Fears of infection have left many people reluctant to go to hospitals and GPs during the pandemic. In many countries, the large reduction in services has put the financial sustainability of healthcare providers at risk under existing payment arrangements.

During the pandemic, hospitals and primary care providers (GPs) across the OECD have experienced large drops in the healthcare services that they provide, as hospitals focused on treating Covid-19 patients, and cancelled other elective treatments, such as hip and knee replacements. Given that in most OECD countries hospital revenues are linked to activity, the reduction in non-Covid-19 healthcare services has generated shortfalls, exposing providers to deficits.

Policy-makers across OECD countries have responded swiftly by changing their payment systems for healthcare providers. Examples include paying hospitals by fixed budgets based on historical spending. Although this addresses the problem of financial shortfalls in the short term, more flexible solutions are required to ensure that payment systems are aligned with healthcare system objectives of improving health while containing costs in the medium and long term.

How has payment for healthcare providers changed?

In most OECD countries, health insurance (mostly publicly funded) is pervasive and patients receive healthcare free of charge (as in some national health services like the UK’s NHS). In settings where patients have to pay, charges are typically limited and well below the cost of the services. Health insurers (public or private) therefore have to cover the costs of healthcare providers through a range of contractual arrangements.

Across OECD countries, the most common payment system in the last two decades is for health insurers to pay hospitals for each treatment or diagnosis provided. For example, in the United States, a payment system based on ‘diagnosis-related groups’ has been in place since the early 1980s. For every patient treated – say, a patient admitted to a hospital for coronary bypass surgery, a hip replacement or cataract surgery – the hospital receives a fixed fee. This implies that providers treating higher volumes of patients are financially rewarded with higher revenues; and that doubling the number of treatments doubles the revenues.

Similar payment systems have been introduced in England, France, Italy and other European countries. The rationale for these payment systems is that they give providers incentives to contain costs, but also to compete on quality to attract patients (Gaynor et al, 2016). Payment systems also increasingly combine these forms of activity-based payment, with ‘pay-for-performance’ schemes that reward providers who perform better on a range of (clinical and non-clinical) quality measures.

During the pandemic, hospitals experienced large reductions in activity due to both provider and patient responses. On the supply side, hospitals responded by putting non-urgent treatments on hold to prepare for and focus on Covid-19 patients. On the demand side, perhaps surprisingly, emergency treatments – such as for patients with heart attacks – also experienced a large drop due to patients’ fear of contracting Covid-19. GPs also experienced large reductions in patient visits due to fears of infection.

In England, hospital admissions for acute coronary syndrome, including heart attacks, fell by 40% between mid-February and the end of March, although this was partially reversed by the last week of May, with a 16% drop relative to mid-February (Mafham et al, 2020).

