Online spending naturally became a bigger share of total UK household consumption during lockdown. While offline spending has risen since restrictions eased, there is early evidence of a ‘new normal’ in which online spending is roughly 25% higher than its pre-pandemic level.

There is a widespread belief that the Covid-19 crisis has accelerated the shift to online spending. In recent research, we use real-time data on individual spending behaviour sourced from UK bank records to present early evidence on patterns in online and offline spending. Many other studies around the world are exploring the impact of the pandemic on household finances and consumer spending.

In the UK, online spending as a share of total spending increased greatly during lockdown, although this was in part due to the decline in offline spending. The share of online spending has reduced during the post-lockdown re-opening of the offline retail economy, with some early evidence of a ‘new normal’ in which the share of online spending is approximately 25% higher than its pre-pandemic level.

What do the data suggest?

The pandemic and the lockdown policy response led to radical changes in consumer spending behaviour. With the forced closure of all but essential offline retail stores, consumers were effectively forced into sourcing many goods and services online.

One particular adaptation has hit the headlines: a shift to online shopping. This strategy has obvious benefits such as lowering health risks, but it also promises lower costs and more choice.

A popular hypothesis is that several years of gradual, structural change towards higher usage of online shopping has rapidly accelerated in a matter of months. But is the recent shift to online a new permanent structural feature of consumer retail, or simply a short-term result of location-constrained consumers sourcing goods and services from available outlets?

To investigate this issue, our study sourced anonymised data containing individual-level bank spending records from Money Dashboard, a banking statement aggregation app. Other studies using the same source include those of Surico et al (2020), Hacioglu et al (2020), Chronopoulos et al (2020), Delestre et al (2020) and Bourquin et al (2020).

Our study defines online spending as that which allows a consumer to order digitally, and to receive the good or service without any need for (substantial) physical involvement of the consumer. To make this more concrete, here are some examples:

- Online: (i) ordering a pizza via an app/website and having it delivered; (ii) buying a camera from Amazon; (iii) grocery shopping at Ocado.

- Offline: (i) paying for anything with cash; (ii) using Uber for a taxi; (iii) buying a plane ticket with Ryanair.

Grey areas such as Click and Collect purchases are counted as offline. Traditional offline businesses that have added (partial) online capability – for example, Aviva, Sainsbury’s and British Airways – are classified as offline merchants unless it is obvious in their clients’ banking transactions that purchases were via an online entity, if any, of the company. For example, ordering groceries online with home delivery by Sainsbury’s counts as online; shopping at one of their stores does not.

Spending at online-by-design businesses – for example, Amazon, Netflix and Spotify – are automatically classified as online. The classification approach uses pattern matching on business names, business lines and transaction descriptions.

