The self-employed have been hit particularly hard by the recession. Government support has been generous for many, but others have fallen through the cracks. Looking ahead, there are signs that self-employment is starting to undergo significant changes.

The growth of self-employment has been one of the key features of the UK’s labour market for the past two decades. At the end of 2019, there were more than five million self-employed people in the UK. The number of workers in this category had risen by 12% since the start of 2015, and represented 15.3% of total employment.

Mounting evidence from a variety of sources points towards the Covid-19 crisis having a disproportionately large impact on these workers, and the latest data suggest a sluggish recovery at best. The size of this group, the distinct way in which they have been affected by the pandemic and the unprecedented nature of government support have led to significant research and policy attention.

How are incomes and hours evolving?

Ad hoc survey evidence suggesting that the self-employed were hit harder than other workers in the early days of the crisis has now been replicated in larger-scale regular surveys such as Understanding Society (Reuschke et al, 2020). Relative to other workers, the self-employed have experienced greater drops in their earnings and hours worked.

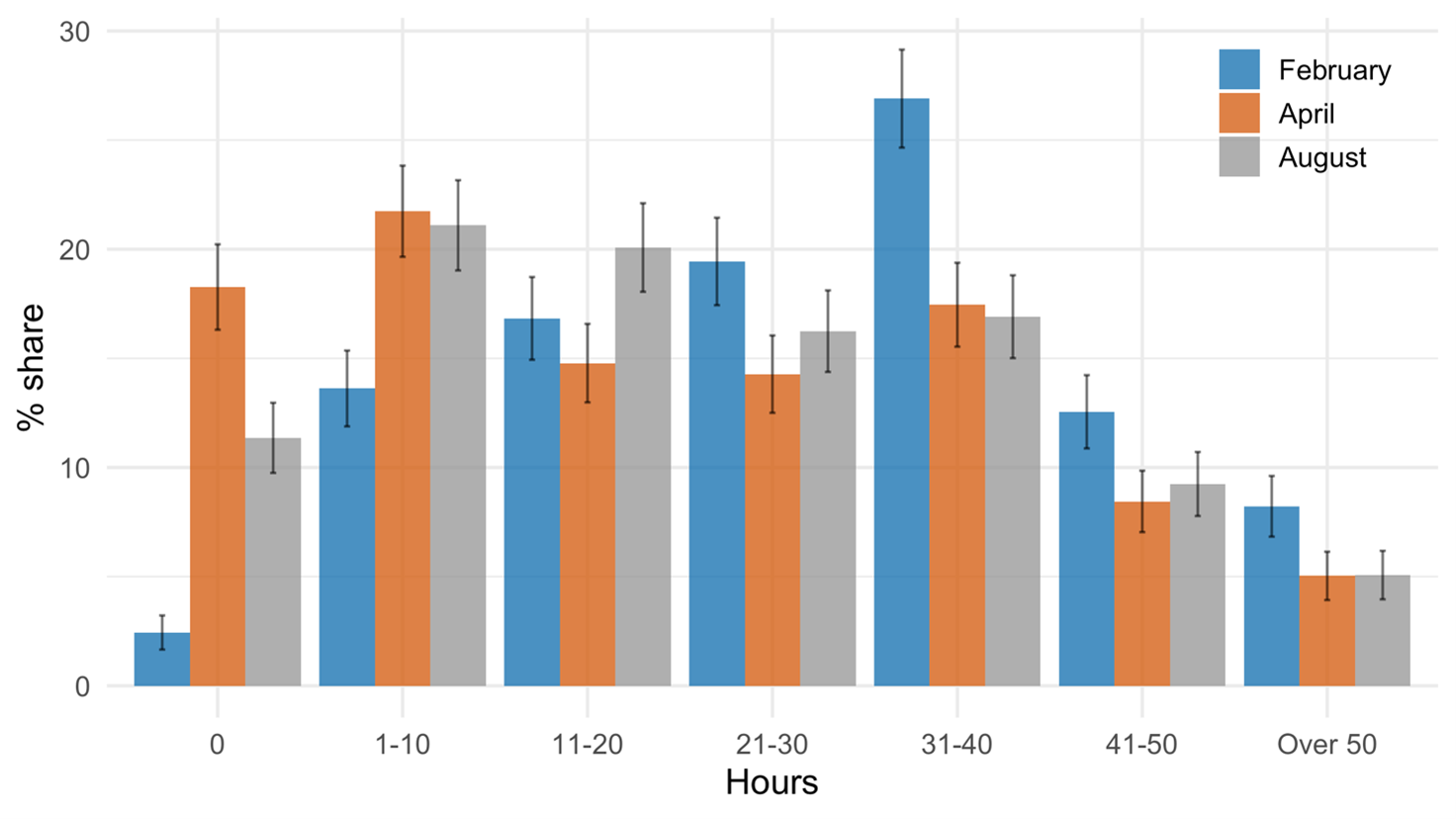

Other recent work also indicates a sluggish recovery in hours and incomes over the summer (Blundell et al, 2020). While the share of workers that report working fewer than 10 hours each week fell from 40% in April to 32% in August, the figure is significantly higher than it was in February, prior to lockdown (see Figure 1). Similarly, the share of workers earning under £1,000 in August (50%) is barely lower than in April (52%).

