The oil and gas sector is wrestling with the dual shock of Covid-19 and substantial falls in the oil price, some of which predated the crisis. What are the implications for the industry – and for exploration and development activity in the UK continental shelf?

Covid-19 and its consequences will have major and long-lasting effects on the North Sea oil and gas industry. The pandemic led many governments to introduce policies that rapidly produced a major reduction in world demand for oil. This has come at a time when the global market was already experiencing a period of instability following unsuccessful attempts by the OPEC+ group (Organization of the Petroleum Exporting Countries) to curtail output in the face of a growing imbalance between world demand and supply led by sharply rising production by the United States.

The dramatic collapse in oil prices in April 2020 will have major effects on activity in the UK continental shelf (UKCS), the region of surrounding waters in which the country has mineral rights. The oil and gas sector has just been recovering from the consequences of the earlier major price fall in 2015-16. The substantial further decrease will have adverse consequences for activity levels. Here, we summarise the nature and extent of these consequences and indicate what government policy measures should be considered in response.

What does evidence from economic research tell us?

There are two recent studies of prospective long-term activity in the UKCS. The first indicated the perspective as seen in 2019 (Kemp and Stephen, 2019) while the second gives the perspective in late April 2020 (Kemp and Stephen, 2020). Both present financial simulations to assess the various risks related to future exploration activity, and to field production profiles and development costs for the many undeveloped discoveries as well as any future fields.

The results are consistent with two very recent publications by Oil and Gas UK, the representative body for the sector: Business Outlook 2020: Activity and Supply Chain and Business Outlook 2020: Market Investment, both published in May.

Key outputs of the research include prospective production, prospective field development expenditures, prospective operating expenditures and prospective decommissioning activity, all covering the period to 2050. The results shown in Figures 1-4 refer to fields and incremental projects that have passed a financial hurdle reflecting capital rationing.

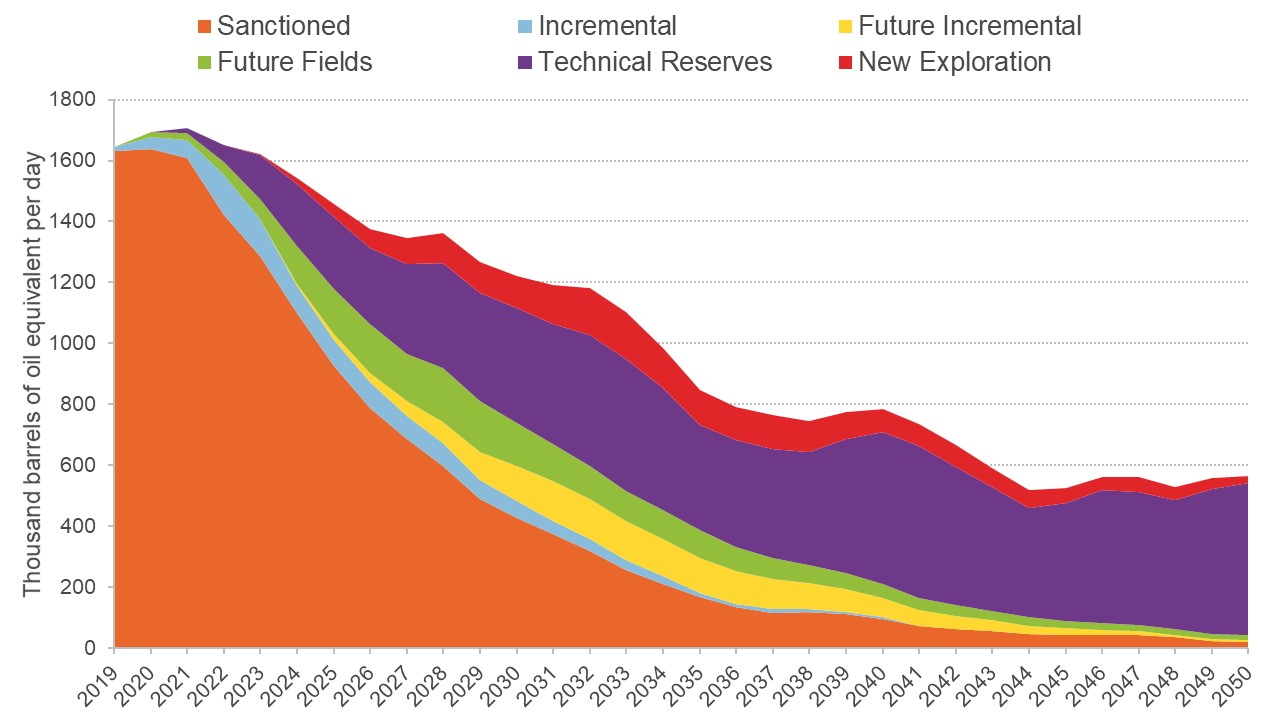

Sanctioned fields and incremental projects are those that have received development appraisal from the UK government. Future fields and projects are those currently under examination for development by the operators. Technical reserves are discoveries not currently being examined for development. New exploration refers to fields discovered from future exploration.

