As across the UK as a whole, the Covid-19 crisis has had a huge impact on the Welsh economy. Despite evidence of a recovery in Wales, the risks of a further spike in infections and forthcoming changes in government support cloud the economic outlook.

A lack of timely official data at regional level makes it hard to gauge precisely the impact of the pandemic and lockdown measures on the Welsh economy. For example, quarterly GDP figures for Wales will not be available for the pandemic until much later this year.

Based on the historic relationship between regional and national growth rates and other indicators, one study projected that Welsh GDP fell by 2.5% in the first quarter of 2020 (McIntyre, 2020). Of course, the impact in the second quarter of 2020 – the period covering the tightest economic restrictions – will be much more severe.

Considering the latest Office for Budget Responsibility (OBR) projections for 2020 for the UK as a whole, Welsh GDP could fall by 13% in 2020 and not return to pre-pandemic levels until 2022.

Meanwhile, a variety of indicators can be used to paint a more timely picture of the economic impact in Wales. From late March, large parts of the Welsh economy were effectively mothballed. Well over a fifth of Welsh businesses had temporarily closed for business by the first weeks of April, according to Office for National Statistics (ONS) survey data (2020).

Around 228,000 workers in Wales were employed in sectors shut down by social distancing measures, amounting to 16% of the working age population (Rodríguez, 2020).

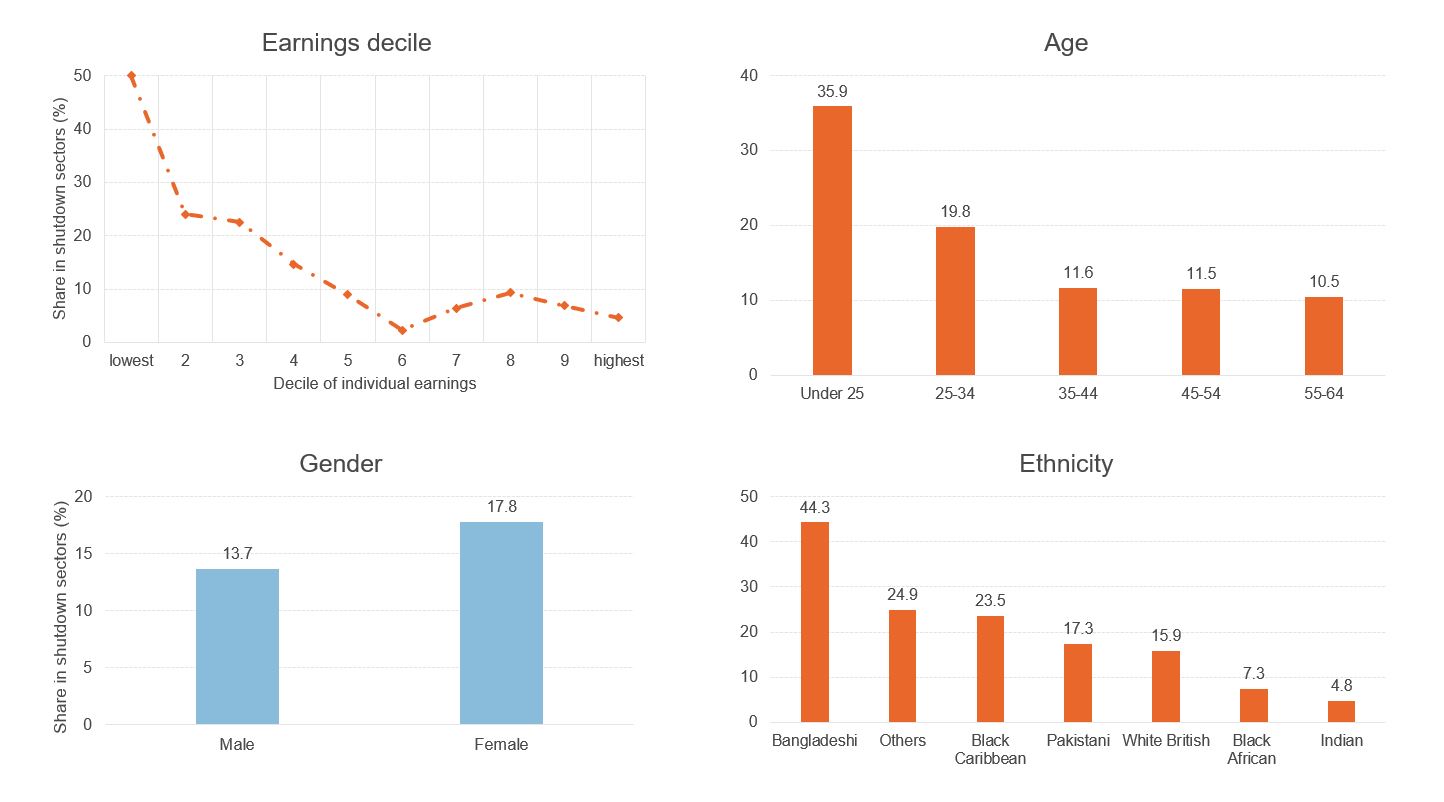

Figure 1: Share of employees affected by the lockdown in Wales by socio-demographic and socio-economic group

Source: Labour Force Survey, 2019

Workers under the age of 25 were almost three times as likely to have been working in shutdown sectors. The impact also varied by gender, with 18% of female employees working in shutdown sectors compared with 14% of male employees. Fully half of the lowest-earning decile of Welsh workers worked in shutdown sectors of the economy – making them ten times more likely to have been affected by the shutdown compared with the highest-earning decile. This asymmetric impact makes it likely that Covid-19 will exacerbate existing inequalities.

Meanwhile, higher levels of public sector employment meant that a higher share of workers in Wales (31%) were designated as key workers by the UK government at the onset of the crisis, with 14% of Welsh workers employed in health and care roles. Women were again significantly over-represented among key workers.

