It is unclear how long restrictions on trade and travel will remain in place – and too soon to say if coronavirus will permanently reduce cross-border flows of goods, services and people. But there is plenty of evidence on the potential damage to the world economy.

World trade is experiencing a severe contraction. This is not surprising given the global downturn triggered by the ‘Great Lockdown’ – and trade has tended to bounce back quickly during the recovery from past recessions. Similarly, international mobility has declined dramatically as countries have imposed travel restrictions and international aviation has ground to a virtual halt. As with trade, international travel is generally expected to recover in line with past crises, within 11 to 19 months.

Yet there are also fears that this crisis could be different. For one thing, it is unclear how long restrictions on international trade and travel introduced in response to the Covid-19 pandemic will remain in place. One risk is that some will be prolonged or reintroduced in the event of a second wave of infections (OECD, 2020).

Another risk is that they reinforce a ‘deglobalisation’ trend fuelled over the past ten years by greater scepticism about the benefits of globalisation among citizens and politicians (Irwin, 2020). It is an open question whether the world economy faces a danger from rising protectionism (Crowley, 2020). But the rules-based international trade system is already in the middle of an existential crisis (Schott and Jung, 2019). There is also evidence that uncertainty about the future direction of trade policy can in itself be a deterrent to international trade (Handley and Limão, 2017).

While it is too soon to say if the Covid-19 crisis will permanently reduce international trade and mobility, economic research offers some insights about how such a reduction might affect the world economy.

What does the evidence tell us?