Figure 1: Hours worked by self-employed workers in 2020

Notes: Self-reported hours worked in February, April and August 2020 among self-employed workers (Blundell et al, 2020). The thin black vertical lines indicate 95% confidence intervals.

This slow recovery may be felt most by young workers with lower qualifications, who are the most likely to experience prolonged earnings losses (Brewer et al, 2020). While at the onset of the crisis roughly equal numbers of 18-34 year olds and 35-65 year olds stopped work entirely, by September, there was a 10 percentage point gap in worklessness between these two groups.

Different concerns arise when looking at the situation of workers in the ‘gig economy’. A third of workers finding work through apps report having more work than usual (Blundell et al, 2020). But they also are more likely to report feeling that their health is at risk while working.

Is government support helping?

There have been two rounds of Self-Employment Income Support Scheme (SEISS) grants. The first, which was made available in May, paid out 80% of a worker’s past profits, with payments capped at £2,500 per month. The second, beginning in July, was slightly less generous.

There will be two more payments, one covering November to January and another covering February to April. The first of these is currently set at of 80% of past profits, although this level has been subject to significant flux as the crisis has developed. Another important development for this group is the extended suspension of the ‘minimum income floor’, which increases the generosity of Universal Credit for the lowest-earning self-employed workers (Waters, 2020).

Since the start of the crisis, commentators have highlighted the poor targeting of SEISS. To be eligible, the main conditions are that workers’ self-employment must provide over half of their taxable income, a tax return must have been submitted for 2018/19 and profits must have been under £50,000 for that year. It has been estimated that around two-fifths of workers with some self-employment income are ineligible for this support (Adam et al, 2020).

With the conditions unchanged, the extension of SEISS well into 2021 widens the gap between those who are eligible for SEISS and those who are excluded. To help plug the gap, in Scotland and Wales additional grants have been made available to newly self-employed. But these are small in value and affect a minority of workers who currently do not qualify.

Ineligibility matters: those who do not receive support are more than twice as likely as other self-employed to report financial difficulties (Blundell et al, 2020). Reflecting this, self-employment has played a prominent role in campaigns, such as that championed by ExcludedUK.

Eligibility conditions, particularly the exclusion of those without a 2018/19 tax return, demonstrate the challenge of designing equitable transfers towards the self-employed. This is also evident in the loose conditions on claims among the eligible. Unlike furloughed employees, the self-employed are allowed to continue working while receiving the grant, and grant levels are fully independent of financial loss.

Recent research using novel bank account data shows that on average, among those in receipt of grants, post-SEISS income has declined by just 4% (Delestre et al, 2020). On average then, SEISS is very successful in smoothing the income shock caused by Covid-19. But this masks substantial variation, with some workers seeing large positive or negative changes in net income. This echoes other findings indicating that one in six claimants have seen no loss in pay (Brewer et al, 2020).

The bank account data suggest that among those who received SEISS, it was effective at maintaining consumption as well as income. One benefit of these data is their high frequency. By inspecting weekly-level consumption, rent and bills payments, the research shows that the timing of payments is critical. Delays to SEISS payments affect mortgage and rent payments, which could be alleviated with more frequent payments.

How is self-employment changing today and what will it look like after the crisis?