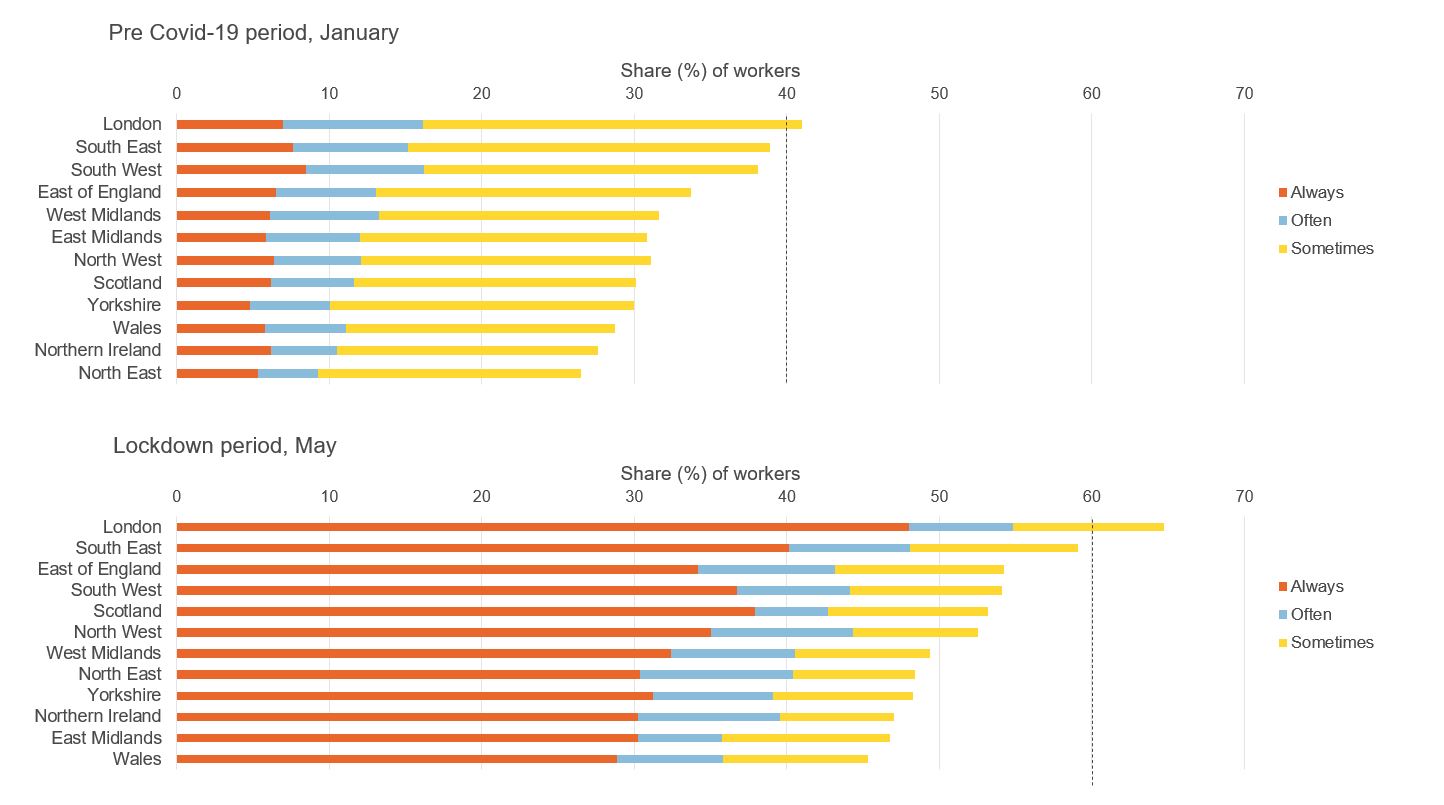

During the period of social distancing measures, the share of jobs that can be performed away from the workplace has been an important factor in the economy’s performance. According to longitudinal data from , 29% of Welsh workers were always working from home in May 2020, with another 7% doing so often and 9% doing so sometimes.

This represents a significant shift away from pre-crisis working patterns. But rates of home working in Wales (45%) during the pandemic remained below the UK average (53%) and substantially below London (65%) and the South East (59%).

Figure 2: Working from home by UK countries/regions

Source: Understanding Society, Covid-19 Study, 2020

Based on an assessment of the feasibility of working from home across different jobs, one study finds that Wales was the UK nation with the lowest potential share of jobs that can be done from home (Rodríguez, 2020). But this potential was still greater relative to some other European countries, such as Finland, Germany, Ireland and Italy.

How has government action mitigated the economic impact of Covid-19?

The economic impact of Covid-19 in Wales has been significantly mitigated by government schemes. Under the UK government’s Coronavirus Job Retention Scheme (CJRS), 400,800 employments had been furloughed at some point up to 31 July. The take-up rate of 30.6% in Wales was slightly below the other nations of the UK, although the shares were significantly higher in rural local authorities most dependent on tourism and hospitality sectors (Bevan Foundation, 2020).