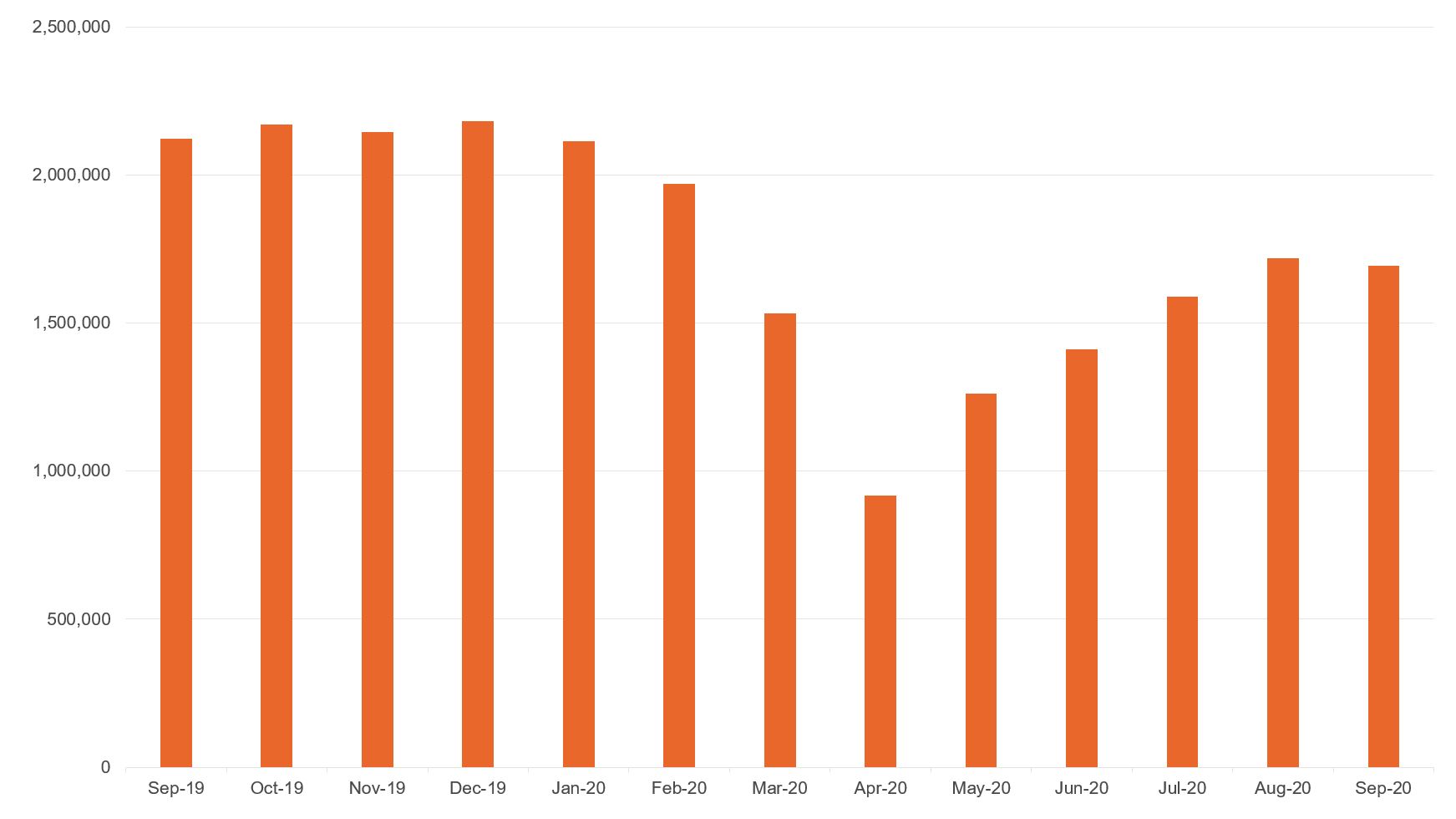

More broadly, Figure 1 shows that patients have been avoiding hospitals for emergency care, as accident and emergency attendances in England dropped from more than two million per month in the period from September 2019 to January 2020 to less than a million in April 2020 (NHS England, 2020).