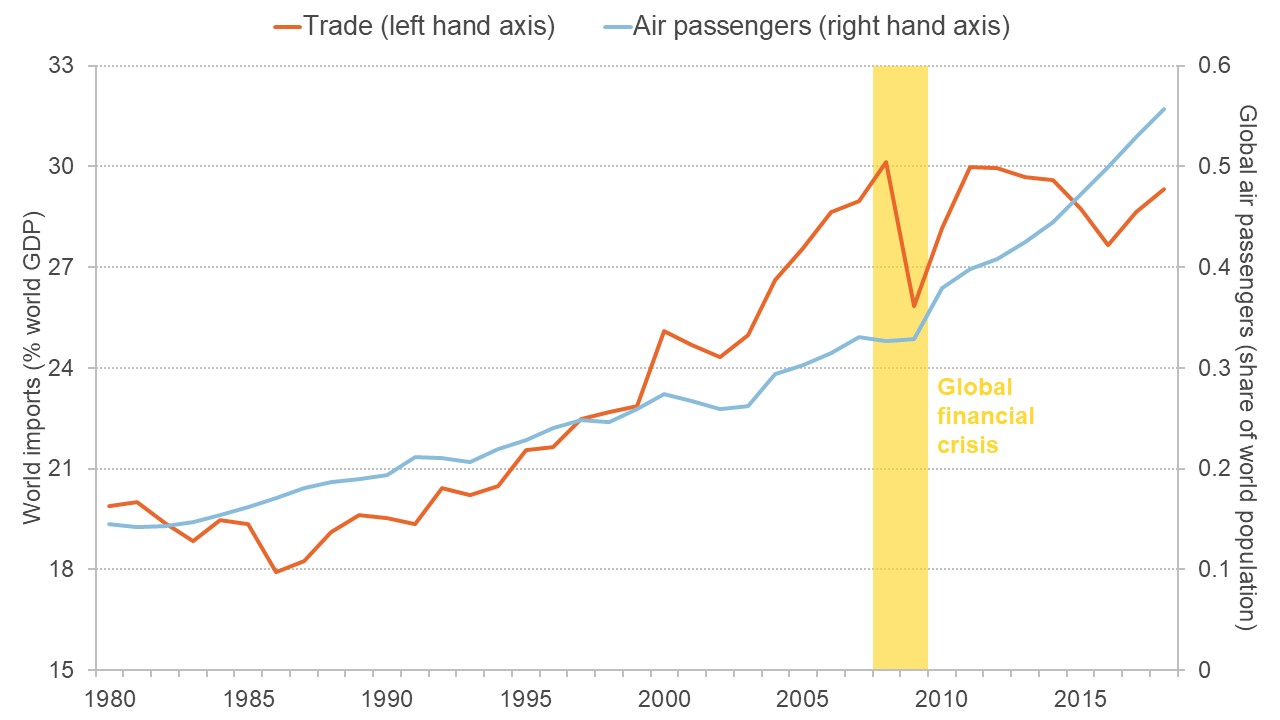

Between 1980 and 2008, world imports grew by 10 percentage points relative to world GDP (see Figure 1). A large share of this increase can be attributed to trade liberalisation by the large, labour-abundant economies of China, India and Brazil (Zymek, 2015; Goldberg and Pavcnik, 2016) The decline in shipping costs – especially for airborne freight – is likely to have also facilitated the growth of world trade over this period (Hummels, 2007). But in the aftermath of the 2008/09 global financial crisis, world trade has stagnated and even declined a little.

Figure 1: Growth in world trade and global air travel since 1980

Source: Annual data on world imports, world GDP, global air passengers and world population from the World Bank's World Development Indicators.

Related question: What happens to trade in a global downturn?

Economic theories that explain why and how countries trade with each other imply that trade generally raises countries’ average real incomes (Anderson, 2008). In practice, measuring the size of these gains is difficult.

Studies that do so chiefly on the basis of economic models find that a one-percentage-point increase in imports relative to GDP raises a country’s per capita real income by around 0.25% (Arkolakis et al, 2012; Simonovska and Waugh, 2014). Studies that mainly rely on empirical methods find that a one-percentage-point increase in imports relative to GDP raises a country’s per capita real income by 0.75-2.5% (Frankel and Romer, 1999; Feyrer, 2020).

Based on these figures, the growth in world trade may have contributed between 5% and 10% of world real income growth in the period 1980-2008.

Figure 1 also shows the evolution of the global number of air passengers relative to the world population. On this measure of international mobility, air passenger numbers have almost quadrupled between 1980 and 2018, with no signs of a deceleration over the past decade. According to the industry’s own figures, aviation was directly responsible for 0.9% of world GDP in 2016.

But the benefits of international mobility significantly exceed its direct effect on the demand for certain services:

- First, research suggests that cross-border mobility of people facilitates international trade in goods because complex buyer-seller relationships require face-to-face meetings (Cristea, 2011).

- Second, through cross-border commuting and migration, international mobility opens the door to improvements in the global allocation of labour that cannot be attained through trade alone (Mundell, 1957).

Assessing the economic gains from migration faces the same difficulties as measuring the gains from trade. Using similar methods as in studies of trade, researchers find that international migration up to the year 2006 may have increased global real incomes by 5-10% (di Giovanni et al, 2014). Moreover, most studies agree that there are sizeable further gains to be realised from increased cross-border mobility (Dustmann and Preston, 2019).