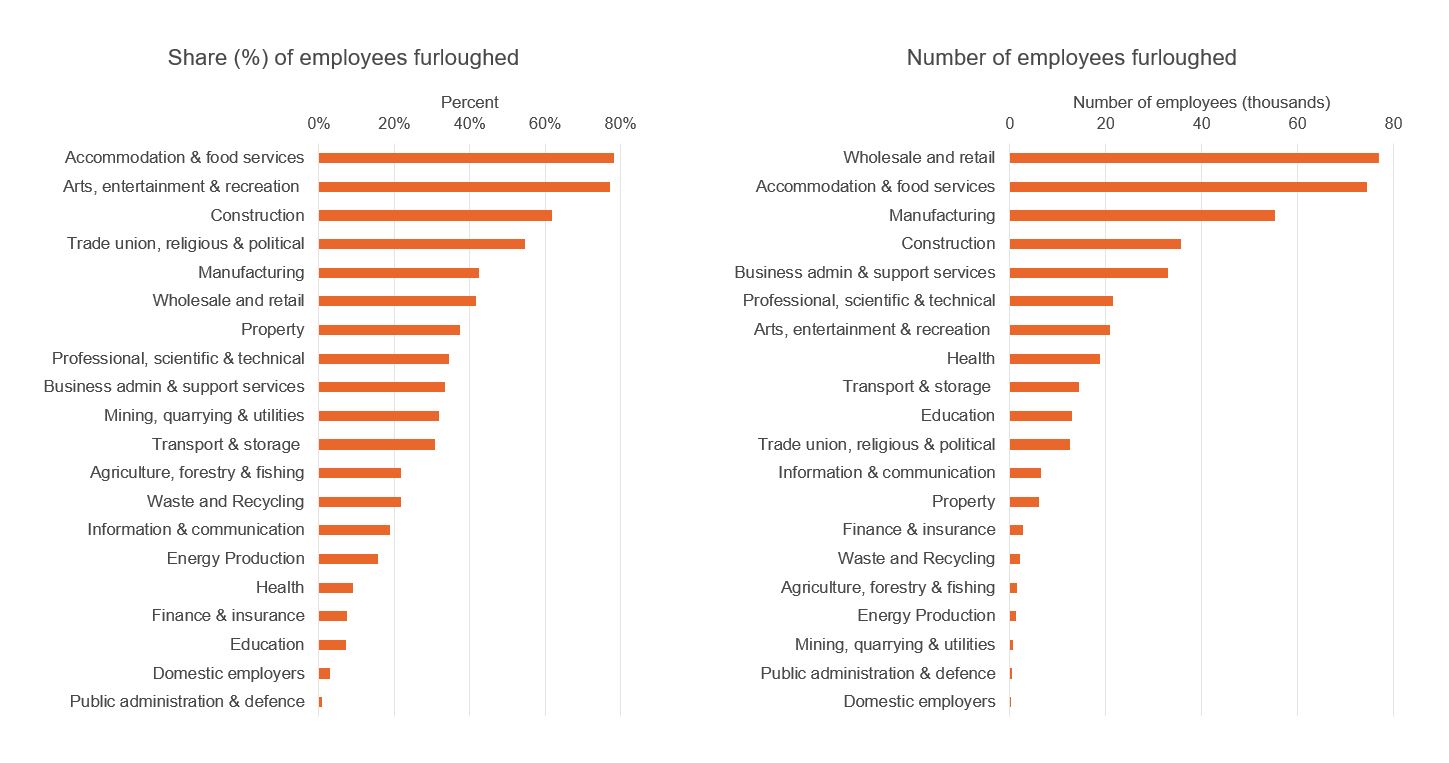

Figure 3: Coronavirus Job Retention Scheme (CJRS)

Source: HMRC, Coronavirus Job Retention Scheme (CJRS) Statistics, August 2020

The gradual re-opening and the tapering of the scheme have reduced the numbers of employees on furlough, but 195,600 employments remained furloughed on 31 August (with 42,300 of these partially furloughed). Wholesale and retail, restaurants, hospitality, arts and recreation sectors are the main users of this scheme, while public sector, education and health jobs are much less likely to benefit.

Figure 4: Coronavirus Job Retention Scheme (CJRS), by sector

Source: HMRC, Coronavirus Job Retention Scheme (CJRS) Statistics, August 2020

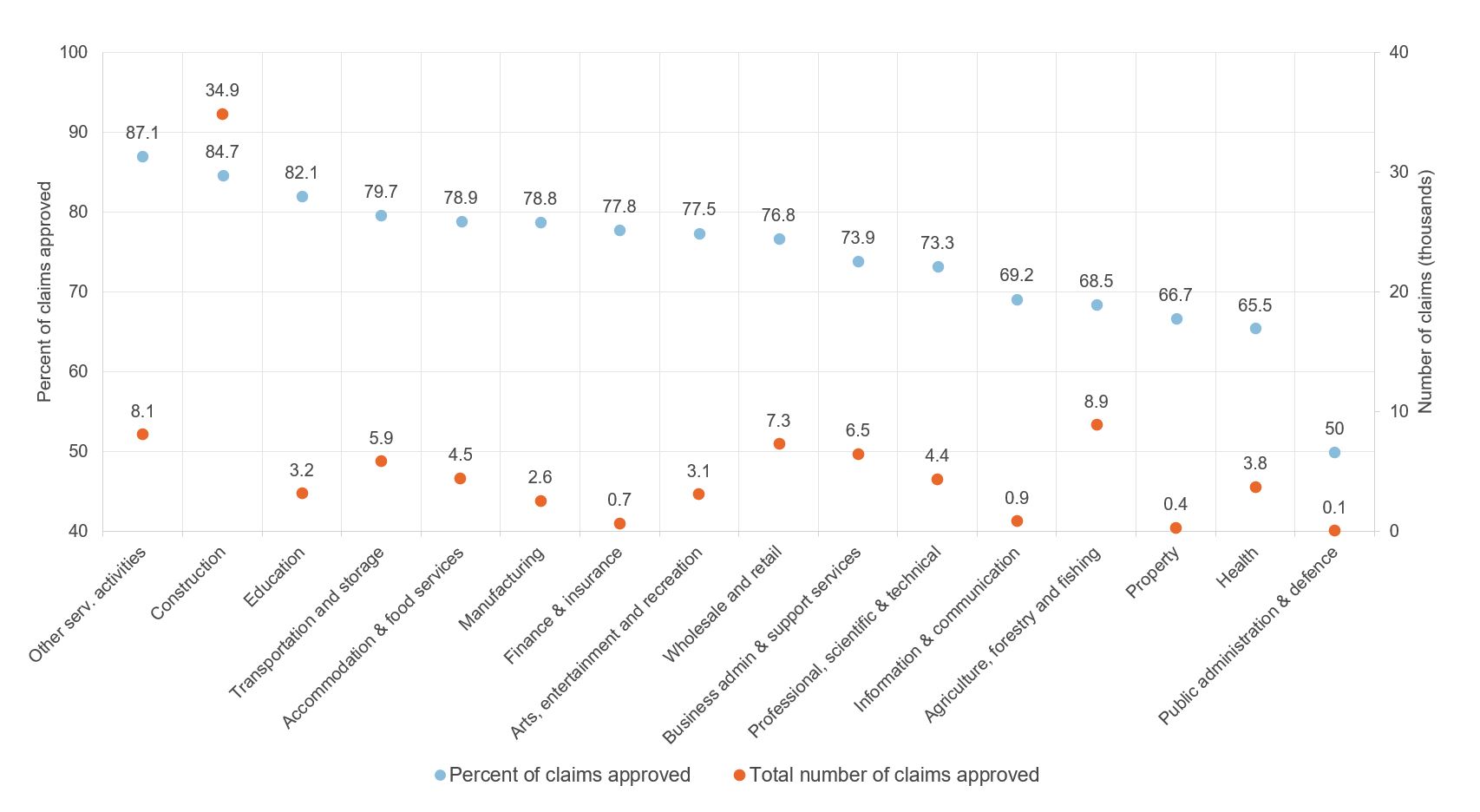

In addition to the CJRS, 110,000 self-employed people in Wales received the first grant through the Self-employment Income Support Scheme (SEISS), to the value of £295 million. The second SEISS had 82,000 claims from Wales. The sector with the higher number of claims is construction, accounting for 34,900, followed by agriculture, forestry, fishing and other service activities. On average, 78% of the SEISS claimants have been approved in Wales.

Figure 5: Self-Employment Income Support Scheme, by sector

Source: HMRC, Self-Employment Income Support Scheme (SEISS) Statistics, August 2020

A substantial amount of support for the Welsh economy has been channelled through Welsh government programmes. Its supplementary budget, published in July, included allocations of £1.24 billion of grants for businesses, as well as £332 million of business rates reliefs (Ifan, 2020).