The 2019 study found that at the $60 real oil price, cumulative total hydrocarbon production over the period to 2050 amounted to 12 billion barrels of oil equivalent (boe). Figure 1 shows the behaviour of annual production over the period to 2050 from the various categories of fields and projects.

Figure 1: Potential total hydrocarbon production at $60/bbl and 45p/therm

Source: Kemp and Stephen, 2019

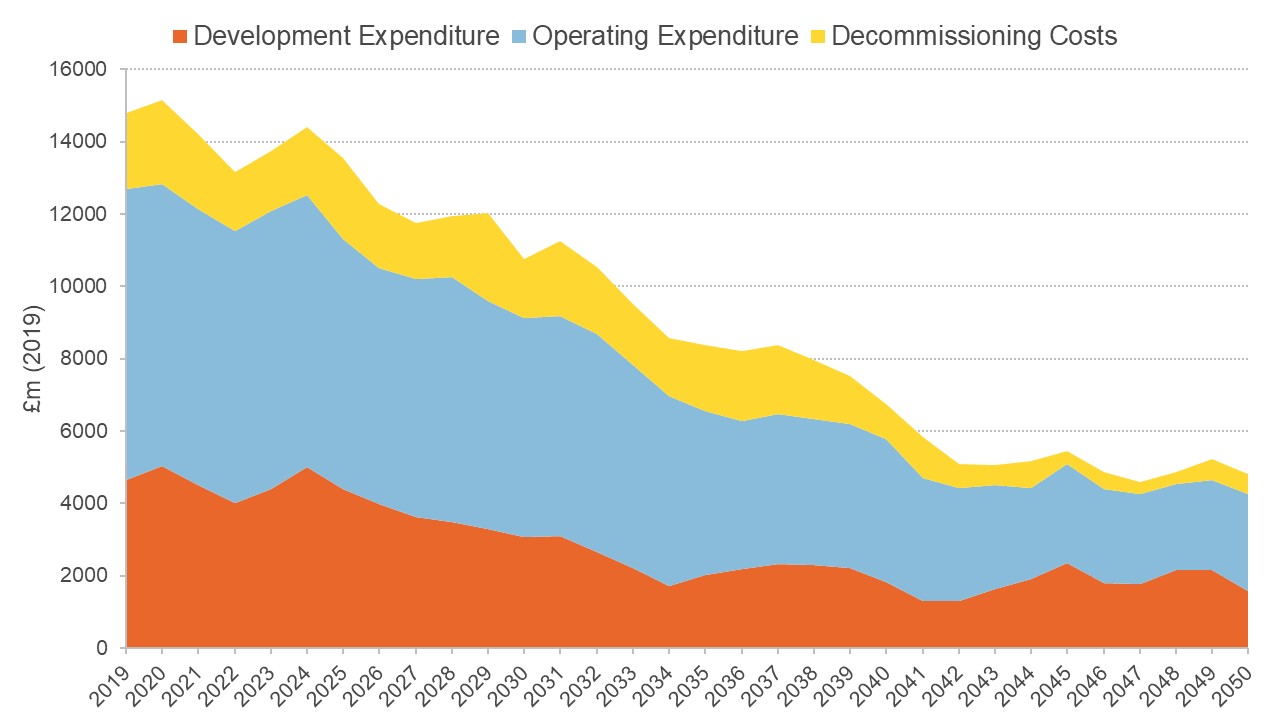

Over the period to 2050, cumulative field development expenditures are forecast to amount to nearly £90 billion in real terms. Cumulative operating expenditures amount to £160.5 billion; and cumulative decommissioning costs to £45.4 billion. Over the period to 2050, no fewer than 542 fields are decommissioned. Figure 2 shows the annual profiles of field expenditures.

