While the rollout of the vaccine is great news for our collective physical health, the increasing probability of a ‘no-deal’ Brexit is not so good for the UK’s economic health. Meanwhile, the idea of a one-off wealth tax is rising up the political agenda.

Newsletter from 11 December 2020

The initial rollout of Pfizer’s coronavirus vaccine across UK hospitals this week was great news for our collective physical health. An early recipient of the Covid-19 jab, one William Shakespeare of Warwickshire, will doubtless have enjoyed both the clinical and media attention – with assorted headlines proclaiming ‘the taming of the flu’ and ‘all’s well that ends well’.

All is not so well with the country’s economic health. Yesterday’s GDP figures from the Office for National Statistics showed the recovery slowing even before the second lockdown in England was imposed. The National Institute of Economic and Social Research (NIESR) now expects the economy to flatline in the final quarter, with GDP at the end of 2020 around 8.5% lower than it was at the end of 2019.

Far more worrying for the UK’s longer-term economic health is the increasing probability of a ‘no-deal’ Brexit. The Office for Budget Responsibility (OBR) expects the long-run effect of leaving the European Union will be to reduce the UK’s real GDP by around four percentage points even if a deal is struck, and by around six without one.

Researchers from the Centre for Economic Performance (CEP) have shown the ‘double whammy’ of Covid-19 and Brexit, with sectors that suffered less during lockdown being most exposed to damage from leaving the EU – including automotive, food, and professional and financial services. In a study published this week, they reveal that the government’s failure to provide clarity to businesses over the future relationship has been a greater hindrance than the largest global economic shock for a century in terms of firms’ ability to prepare.