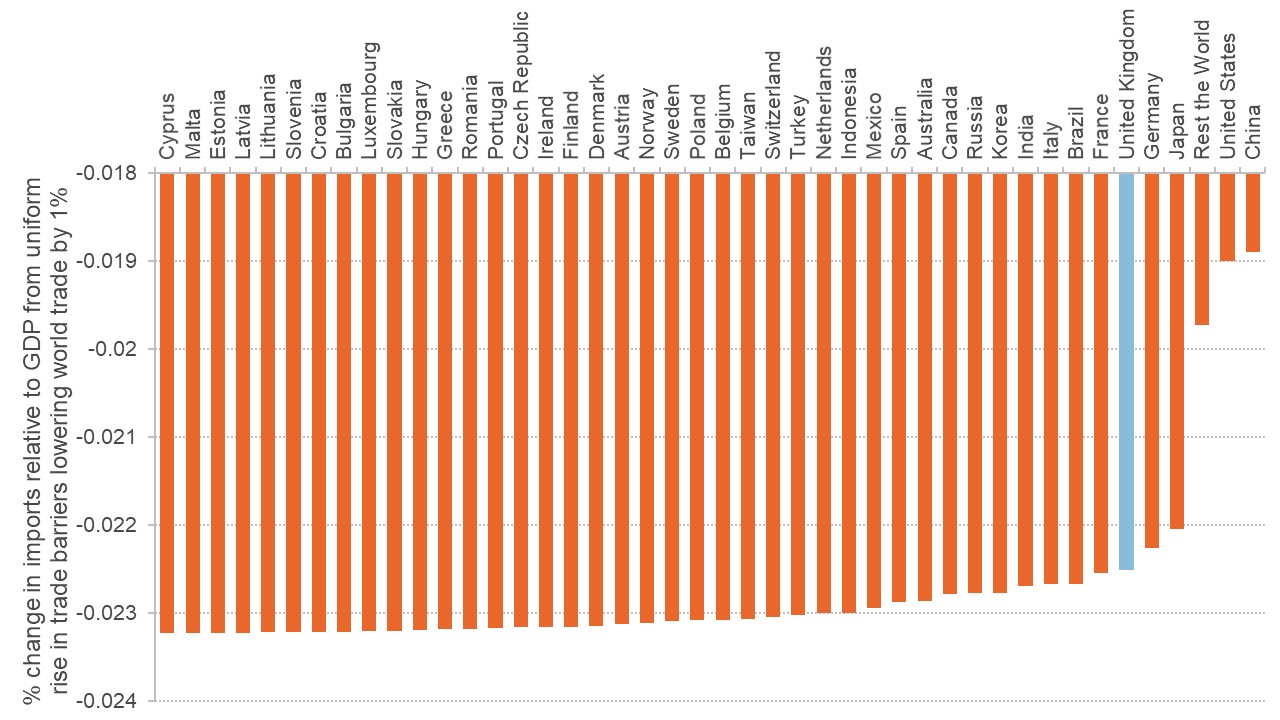

A permanent decline in international trade and mobility would erase some of the economic benefits. It is also likely to have uneven effects across countries. For example, a uniform decline in trade barriers that reduces world trade by 1% would have a larger effect on small economies, as they tend to be more open to trade.

Figure 2 provides an indicative scenario of how such a decline would play out across 43 economies (and the rest of the world). It highlights that countries like Cyprus and Luxembourg would see a larger decline in trade relative to GDP – and thus in real incomes – than countries like the United States and China. Similar arguments apply for international flows of people, whose empirical patterns share many common features with data on the international flows of goods and services (Anderson, 2011).

Figure 2: Impact of a uniform rise in trade barriers that reduces world trade by 1%

Sources: Indicative scenario based on a linear approximation of the structural gravity model following Baier and Bergstrand (2009). Underlying data on the shares of world output for 43 countries and the ‘Rest of the World’ is taken from 2016 release of the World Input-Output Database. More details can be found here.

How reliable and complete is the evidence?

Some measures of the economic gains from international trade and mobility are based on quantitative applications of theoretical models. Therefore, they are contingent on the validity of the assumptions that underpin these frameworks (Borjas, 2015; Melitz and Redding, 2015). The track record of some early computable general equilibrium (CGE) models of trade in predicting policy changes was mixed (Kehoe et al, 2017). But trade models have evolved significantly over the past two decades, and now capture many salient features of the international data better (Costinot and Rodríguez-Clare, 2014).

Other measures are based on empirical data on trade flows, migration flows and real incomes. But studies that proceed on this basis have had to develop identification strategies – usually involving geography or particular historical episodes – that allow them to ascertain the true causal effect of openness on incomes. The robustness and general validity of these strategies is open to criticism (Rodríguez and Rodrik, 2000; Borjas, 2020).

As illustrated by the range of numbers cited above, the different methodologies yield starkly different assessments of the size of the contribution of international trade and mobility to global incomes – and, hence, the losses if they were permanently impaired. Furthermore, the numbers reflect the long-run effect of trade and mobility on incomes. There is still very little research on how – and how quickly – this ‘long run’ is reached (Head and Mayer, 2014).