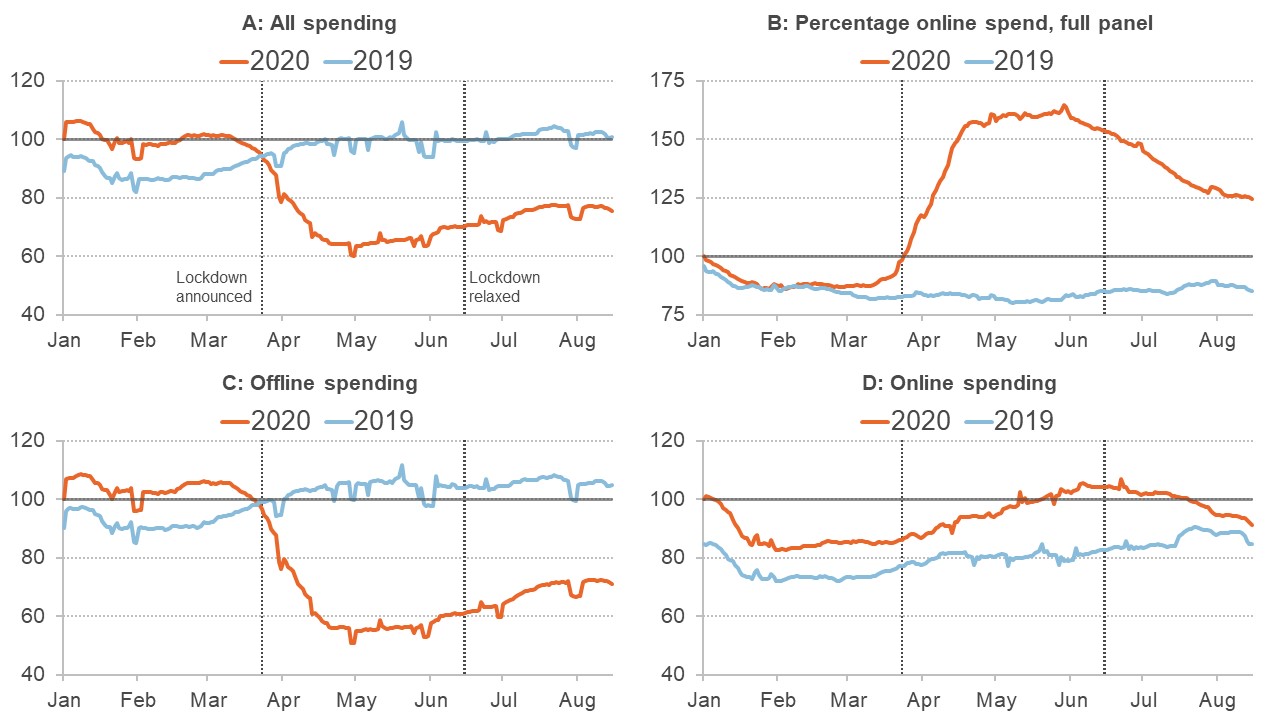

Figure 1. Online and offline spending

Notes: 28-day moving averages for a balanced panel of 12,949 users with a total of 20.8 million relevant transactions. 01/01/20 = 100.

Source: University of Nottingham/Warwick Business School; underlying data from Money Dashboard

Figure 1 illustrates the main results (spend in Figure 1 is a mix of discretionary and essential purchases, but excludes certain debit transactions such as flows into investments, pensions and tax payments). Of particular interest is Panel B, which shows that the shift online was indeed massive: a doubling in the proportion of online spending. But Panels C and D indicate that this is mainly driven by a reduction in offline spend. Indeed, Panel D indicates that online spend is on a secular trend.