Figure 2: Potential total expenditure at $60/bbl and 45p/therm

Source: Kemp and Stephen, 2019

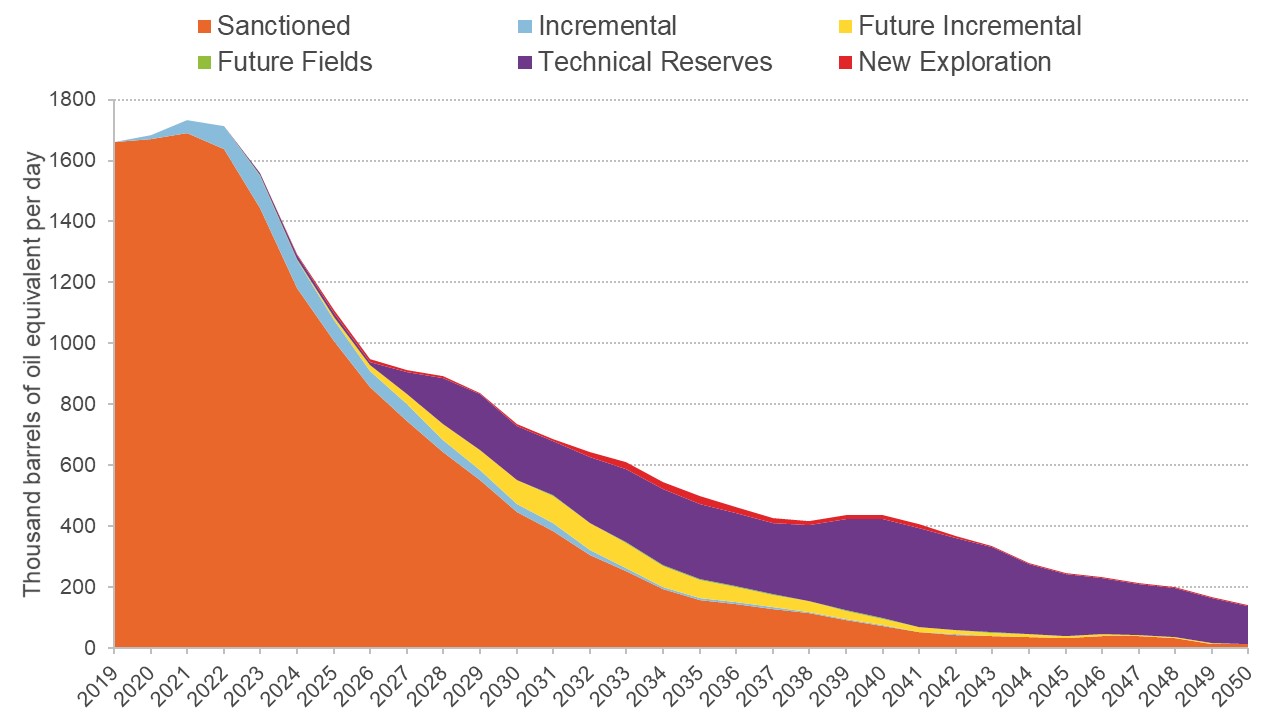

These results, compared with those from the analysis conducted in April 2020, reflect the dramatic fall in oil (and gas) prices. At the current price of around $35, cumulative total hydrocarbon production to 2050 is only 8.3 billion boe. A total of 4.6 billion boe remain uneconomic at this price.