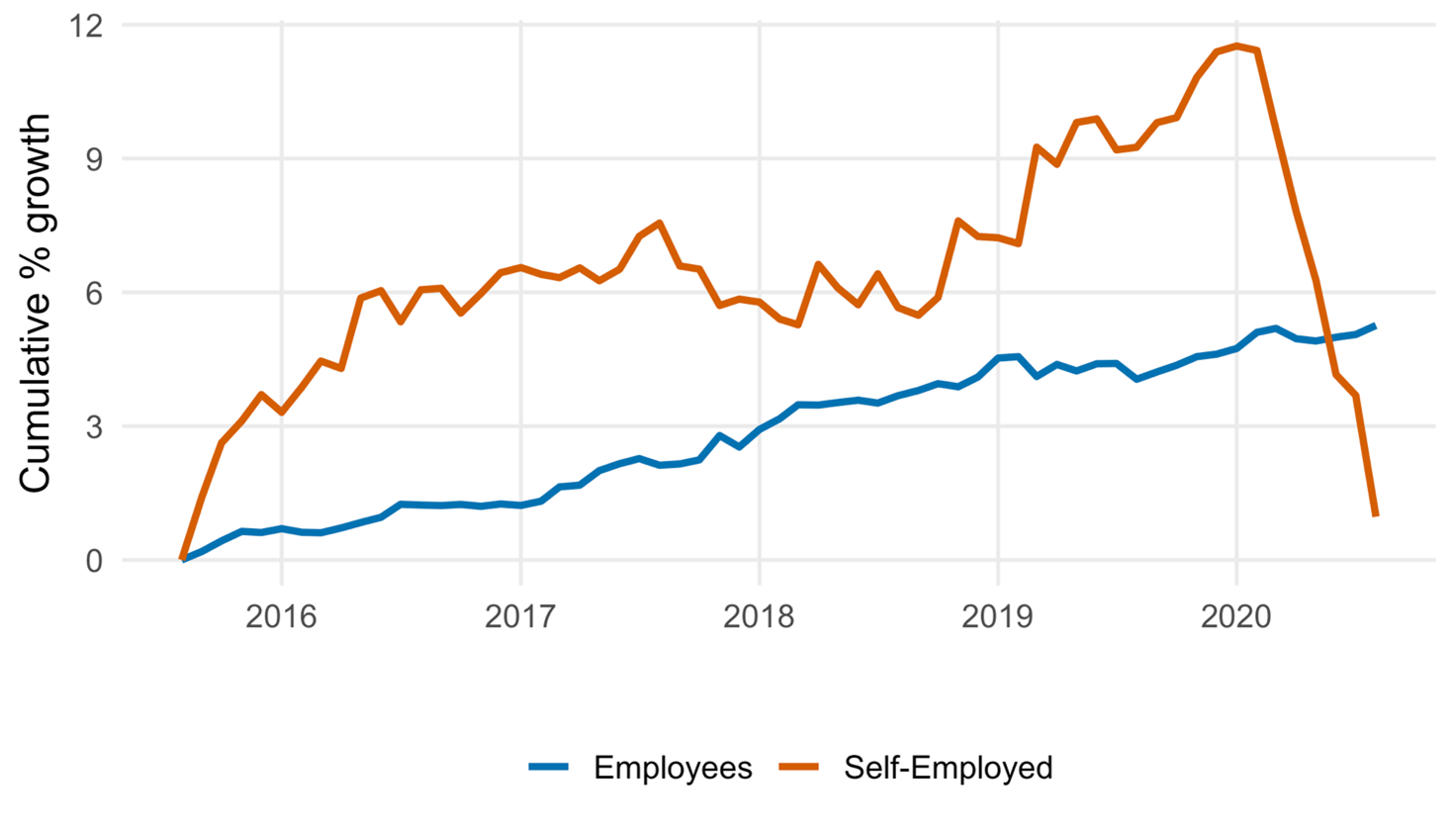

Having risen for two decades, this year has seen the sharpest decline in self-employment since records began, with the latest data from the Office for National Statistics (ONS) showing 8% fewer self-employed workers this summer compared with last. This is in stark contrast to the experience of employees (see Figure 2).

Figure 2: Self-employment and employee growth, 2015 to today

Source: Employment in the UK: October 2020, ONS

Survey data also show that one in five current self-employed workers thinks it likely that they will leave self-employment (Blundell et al, 2020). This is higher among younger, higher-income workers and those with a greater risk tolerance. Coming out of the crisis then, self-employment will not only be smaller but it will also consist of different types of workers.

Looking further ahead, the chancellor has indicated tax reforms that are likely to involve an increase in self-employed workers’ national insurance contributions (NICs). This would be welcomed by many commentators, who have criticised the inequity and distortionary incentives of the current system (Freedman and Miller, 2020).

The ONS estimates that almost 300,000 workers changed their status from self-employed to employee between the second and the third quarter this year, the highest number since 2005. Removing some of the tax incentives to become self-employed would push more workers towards wage employment, compounding the disproportionate effects of the crisis on self-employed workers.

Where can I find out more?

- Covid-19 and the self-employed: six months into the crisis: Jack Blundell, Stephen Machin and Maria Ventura at the Centre for Economic Performance discuss updated evidence from their targeted survey of self-employed workers.

- Jobs, jobs, jobs: evaluating the effects of the current economic crisis on the UK labour market: Mike Brewer and colleagues from the Resolution Foundation examine the effect of the coronavirus crisis on different types of workers, using data from their new survey.

- Self-employment income support and the second national lockdown: Tom Waters from the Institute for Fiscal Studies discusses the different sources of support available for the self-employed during the new wave of restrictions.

Who are the experts on this question?

- Abi Adams-Prassl has written on the gig economy and the effect of technology on labour markets, particularly surrounding alternative work arrangements.

- Jack Blundell and Maria Ventura have written on the impact of the crisis on UK self-employment.

- Stephen Machin has written a number of papers on solo self-employment and alternative work arrangements.

- Helen Miller, Stuart Adam and Tom Waters have written extensively on tax reform for self-employment as well as on the details of the SEISS support.

- Giulia Giupponi has written on flexible labour market arrangements and policy.