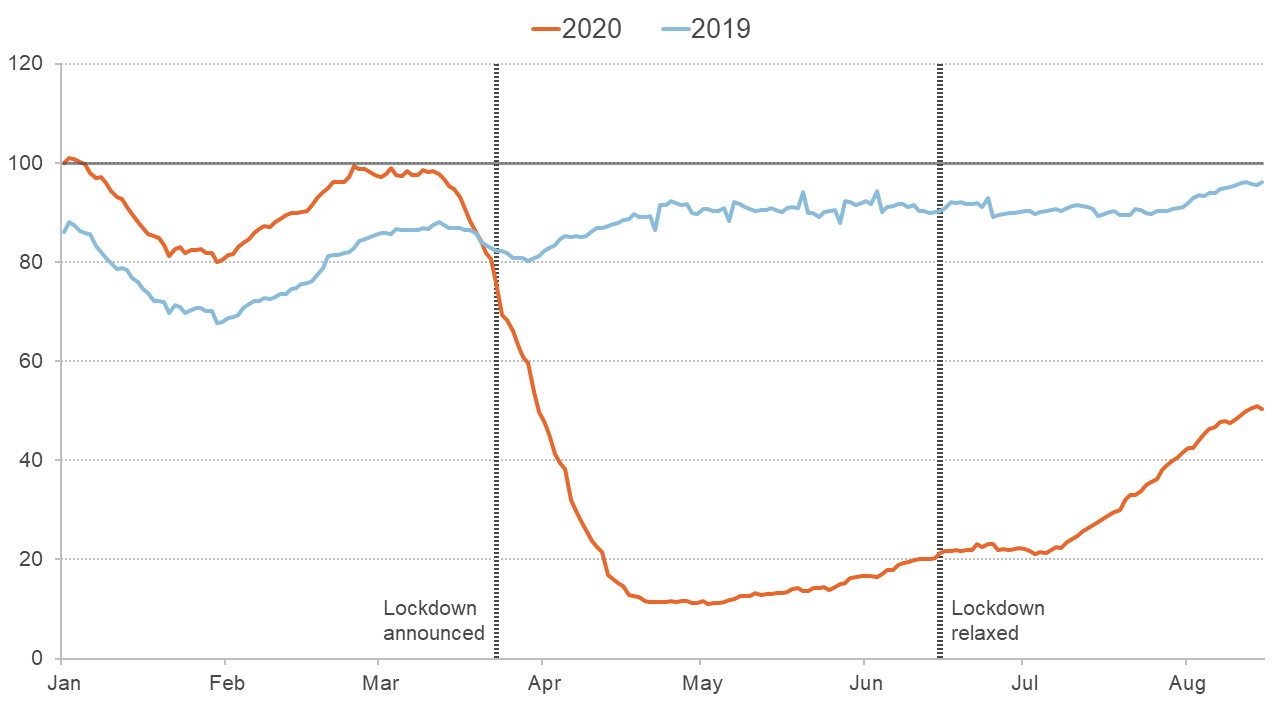

Some forms of consumption cannot easily be sourced online. You can’t have a virtual haircut. You can’t eat out in a restaurant online, though takeaway food is a partial substitute. Unsurprisingly, during the period of intense lockdown, consumer spending on dining out fell radically, but has recovered most of the losses.

Figure 2 shows a more than 90% decline in food spend away from the home during lockdown, with a slow recovery in July accelerating in August, which is most likely to have been a result of the ‘Eat Out to Help Out’ scheme.

Figure 2. Spend on dining or going out

Notes: 28-day moving averages for a balanced panel of 12,949 users with a total of 20.8 million relevant transactions. 01/01/20 = 100.

Source: University of Nottingham/Warwick Business School; underlying data from Money Dashboard

Broader effects of changes in household finances

These changes in spending patterns are occurring alongside broader changes in household finances occurring during the pandemic. There is an already familiar Covid-19 narrative: the crisis has generated a sudden, sharp shock to UK household finances and lifestyles. For example, between March and April 2020, the number of paid employees fell by 449,000 (Office for National Statistics, ONS, 2020b); half of all working adults had worked from home in June 2020 (ONS, 2020a).

Moreover, many households are not equipped to deal with financial shocks of such severity. Looking at 342 million European Union residents, Midões (2020) notes that 57 million of those individuals have as little as two months of savings. But there has also been a reduction in spending; one-third to one-half of working age families had experienced falling outgoings (Brewer and Gardiner, 2020).

In the current situation, it is likely that households are updating their assessments of the long-term risks they face and adapting their spending and savings behaviour. Arguably, all kinds of background risks have undergone permanent changes, not just the obvious one such as health risks and job security. Other examples include: diminished graduate employment prospects (Henehan, 2020); prospects of negative house equity (Gustafsson, 2020); and likelihood of earlier retirement (Coibion et al, 2020).

Economic theory and empirical studies suggest that mainly permanent income changes lead to major revisions in consumption (Jappelli and Pistaferri, 2010). Transitory shocks include variable overtime pay, bonuses and windfalls. Permanent income changes include promotions, job losses and health crises. How households react also depends on state or private insurance, and credit constraints (whether they can borrow).

What further research is going on?