Past crises offer little guidance on which sectors of the world economy are most at risk from higher barriers to trade and mobility in the wake of Covid-19. Yet two groups of sectors look particularly vulnerable: high-end manufacturing sectors, such as electronic products, machinery and transport equipment; and services.

High-end manufacturing sectors are especially reliant on ‘global value chains’, whereby intermediate inputs in production are sourced from different countries (UNIDO, 2011). Such trade along the production chain has been a major part of the growth in world trade in recent decades, and it is especially sensitive to changes in the cost, speed and ease of international imports and exports (Yi, 2003). There had already been some trend towards the ‘reshoring’ of value chains, and the Covid-19 pandemic may accelerate that (Kilic and Marin, 2020).

Trade in services is subject to different types of barriers than trade in goods (Borchert et al, 2014). In particular, it is often argued to be more reliant on the ability of people to move across borders (Head and Mayer, 2018). This is especially true for tourism and education services, which have been severely affected by the Covid-19 crisis, and which would have to transform radically if barriers to international mobility were to persist (World Trade Organization, 2020).

Both of these two groups of sectors make up a significant share of the UK’s exports. Electronic products, machinery and transport equipment account for 26% of the value of UK exports; while tourism and education contribute another 11% (Office for National Statistics, 2020).

What does this imply for policy?

Government policy should seek to restore the openness of borders to trade and travel as much and as quickly as the continuing containment of Covid-19 permits. There is little evidence that barriers to international trade and mobility are effective at this stage in slowing the spread of the disease if there is a well-working containment regime within countries (European Centre for Disease Prevention and Control, 2020).

In addition, countries should remove protectionist measures that were introduced at the outset of the crisis – such as export restrictions on medical supplies – and carefully consider the implications of policies designed to interfere with global supply chains (Baldwin and Freeman, 2020). Aside from the possible economic damage, such unilateral measures may further undermine the rules-based multilateral system that has overseen the rapid growth of global trade since the Second World War.

Related question: Does the world economy face a danger from rising protectionism?

As the UK establishes its post-Brexit trade regime, maintaining the integrity of this system ought to be a key concern for the government. The UK could seize this opportunity to devise a model trade policy that accommodates recent globalisation trends – such as global value chains and growing services trade – while reflecting the concerns of those segments of society that have seen few benefits from them so far (Dhingra, 2019).

Related question: Should Brexit trade policy changes be delayed because of Covid-19?

Where can I find out more?

Trade and travel in the time of epidemics: Hans-Joachim Voth of the University of Zurich discusses the feasibility and desirability of restricting international trade and travel in the light of the experience from different historical episodes.

Global supply chains will not be the same in the post-Covid-19 world: Beata Javorcik of the European Bank for Reconstruction and Development (EBRD) comments on the future of global supply chains in the wake of the Covid-19 epidemic.

Services trade and Covid-19: Anirudh Shingal of the Indian Council for Research on International Economic Relations (ICRIER) explains why international trade in services may only recover slowly from the crisis.

Brexit and the future of trade: Swati Dhingra of the London School of Economics explores some principles for a modern, inclusive UK trade policy after Brexit.

Who are UK experts on this issue?

- Ingo Borchert, University of Sussex, has published on the determinants of international trade in services and written about the prospects for UK services trade after Brexit.

- Swati Dhingra, London School of Economics, is working on the division of the gains from trade between consumers, importers and exporters and has published on the impact of trade agreements on consumer welfare.

- Christian Dustmann, University College London, has authored research on the benefits of international mobility and the economic impact of immigration.

- Beata Javorcik, University of Oxford and EBRD, has published research on the impact of service trade liberalisation on manufacturing firms and has prominently contributed to the public debate on how Covid-19 will reshape the global economy.

- Robert Zymek, University of Edinburgh, has published on the growth in world trade and is currently working on the role of trade in explaining income differences between countries.