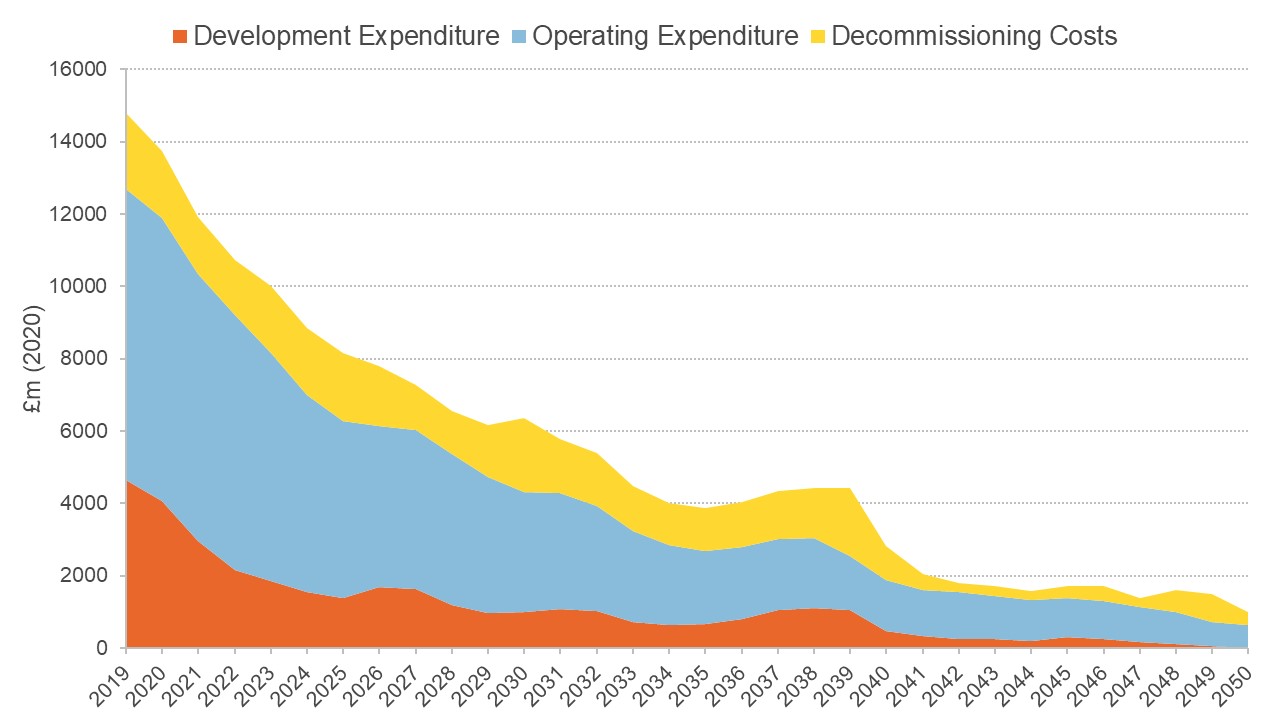

Cumulative field development expenditures are only £35.4 billion at 2020 prices. Cumulative operating expenditures are £99 billion; and total decommissioning expenditures £37 billion. It should be noted that the lower levels of expenditure on decommissioning largely reflect the lower number of new field developments at the lower oil prices, and thus the lower numbers being decommissioned over the period to 2050.

Figure 3 shows the annual behaviour of total hydrocarbon production at the $35 price.

Figure 3: Potential total hydrocarbon production at $35/bbl and 25p/therm

Source: Kemp and Stephen, 2020

Figure 4 shows the annual field expenditures under the main categories.

Figure 4: Potential total expenditure at $35/bbl and 25p/therm

Source: Kemp and Stephen, 2020

The prospects with an oil price of $45 in real terms are also examined in the 2020 study. Economic recovery of total hydrocarbons over the period to 2050 now becomes 10.5 billion boe, substantially higher than the case with the $35 price. But 4.2 billion boe of discovered hydrocarbons remain undeveloped.

At the $45 price, total field investment becomes £52.8 billion over the period. This is still substantially below the levels felt to be achievable with the prices ruling in 2019. At the $45 price, total operating expenditures amount to £121 billion over the period; and total decommissioning costs to £38 billion.

How reliable is the evidence?

The field databases employed in the analysis are comprehensive and have been updated in 2020. The investment hurdle employed reflects that used when there is capital rationing.

Much uncertainty surrounds future oil and gas prices. They are very likely to continue to be volatile. Those shown in the more recent study for the 2020 perspective reflect the underlying view that oil and gas demand will remain sluggish not only because of the indirect effect of Covid-19 but also the longer-term effect of worldwide emissions reduction policies. The value of $60 for the 2019 perspective approximates the average value for that year.

What does this imply for policy?

There are several implications for policy from these research findings. It is clear that economic recovery from the UKCS is substantially reduced. New field investment in particular suffers a major decline.

There will be substantial job losses. Oil and Gas UK (OGUK) has stated that these could amount to 25-30,000 jobs over the next year and a half. The supply chains contractors, particularly those dealing with exploration, appraisal and new field developments, will particularly suffer.

One policy objective would be to introduce measures to stimulate activity. Technological progress could enhance productivity and render economic more of the many undeveloped discoveries. The Oil and Gas Technology Centre (OGTC) has been established to foster productivity gains. The extent to which this could be enhanced if further resources were available to OGTC could be examined.

Given that the industry is currently severely cash-strapped, consideration could be given to the issue of whether tax incentives, perhaps on a temporary basis, could be introduced to stimulate new investment. There are several possibilities including a field development tax credit akin to what has been proposed in Norway or changes to the current Investment Allowance for Supplementary Charge.

It is likely that HM Treasury will need to be convinced that any tax concession will bring a return in the form of extra tax revenues from enhanced activity. Care would also be required to ensure that a concession does not result in subsidies being given to the industry.

The industry also has to deal with the issue of climate change, and the need to contribute to the ‘net-zero’ emissions commitment by 2045 in Scotland and 2050 in the UK. This suggests that the industry could be given incentives tied to investments in emissions reduction. These could include replacement of the use of diesel and natural gas for power generation on North Sea platforms by renewable sources of electricity.

Related question: Is this a good time to pursue environmental objectives?

Incentives could also be given to procure a change of use (repurposing) of oil facilities in the North Sea for other purposes, such as supporting wind farms; providing transport and storage for carbon sequestration; and production of hydrogen extracted from natural gas. The economic and tax aspects of these possibilities could be examined. The currently financially distressed supply chain would, of course, benefit from investment in these projects.

Where can I find out more?

- Business Outlook 2020: Activity and Supply Chain, May 2020

- Business Outlook 2020: Market and Investment, May 2020

- Business Outlook 2020: Security of Supply, May 2020

Who are UK experts on this issue?

- Alex Kemp, Professor of Petroleum Economics and Director of Aberdeen Centre for Research in Energy Economics and Finance, University of Aberdeen

- Linda Stephen, Research Fellow, University of Aberdeen