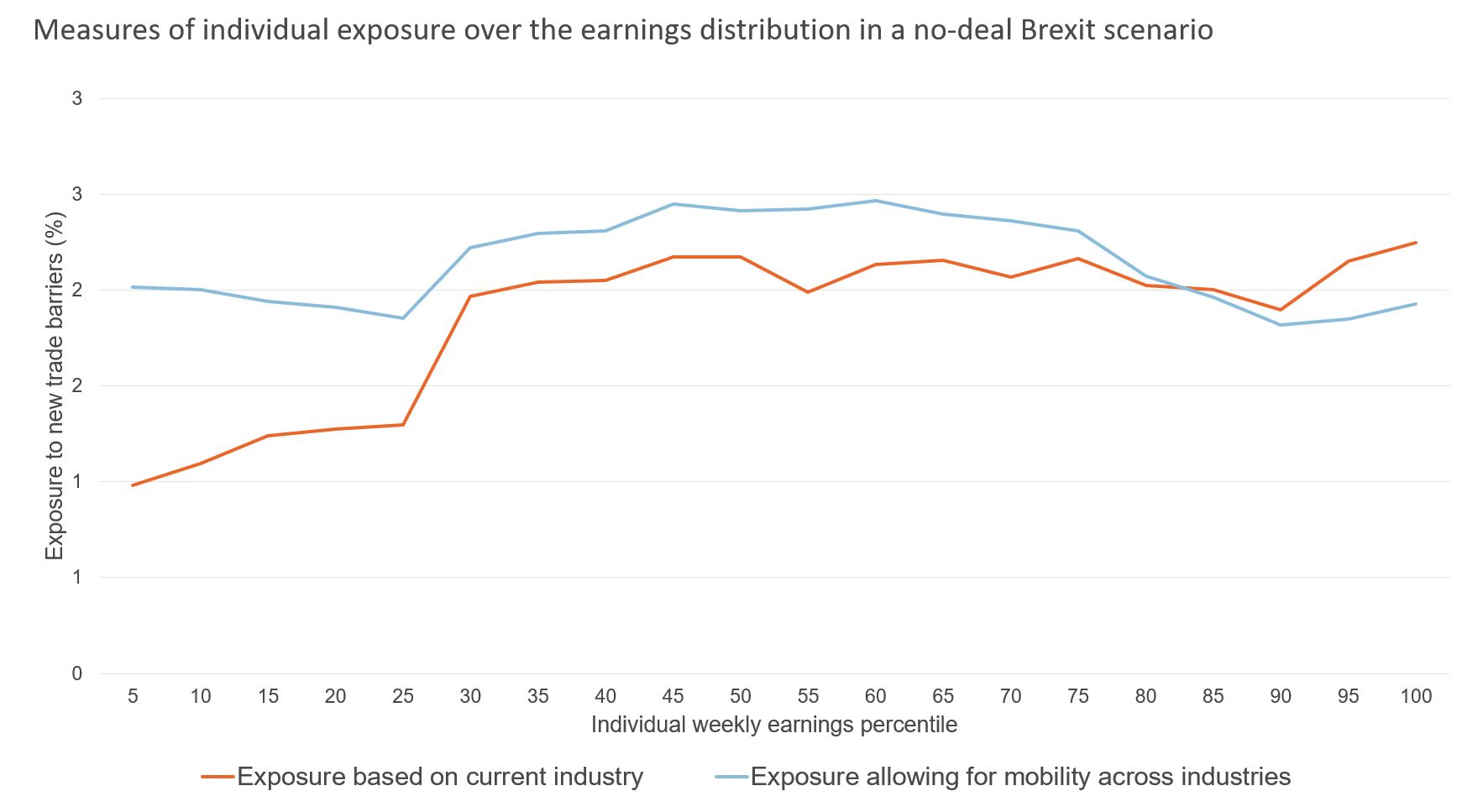

Here at the Economics Observatory, we have looked at potential repercussions for earnings. Peter Levell and colleagues at the Institute for Fiscal Studies (IFS) find that the effects are likely to be highly unequal, with ‘blue-collar’ workers in exposed sectors the worst hit. High earners, such as managers, and less skilled workers, such as cleaners, who are employed in the same industries will probably experience smaller overall wage impacts because they have employment opportunities in other sectors.

Vaccination and its discontents

While scenes of elderly people receiving vaccinations against Covid-19 have been encouraging, our data piece this week suggests that there could be more resistance as the programme is rolled out across the population. A public survey in September (before the UK’s approval of the Pfizer vaccine) finds that individuals who are more vulnerable to illness and death from the pandemic are also more likely to express negative attitudes towards vaccines. This includes people from ethnic minority backgrounds or in lower socio-economic groups, as well as those with poor knowledge of the virus and poor adherence to Covid-19 guidelines.

These findings of mistrust suggest the importance of effective public health messaging, which, as health policy expert Linda Bauld explained in a podcast this week, has not been the UK government’s strong suit to date. University of Toronto economist Joshua Gans had some fun with the confusions around what we can and cannot do in a blog post on the UK’s Covid-19 Christmas guidelines.

A number of Observatory contributions have touched on these issues, including how public health messages can promote compliance with protective measures like quarantining and social distancing; how behaviour changes when masks are mandatory; and the role of emotion in our responses to coronavirus.

Rich pickings

In a recent Observatory piece, Roger Farmer looked at the big rise in government borrowing as an essential policy response to the health and economic effects of Covid-19. He warned that seeking to reverse this spike too soon would damage the recovery – and that we should beware the dangerously widespread view that the public finances are just like those of an individual or family, what he calls the ‘household fallacy’. In a recent letter to the BBC’s director general, a number of top economists echoed these concerns.

Here at the Observatory, we’ve tried to clarify exactly how the public finances work in a great ‘explainer’ video on Paying Back the Debt put together by Michael McMahon at the University of Oxford and Helen Miller at the IFS.