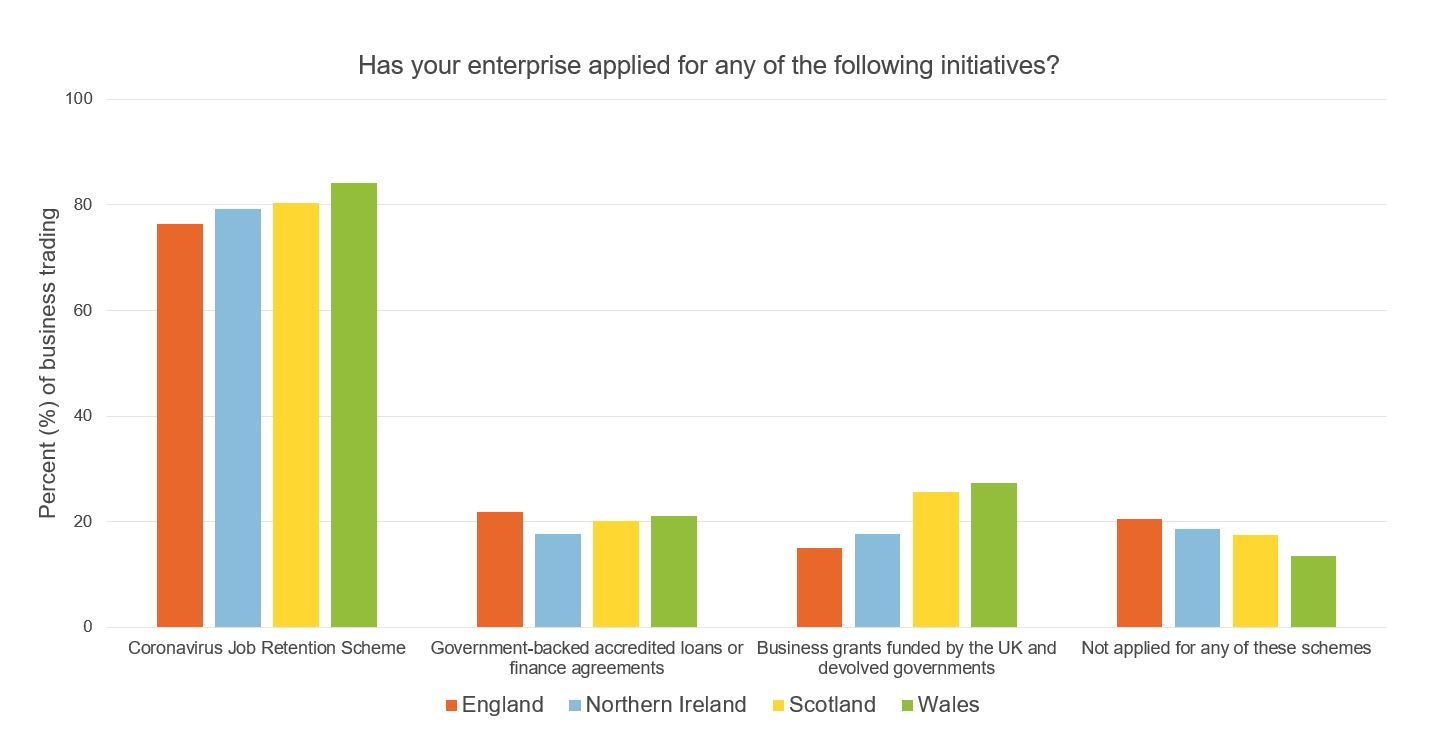

Data from the ONS business survey suggest that a higher share of Welsh businesses (27%) had applied for grant funding compared with businesses in England (15%). On the other hand, by far the largest form of support for businesses was the UK government’s furlough scheme (Siôn, 2020). In fact, in August, 84.2% of businesses said that they had applied for the CJRS. Wales is the UK nation with the highest proportion of businesses that have applied for this form of support.

Figure 6: Business impact of Covid-19

Source: ONS, Business Impacts of Coronavirus (Covid-19) Survey data, wave 12

Nonetheless, the potential for a substantially different fiscal response to support the economy in Wales is limited given a lack of budgetary flexibilities and borrowing powers (Phillips, 2020; Ifan, 2020). This is likely to be exacerbated further by the UK government’s decision to scrap the Autumn Budget – which would have given an outline of long-term spending plans and, by implication, the funds available to the devolved governments. Additional funding for the Welsh budget is triggered by increases in spending in England through the Barnett formula. Covid-19-related funding announced to date amounts to £4 billion.