John Gathergood and Neil Stewart are starting a UKRI Rapid Response grant-funded project ‘Real-time evaluation of the effects of Covid-19 and policy responses on consumer and small business finances’ in conjunction with the UK Financial Conduct Authority and retail banks.

Paolo Surico is undertaking analysis of the economics aspects of the Covid-19 crisis in the UK as part of the Royal Society’s DELVE initiative: Data Evaluation and Learning for Viral Epidemics, a multi-disciplinary group, convened by the Royal Society, to support a data-driven approach to learning from the different approaches that countries are taking to managing the pandemic.

Who are UK experts on this question?

- Chris Firth, Research Fellow at Warwick Business School, University of Warwick

- John Gathergood, Professor at University of Nottingham

- Neil Stewart, Professor of Behavioural Science at Warwick Business School, University of Warwick

- Paolo Surico, Professor at London Business School

Where can I find out more?

Since the pandemic began, there have many studies conducted around the world of the impact on household finances, consumption, savings and balance of spending between online and offline. Below is a list of studies by country:

United Kingdom

- Consumption in the time of Covid-19: Evidence from UK transaction data – Surico et al (2020)

- The distributional impact of the pandemic – Hacioglu et al (2020)

- Consumer spending responses to the COVID-19 pandemic: An assessment of Great Britain – Chronopoulos et al (2020)

- Income protection policy during COVID-19: evidence from bank account data – Delestre et al (2020)

- The effects of coronavirus on household finances and financial distress – Bourquin et al (2020)

United States

- How does household spending respond to an epidemic? Consumption during the 2020 Covid-19 pandemic – Baker et al (2020a)

- Income, liquidity, and the consumption response to the 2020 economic stimulus payments – Baker et al (2020b)

- Do stay-at-home orders cause people to stay at home? Effects of stay-at-home orders on consumer behavior – Alexander and Karger (2020)

- How did COVID-19 and stabilization policies affect spending and employment? A new real-time economic tracker based on private sector data – Chetty et al (2020)

- The COVID-19 shock and consumer credit: Evidence from credit card data – Horvath et al (2020)

- Initial impacts of the pandemic on consumer behavior: Evidence from linked income, spending, and savings data – Bachas et al (2020)

- Measuring the effects of the COVID-19 pandemic on consumer spending using card transaction data – Dunn et al (2020)

- Income and poverty in the COVID-19 pandemic – Han et al (2020)

Spain

- Tracking the Covid-19 crisis with high-resolution transaction data – Carvalho et al (2020)

- Consumption in Spain during the state of alert: An analysis based on payment card spending – González Mínguez et al (2020)

Denmark/Sweden

- Consumer responses to the COVID-19 crisis: Evidence from bank account transaction data – Andersen et al (2020a)

- Pandemic, shutdown and consumer spending: Lessons from Scandinavian policy responses to COVID-19 – Andersen et al (2020b)

France

- Consumers' mobility, expenditure and online-offline substitution response to COVID-19: Evidence from French transaction data – Bounie et al (2020)

China

- The impact of the COVID-19 pandemic on consumption: Learning from high frequency transaction data – Chen et al (2020)

Japan

- Online consumption during the COVID-19 Crisis: Evidence from Japan – Watanabe and Omori (2020)

Taiwan

- COVID-19 and the demand for online food shopping services: Empirical evidence from Taiwan – Chang and Meyerhoefer (2020)

Switzerland

- Weighting bias and inflation in the time of Covid-19: Evidence from Swiss transaction data – Seiler (2020)

Mexico

- Consumption and geographic mobility in pandemic times: Evidence from Mexico – Campos-Vazquez and Esquivel (2020)

Portugal

- What and how did people buy during the Great Lockdown? Evidence from electronic payments – Carvalho et al (2020)

Iran

- Emergency loans and consumption: Evidence from COVID-19 in Iran – Hoseini and Beck (2020) and Hoseini and Valizadeh (2020)