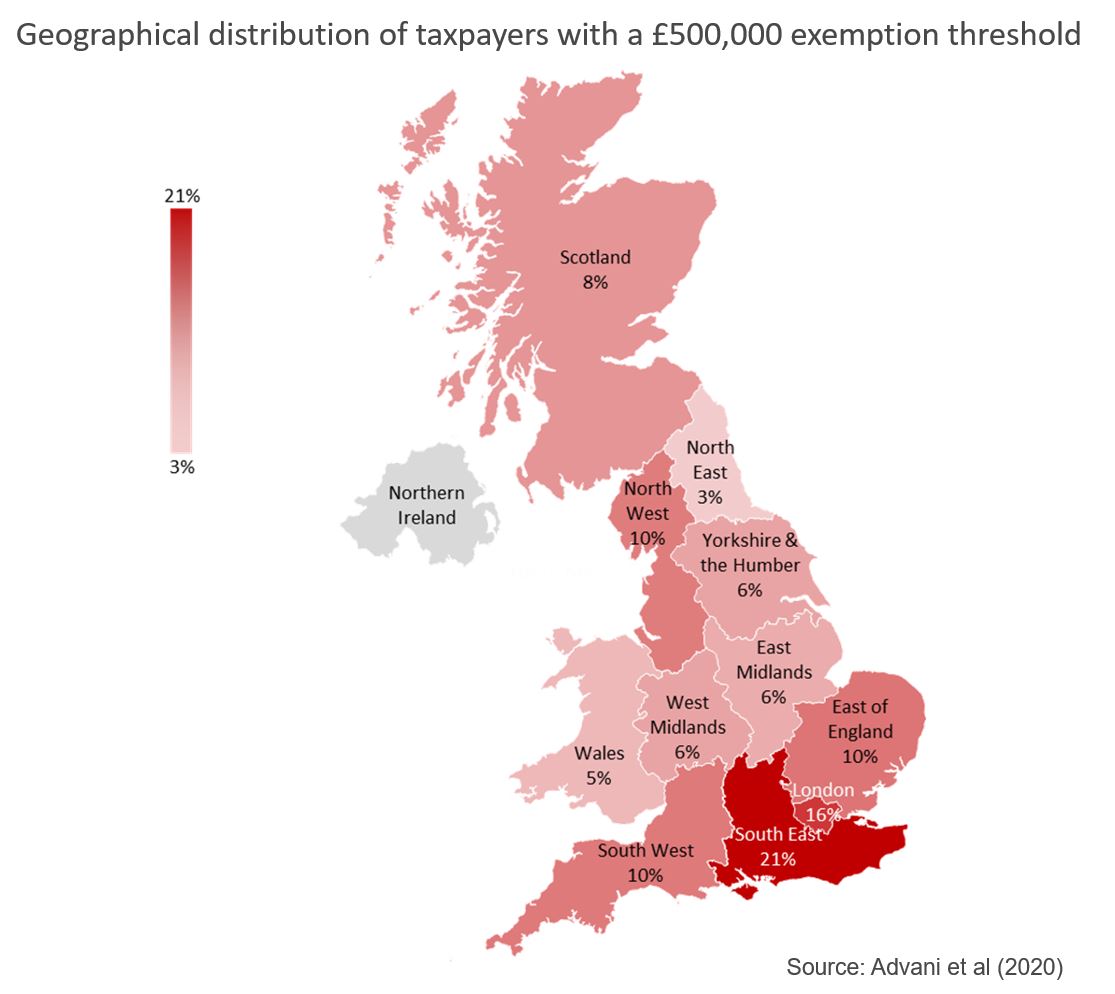

Paying for the pandemic is one potential justification for the introduction of a wealth tax – an idea that was pushed up the political agenda this week by Arun Advani of the Centre for Competitive Advantage in the Global Economy (CAGE) and colleagues on the Wealth Tax Commission. The central conclusion of their final report: a well-designed one-off wealth tax would raise significant revenue in a fair and efficient way; it would be very difficult to avoid; and it would work in practice without excessive administrative costs.

On the Observatory, we’re publishing summaries of some of the evidence the Commission has pulled together. Arun and colleagues outline their estimates of how much revenue such a tax might raise (including a tax simulator where you can plug in your chosen tax rates and thresholds), and where and on whom the main burden might fall (see figure below). Nick O’Donovan at the Future Economies research centre explores the varying degrees of success of other countries’ efforts to introduce one-off wealth taxes or capital levies in the aftermath of major crises. And economic historian Martin Chick at Edinburgh asks whether the UK’s past experiences suggest that wealth taxes can help to improve the public finances.

Coming up

Next week will see our last crop of articles before the holiday season. We’ll have more on fiscal and monetary policy matters, including former Bank of England deputy governor Paul Tucker on whether we need a new constitution for central banking. And we will be posting a couple of pieces on consumer spending in Covid-19 times, one focused specifically on challenges for the retail sector in the run-up to Christmas.