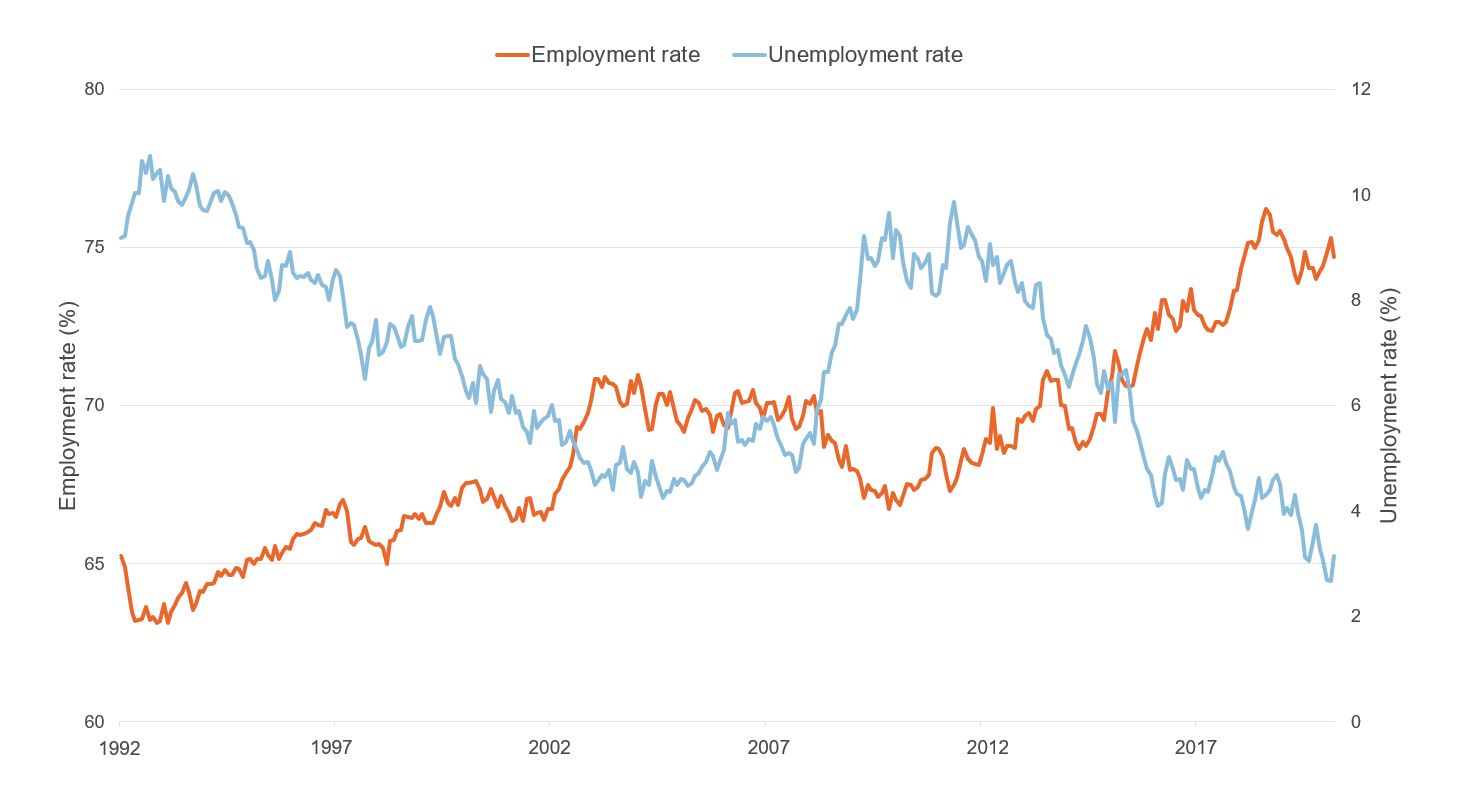

Government support for the economy, particularly the furlough scheme, means the forced shutdown of industries has not translated into a sharp increase in unemployment. The latest ONS Labour Force Survey data for Wales – covering the period from May to July 2020 – shows unemployment remaining at historically low levels of 3.1% or 47,000.

Figure 7: Unemployment and employment rate in Wales (seasonally adjusted)

Source: ONS, regional labour market statistics: Labour Force Survey Indicators for Wales

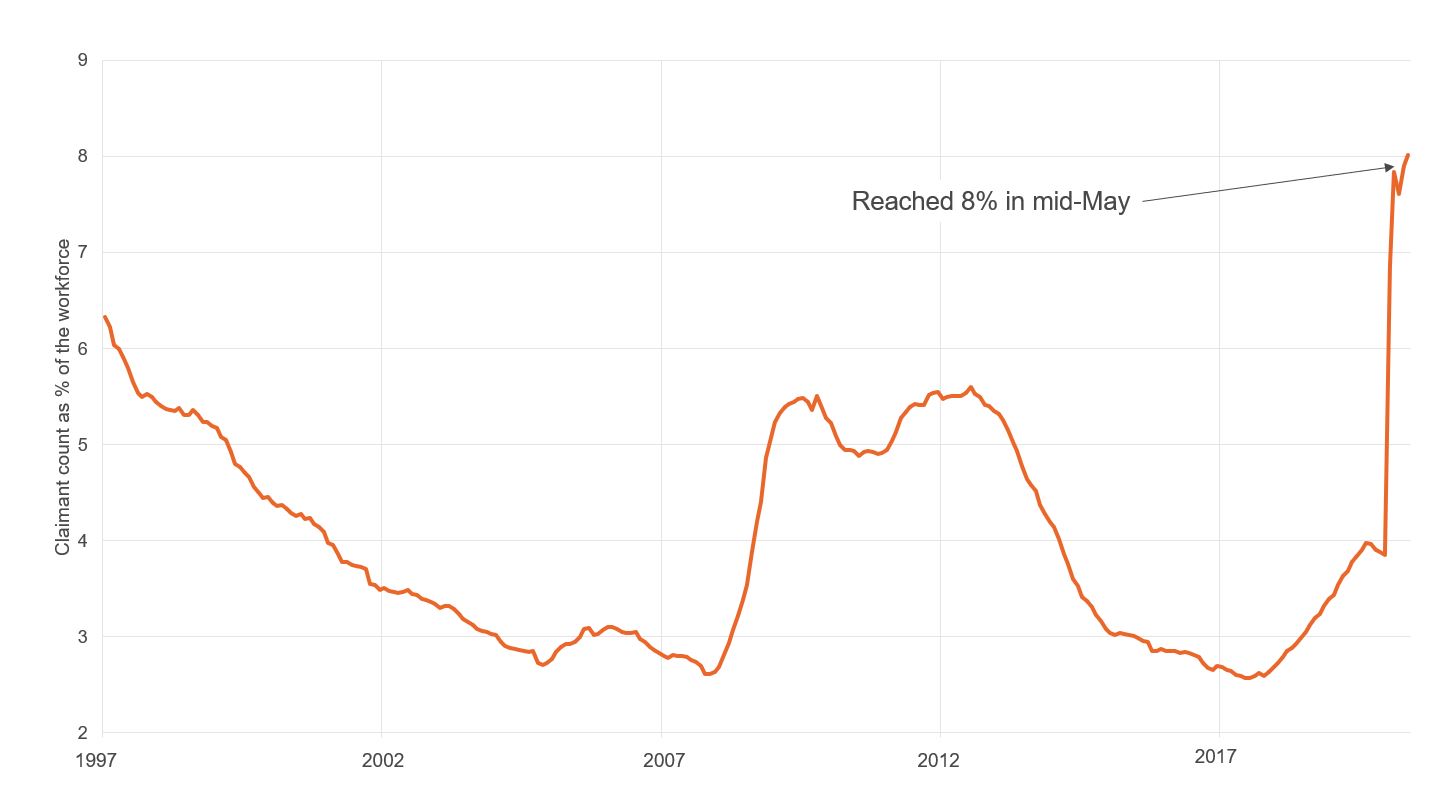

On the other hand, the claimant count rate in Wales – reflecting those claiming Jobseeker’s Allowance or Universal Credit and currently ‘searching for work’ – shows a huge rise (108%) from 58,600 in March 2020 to 121,800 in August 2020, already surpassing the levels reached after the 2007/08 global financial crisis. But this measure overstates the true increase in unemployment and is likely to include many people who are still working, furloughed or recipients of SEISS grants (Brewer et al, 2020).

Figure 8: Claimant count rate in Wales (seasonally adjusted)

Source: Regional labour market statistics: HI10 Headline indicators for Wales, ONS (August 2020)

With substantial numbers of workers still on furlough, the winding down of the UK government’s CJRS will be a key test for the resilience of the Welsh economy over the coming months, notwithstanding any possible replacement schemes.

