government is borrowing more, both households and businesses are saving more, which means that government borrowing is not particularly reliant on overseas finance. Indeed, despite the large increase in the government deficit, there has been no deterioration in the current account, which measures the scale of borrowing from abroad.

How is it possible that households and businesses are saving more during the crisis?

The pandemic and lockdowns have led to huge income losses for many households and businesses, widening disparities in incomes and revenues. At the same time, the crisis has brought dramatic falls in consumption and investment expenditure, ultimately driving up the net savings of households and businesses.

Related question: What are the effects of Covid-19 on poverty and inequality?

One study presents evidence that low-income households have seen their saving rates decline sharply as their earnings fell more than their expenditure (Hacioglu et al, 2020). In contrast, middle- and high-income households have seen their saving rates increase due to containment measures that restricted spending on contact-intensive services and non-essential goods. On balance, the fall in consumption has been more pronounced among households with higher income levels, driving up the net savings of the household sector.

There are similar contrasts among businesses. According to the Business Impact of Coronavirus Survey (BIC, 2020), across all industries, 29% of businesses that had not permanently stopped trading had low business resilience with cash reserves that will last between zero and three months. Hospitality and construction have a significantly higher percentage of businesses with low cash reserves: 44% and 40% respectively.

At the same time, 35% of businesses reported higher resilience with more than six months of cash reserves. Companies have raised almost £80 billion in net finance since the beginning of the year with the help of government-backed loan schemes (Bank of England, 2020). But with business investment projected to fall almost by 18% in 2020 (Office for Budget Responsibility, OBR, 2020), the net savings of the corporate sector have seen a rise, albeit a much smaller one compared with that of households.

What do we learn from sectoral balances?

Quarterly sector accounts published by the ONS help us to track the net financial position of each sector in the UK economy. Sectoral balances show the difference between saving and investment across all members of a particular sector of the economy – that is, households, businesses and the government. If investment is greater than saving for a sector, then that sector is a net borrower.

The aggregation of these three domestic sectors gives the resulting balance with the rest of the world – that is, the current account balance (CAB). If national investment, I, exceeds national savings, S, the excess of investment over savings need to be financed by savings from abroad (net borrowing from abroad), which is the counterpart to a current account deficit:

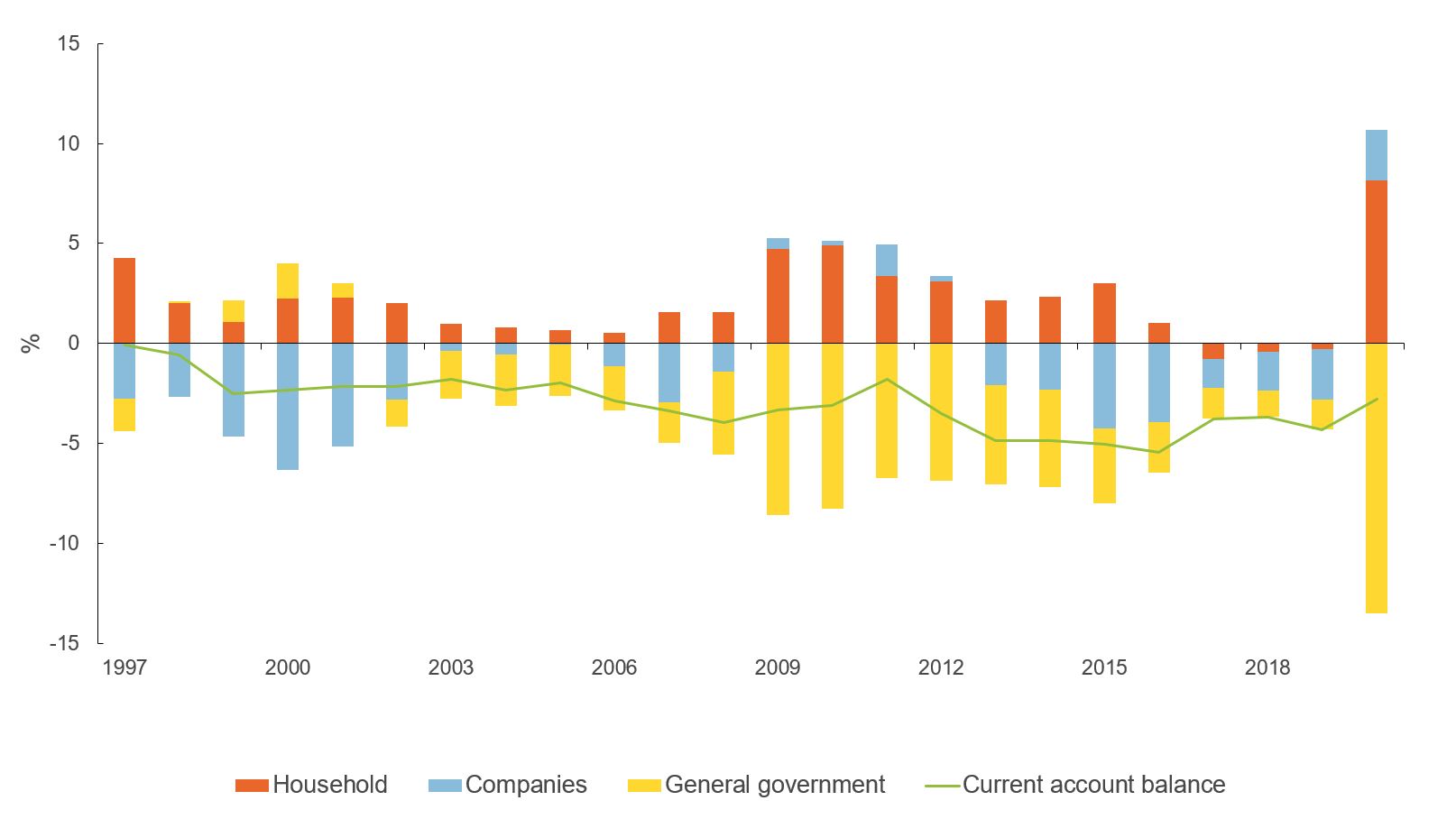

Figure 2: Sectoral balances (percentage of GDP)

Source: ONS, NIESR.

Note: 2020 is forecast. Saving and investment data are gross of depreciation unless otherwise stated.

Figure 2 shows the sharp rise in government borrowing in 2020. This rise is unprecedented in peacetime in the UK and has been offset by record rises in saving. As a result, there was a significant fall in the current account deficit.

A similar pattern was observed in the global financial crisis of 2008/09 – but with significantly smaller sectoral imbalances. While general government increased its net borrowing, households and firms increased their savings, effectively lending to the government.

On one hand, this precautionary response to heightened uncertainty makes it easier for the government to fund its debt. On the other hand, it may delay the recovery if lower household and firm spending persists. A weaker recovery due to lower consumption and investment by households and firms, in turn, may act to keep government borrowing requirements at high levels for longer.

How will household and corporate sector savings evolve in the recovery phase?

Despite the massive monetary and fiscal stimulus in the aftermath of the global financial crisis, it took around four years before households and firms were willing to spend and government borrowing started to decline. This time, spending and saving will depend on the evolution of the pandemic, how the associated restrictions evolve and the speed at which the economy adjusts to the post-pandemic normality.

The UK economy is expected to take a long time to recover fully to its pre-pandemic levels – the Bank of England and NIESR expect the economy to go back to its pre-Covid-19 levels by 2022 and 2023, respectively. Consistent with that, household saving rates might continue to stay at relatively high levels for the next few years.

Indeed, recent evidence suggests that serious economic downturns can ‘scar’ consumers in the long run by increasing their tendency to save (Malmendier and Shen, 2020; Kozlowski et al, 2020). Corporate savings also increase as businesses take control of their balance sheets in response to high uncertainty and restrain their investment.

But a revival of confidence on the back of successful vaccine rollouts might imply a faster recovery. This would lower the government borrowing requirement gradually, but it might also lead to borrowing from abroad if consumers run down savings very quickly because of pent-up demand. But as long as stable demand for UK government gilts remain, the risks associated with financing a larger current account deficit are likely to be limited.

How household spending changes – especially in relation to travel and leisure activities, and in reaction to rising unemployment rates – will be particularly important. Even with a faster recovery, business investment is likely to respond more slowly than household expenditure. Both Brexit-related uncertainties and relatively high levels of corporate sector debt – which stood at almost 80% of GDP at the start of 2020 – are likely to play a role (Bank for International Settlements, 2020).

While sectoral balances give us a broad view of the net financing requirements of a sector as a whole, they may mask growing inequalities within each sector, as explained above. As with Brexit, the Covid-19 shock has also been a highly sectoral one, with some households and businesses much worse affected than others (Bhattacharjee and Lisauskaite, 2020).

Lower incomes and business cash flows due to weak economic activity could lead to insolvencies and unemployment, which may damage the long-term potential of the economy. The Bank of England forecasts that the supply capacity of the economy will be 1.75% smaller relative to what it would have been in the absence of Covid-19, while the OBR estimates a two percentage point ‘scarring’ effect on productivity (Bank of England, 2020 and OBR, 2020).

Therefore, given that government borrowing continues to be financed at very low interest rates, fiscal policy may have the space to provide support to limit long-term damage.

Where can I find out more?

- Household spending in lockdown: Blog by Dawn Holland at the National Institute of Economic and Social Research.

- Consumption in the time of Covid-19: Evidence from UK transaction data: Sinem Hacioglu, Diego Kaenzig and Paolo Surico present real-time indicators on consumer spending, labour income, mortgage payments and household financing needs.

- The corporate saving glut and falloff of investment spending in OECD economies: Study by Joseph Cruber and Steven Kamin documenting the rise in net lending by corporate sector following the global financial crisis.

- Revisiting external imbalances: insights from sectoral accounts: Study by Cian Allen of the role of sectoral balances in explaining external adjustment.

- Public and private saving and the long shadow of macroeconomic shocks: VoxEU article by Joshua Aizenman and Ilan Noy on the effects of crises on public and private saving behaviour.

Who are experts on this question?

- Hande Küçük

- Jagjit Chadha

- Dawn Holland

- Paolo Surico

- Cian Allen