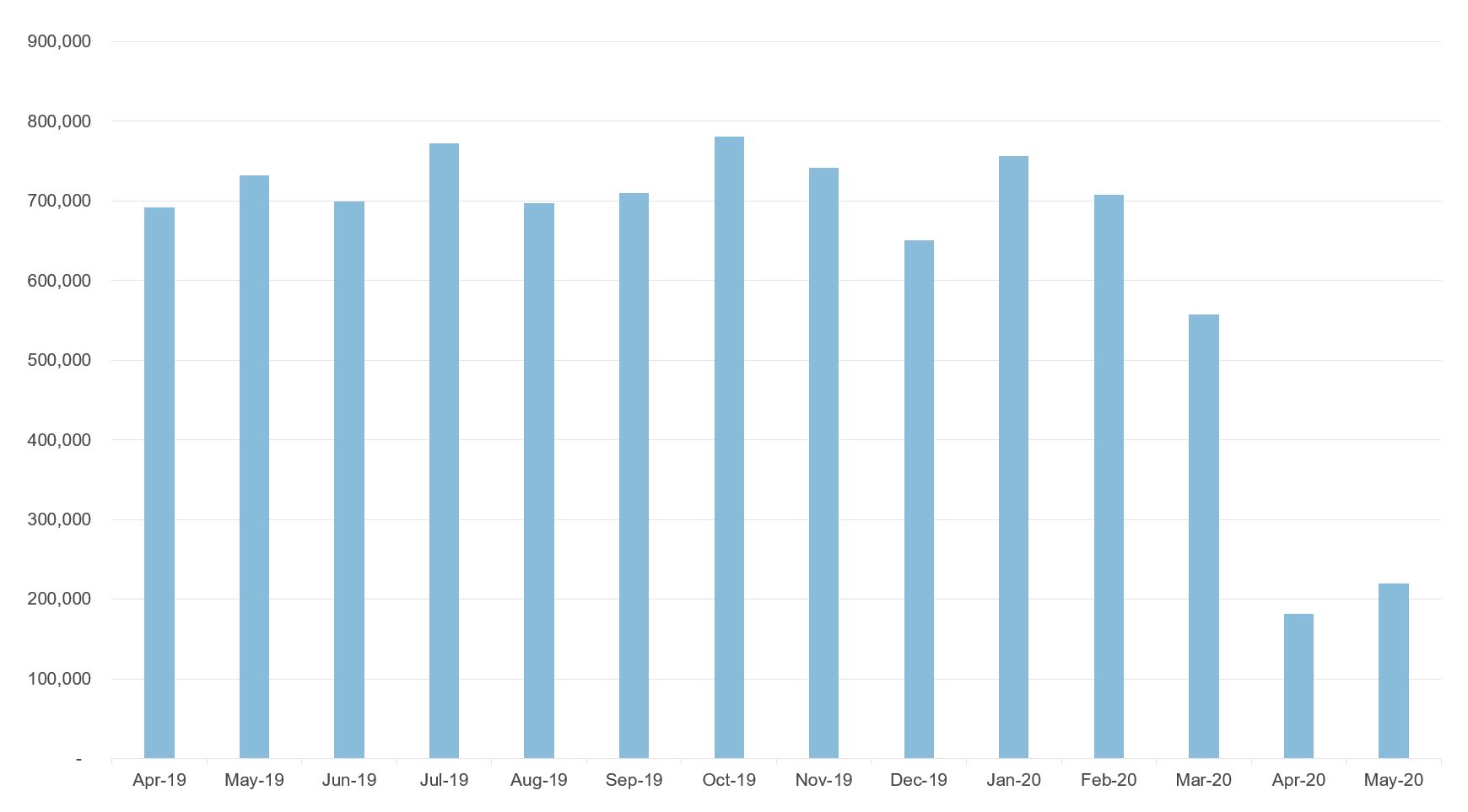

Hospitals also put elective care on hold. Figure 2 shows that elective (general and acute) hospital admissions fell to 182,000 in April 2020 relative to 692,000 in the same month of the previous year, April 2019 (NHS England, 2020). As a result, waiting times for routine operations have been steady increasing: the proportion of patients waiting more than 18 weeks increased from about 15% before January 2020 to 50% in July 2020.

Figure 1: Accident and emergency attendances in England

Source: NHS England

Figure 2: Elective (general and acute) hospital admissions in England

Source: NHS England

Under pre-Covid-19 hospital payment arrangements, the reduction in treatments would have implied a large reduction in revenues, threatening hospitals’ financial sustainability and ability to maintain their health workforce and, ultimately, to provide care.

This was the case in the United States, where many hospitals started to face critical cash shortages as they had to cancel planned elective treatments, where profit margins are higher relative to emergency treatments. In turn, these cancellations may prevent hospitals from covering their fixed costs and could lead to bankruptcy, forcing them to exit the market. Other countries that rely on private providers may face similar issues without further interventions.

Policy-makers have quickly responded in several European countries. They have covered the large financial shortfalls caused by lower elective and emergency activity – for example, by switching to fixed budgets based on historical spending – in addition to introducing payment to cover the costs of new services to treat Covid-19 patients – for example, in relation to payment for new services in intensive care units (Quentin, 2020).

The payment system tends to be different for primary care. Again, patients are covered by public or private insurance, and therefore have no or limited out-of-pocket payments. Two contractual arrangements between (public or private) insurers and primary care providers are dominant across OECD countries.

In some countries with social health insurance, such as France and Belgium, health insurers reimburse GPs by fee-for-service with a fee paid to the GP for every patient visit. Other countries, like the UK, mostly have a ‘capitation’ system, which is an annual payment for every individual registered with a GP practice.

Yet other countries, such as Denmark and Norway, use a mix of the two systems, combining capitation with fee-for-service based on visits. Some healthcare systems also combine capitation or fee-for-service with pay-for-performance, which makes financial payments contingent on improvements in (measured) quality.

For countries paying GPs and primary care providers by fee-for-service, the fall in visits would also have generated large revenue losses without policy interventions. GPs with only half of patients visiting them would suddenly see their income halved. Therefore, as for secondary care (hospitals), public or private insurers introduced a range of mechanisms to compensate for such losses (Waitzberg et al, 2020).

For countries paying by capitation, GPs do not experience financial losses if the capitation payments stay in place. These payments are generally based on the number (and type) of patients registered with the GP or GP practice. The payment per registered patient remains unaffected and so does GP income or the revenues of the GP practice.

Therefore, with no policy intervention, there is no threat to GPs’ financial sustainability. But the (public or private) insurer now risks paying the same amount of money for reduced health services in return.