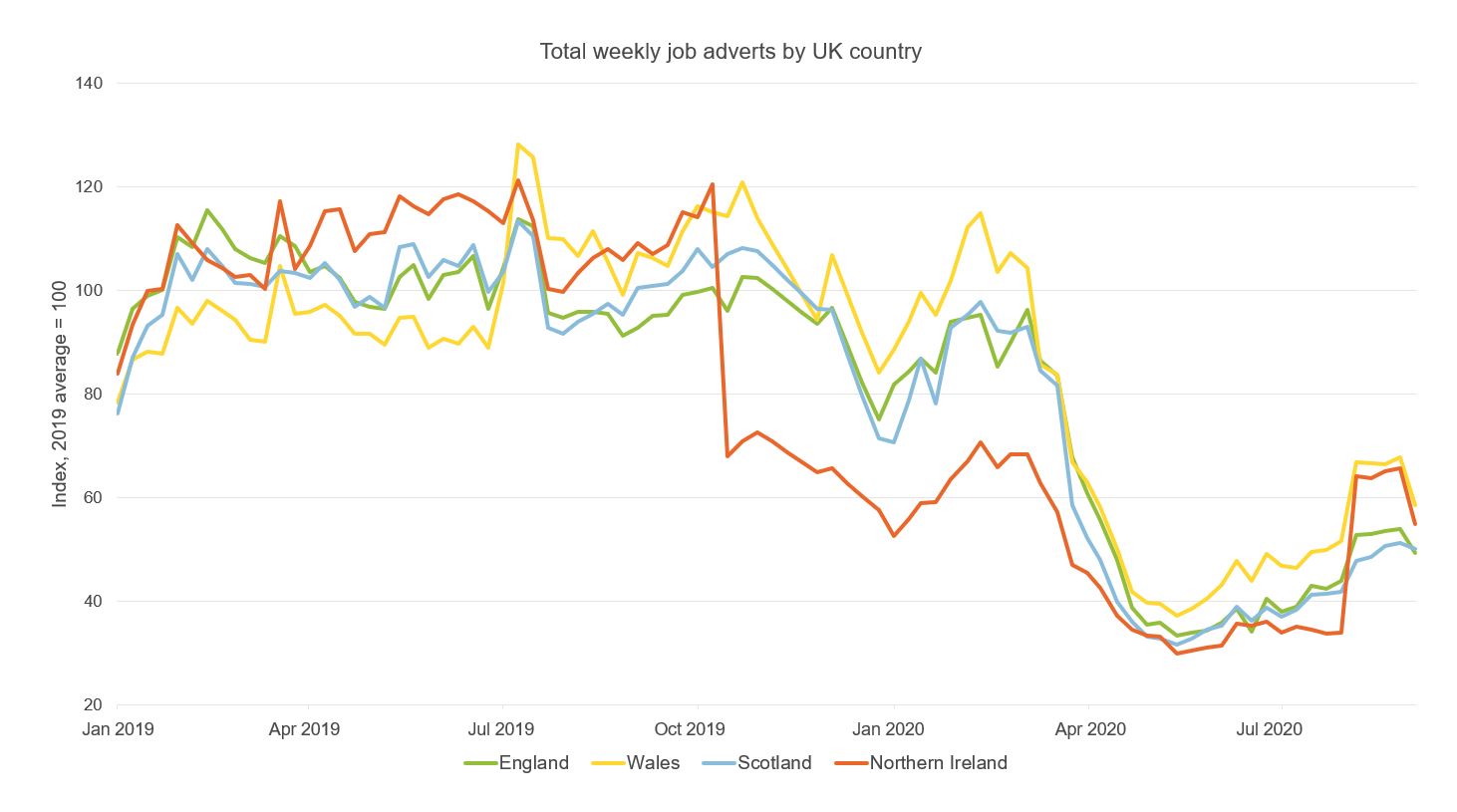

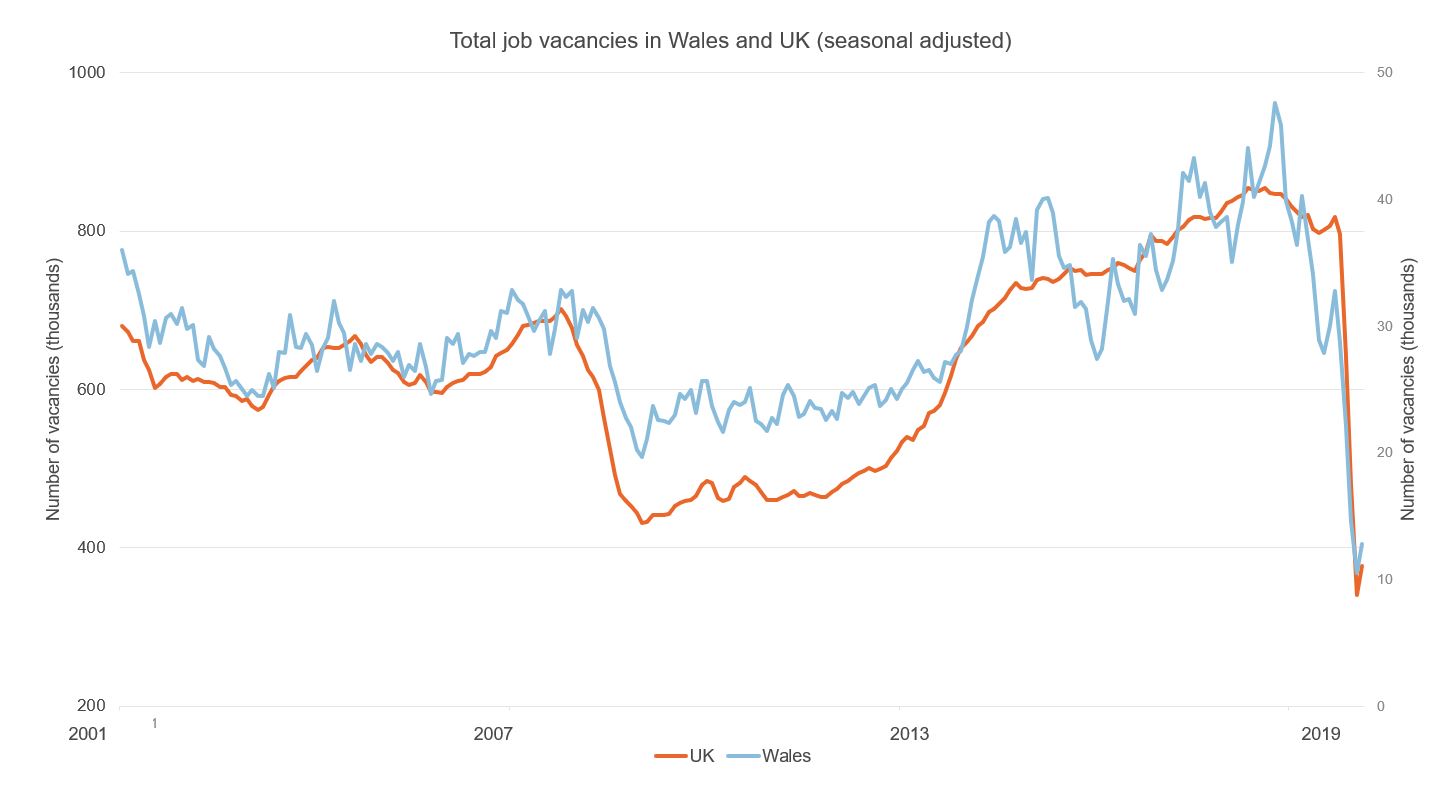

The Welsh labour market – as in the whole of the UK – has also been highly affected by Covid-19. Labour demand measured in terms of weekly job adverts has plummeted, reaching its lowest level in May 2020, which represents a reduction of 48% compared with the level registered in February 2020.

Despite a slight recovery since May, the numbers are still lower than those registered in the pre-Covid-19 period. Likewise, the latest data from ONS vacancy survey show that the numbers of job vacancies are lower than levels seen following the 2008/09 recession. This is likely to reflect a lack of confidence by businesses in the economic recovery. In Wales, total job vacancies have been reduced by 60% since the end of February.

Figure 9: Labour market impact of Covid-19

Source (Total weekly job adverts by UK country): Adzuna, Online Job Advert Estimates, September 2020

Source (Total job vacancies in Wales and UK): ONS Vacancy Survey/Labour Force Survey and author calculations, September 2020

Is the economic recovery faster or slower in Wales?

The relative economic impact of Covid-19 in Wales compared to the UK as a whole is an important consideration. Following the partial devolution of taxes to the Welsh government, the Welsh budget is now influenced by the relative performance of the Welsh tax base.

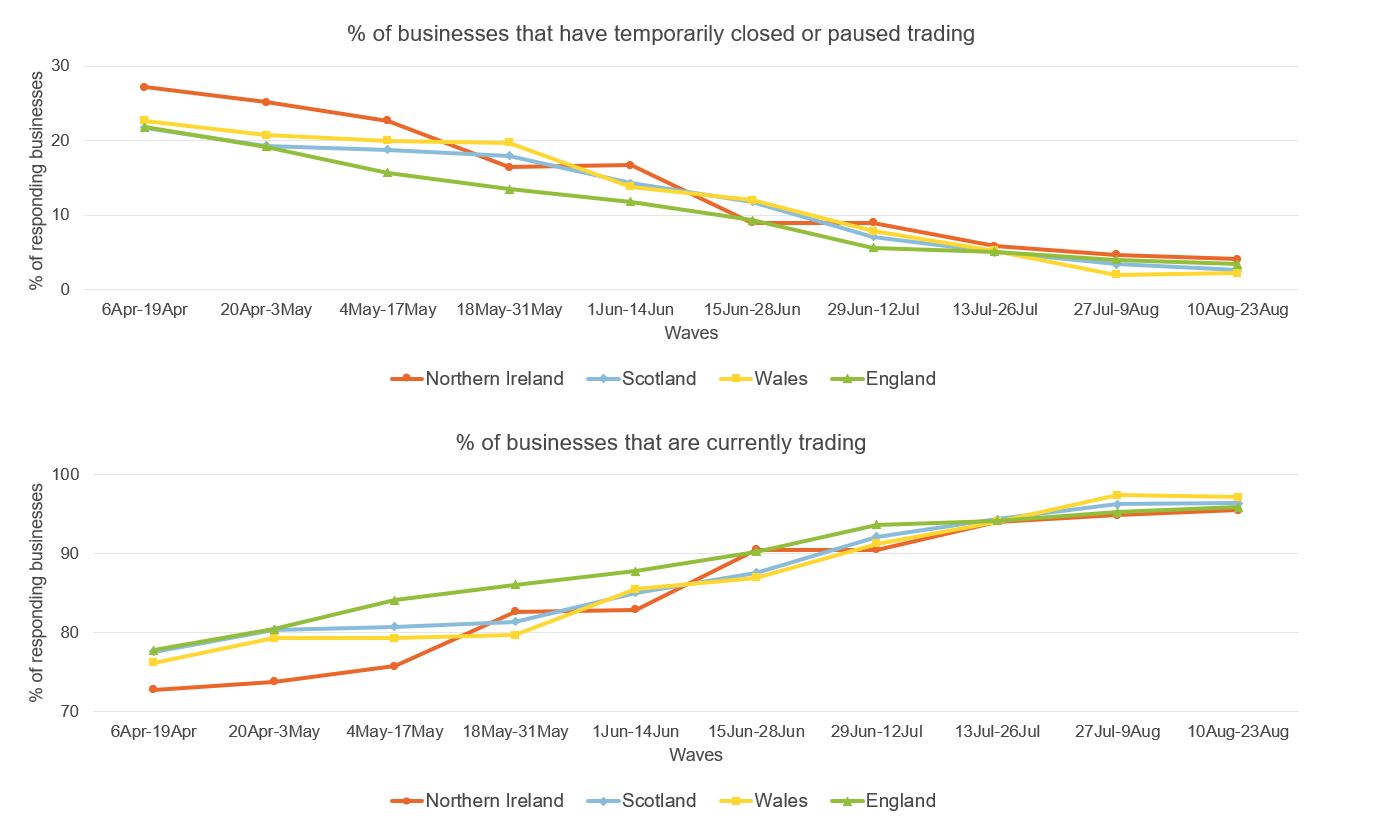

Public health is a devolved matter in Wales and the relaxation of social distancing measures has differed slightly in Wales over the course of the pandemic. The Welsh government has generally adopted a more cautious approach to re-opening of the economy, for example, through the slower re-opening of the hospitality sector and imposition of ‘stay local’ guidance.

The ONS business survey shows that this more gradual re-opening may have had an impact on businesses in Wales – a higher share of Welsh businesses remained temporarily closed for longer in May and June. It is worth noting that since wave 7 – conducted in the period 1 to 14 June – the survey sample design was reviewed and refreshed to improve coverage for the smaller businesses. Taking this change into account, the reported share of Welsh businesses that was temporarily closed fell below the levels in England by early August.