What are the challenges ahead?

Although these short-term solutions are welcome to fix an immediate problem, changes in contractual arrangements between (public and private) insurers and providers can trigger provider responses. Research has shown that healthcare providers generally respond to financial incentives (Christianson and Conrad, 2011), and this is the result of the discretion that they have in the design of health services. For example, the volume of patients treated grew at a faster rate when providers switched from contractual arrangements based on fixed budgets to one that was linked to the patients treated (Farrar et al, 2009).

This suggests that the design of payment systems matters. Policy-makers responsible for these payment systems have to anticipate possible provider responses and ensure that their systems are aligned with healthcare system objectives of improving quality and containing costs. Good payment systems will ensure financial stability for providers, while at the same time enabling innovation and the capacity to evolve dynamically to allow for flexibility in the introduction of new services.

But trade-offs may arise if, for example, rewarding hospitals for higher volumes comes at the detriment of lower quality. As a result of the pandemic, payment systems for healthcare providers face several challenges, and they will have to evolve and adapt to accommodate new services.

The first challenge relates to payment for new healthcare services and treatments for Covid-19 patients. For hospitals, this can be accommodated within the existing contractual arrangements with health insurers that are already designed to reimburse for a specific treatment or diagnosis.

The challenge will be to design a set of fees for the relevant mix of services and ensure that the fees reflect the costs of the services provided, especially for new services where estimates of the costs may be less reliable. Performance indicators for Covid-19-related care could also be developed. As time passes, there will be a better understanding of the disease, available treatments and of what constitutes best practice, which could be encouraged with financial incentives.

Another challenge relates to payment for resuming the wide range of health services needed by non-Covid-19 patients. Fixed budgets give a short-term solution to address the financial shortfalls, but generally give weak incentives to increase volume or improve quality. They have been abandoned in the past in favour of activity-based payment and pay-for-performance.

Policy-makers are likely to resume elements of activity-based financing combined with pay-for-performance. Activity-based financing will give further incentives for providers to resume non-Covid-19 care and ensure that they are compensated for the costs, while pay-for-performance based on quality measures can ensure that higher volumes are not traded-off against lower quality.

Activity-based payment for hospitals will need to be refined. Resuming elective treatment in a safe environment while there is still a pandemic will be more costly, and may also imply fewer patients are treated for a given capacity. Such additional costs could be compensated by additional fixed payments at the organisation level, or with a higher per-patient fee.

Ideally, additional capacity could be funded to reduce the number of patients on the waiting list, which has increased due to the cumulated backlog of elective treatments. But this seems unlikely in publicly funded systems given the current economic climate.

Similar issues will apply to emergency care and more urgent care, such as for cancer patients who are at higher risk. Some specialist consultations will happen digitally (for example, some therapy services and some oncology services), which may be appropriate for certain treatments and follow-up appointments. This involves redesigning the payments to the providers to accommodate these new digital services.

Similarly to secondary care, there is a rise in digital consultations within primary care (NHS England). Patients can be reluctant to visit GPs in person due to fears of infection, and this can in some cases be accommodated through a digital consultation without health consequences (for example, a routine prescription). In other situations, this will limit GPs’ ability to perform a diagnosis.

As mentioned above, several countries pay GPs by fee-for-service with a fee per ‘visit’. The move towards digital consultations involves redesigning and broadening the definition of a visit towards any form of contact between the patient and provider. This immediately raises the issue of how tariffs should be set and whether, for example, the fee for a consultation in person should be the same as for a digital consultation.

Research has shown that differential prices in different settings (for example, hospital day cases versus overnight admissions) can influence providers’ propensity to favour one setting over another (Gaughan et al, 2019). Therefore, the price differential between different types of consultations needs to be designed to deliver the appropriate mix of services. Primary and secondary care providers will also need to be given incentives to invest in digital technologies if they have not already done so.

Where can I find out more?

- How do countries adjust hospital payment systems for Covid-19? Advice from the Covid-19 Health System Response Monitor.

- How are countries compensating health professionals for income losses and extra expenses due to Covid-19? Advice from the Covid-19 Health System Response Monitor.

- Assessing the impact of digital transformation of health services: 2019 report of the expert panel on effective ways of investing in health (EXPH) provided to the European Commission.

Who are experts on this question?

- Wilm Quentin, Technical University Berlin

- Luigi Siciliani, Department of Economics and Related Studies, University of York

- Ruth Waitzberg, Technical University Berlin