Figure 10: Business impact of Covid-19

Source: ONS, Business Impacts of Coronavirus (Covid-19) Survey data, waves 2-12

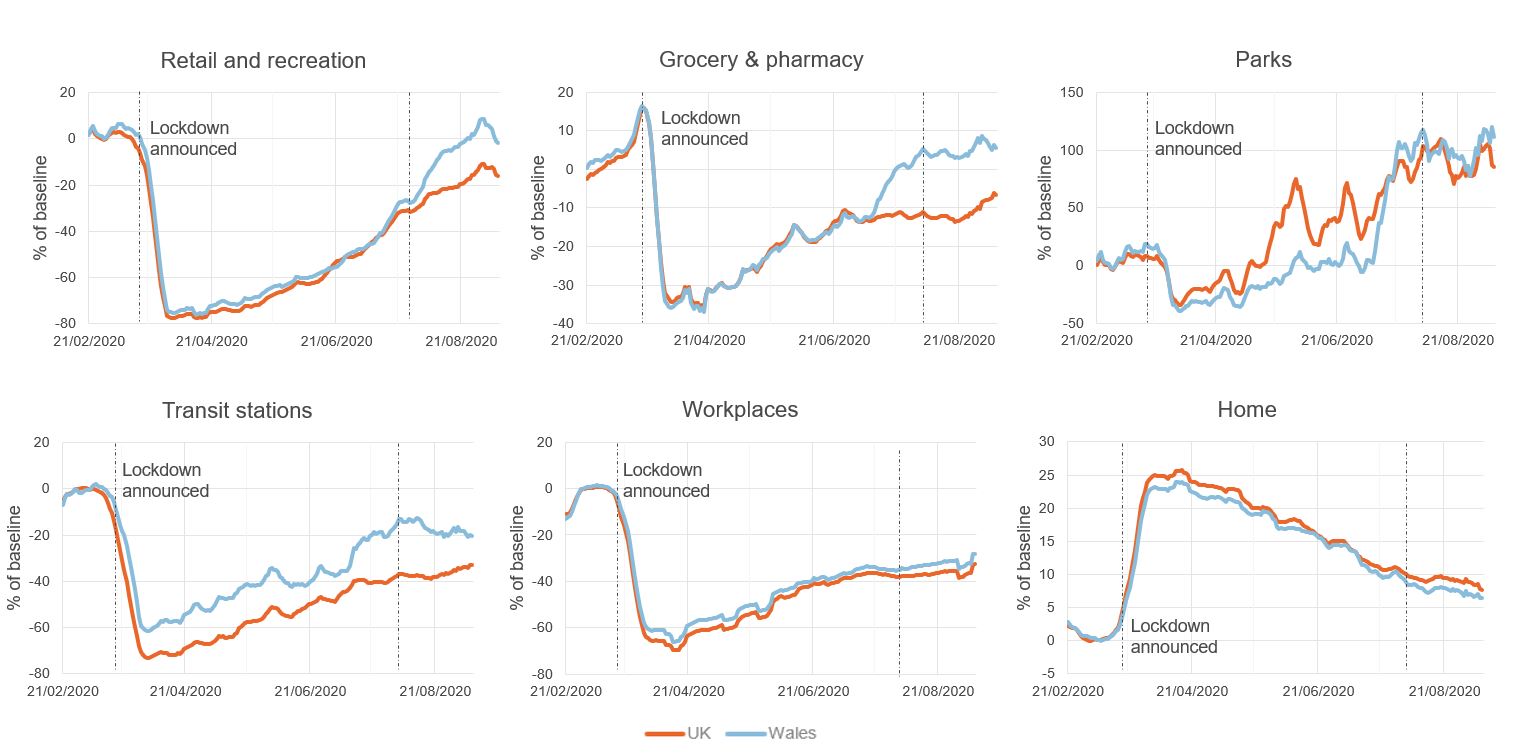

The impact of the ‘stay local’ guidance in Wales can also be seen in analysis of Google Mobility Trends data, in particular lower levels of visits and travels to public parks in Wales during lockdown. But trends in visits and travel to retail and recreation locations (such as restaurants, cafes and shopping centres) were similar in Wales to the UK as a whole during lockdown, following the large drop at the onset of the pandemic.

Figure 11: Community Mobility Trends, 7-day average

Source: Google Covid-19 Mobility Reports

Moreover, the most recent data show a faster recovery to pre-Covid-19 baselines in visits to retail and recreation places in Wales compared with the UK as a whole. This faster recovery in Wales will partly be capturing the greater importance of seasonal tourism in Wales. The lower prevalence of coronavirus in Wales (ONS, 2020) and initial success in dealing with localised outbreaks may also have led to greater confidence to return to pre-pandemic behaviour.

In this respect, the greatest risk for the economic recovery in Wales will be a resurgence of Covid-19 cases over the coming weeks and months, requiring the re-imposition of social distancing measures. At the time of writing, 16 of Wales’ 22 local authorities (containing roughly 2.3 million people, which represents almost three-quarters of the Welsh population) have local lockdown restrictions in place.

What will be the longer-term effects of Covid-19 on the Welsh economy?

While the longer-term economic effects of Covid-19 are highly uncertain, the recovery will depend significantly on UK and Welsh government policies.

A key question will be how government support can avoid the ‘scarring’ effects on the economy that have followed previous periods of high unemployment in Wales. A related question is how policy-makers can help the economy to adapt to the structural and sectoral changes brought about by the pandemic.

In this regard, the Welsh government is responsible for many of the long-term drivers of economic growth, such as education and skills, transport and enterprise support.

With only a fifth of the Welsh population living in settlements of over 125,000 people, the longer-term economic impact may be different from other regions of the UK economy. The need for social distancing and changes in methods and patters of work may erode the advantage of regions with larger cities.

The greater prevalence of home working may therefore be an opportunity for the Welsh economy, as reflected by the Welsh government’s long-term ambition to see around 30% of Welsh workers working from, or close to, home. The economic recovery in Wales will also be affected by changes to the UK’s future trading relationship with the European Union in January 2021, as well as any policies related to the UK government’s ‘levelling-up’ agenda.

Where can I find out more?

- The Wales Fiscal Analysis programme of Cardiff University’s Wales Governance Centre publishes regular reports on fiscal and economic issues in Wales.

- The Welsh government’s Key economic statistics brings together monthly data covering topics such as employment indices, exports and earnings.

- The Welsh Parliament’s Senedd Research InBrief blog often collates research on the Welsh economy and other relevant policy areas.

- The Bevan Foundation produces regular commentary on labour market data for Wales.

- The Wales Centre for Public Policy collaborates with policy experts to produce research on economic and social issues in Wales.

Who are experts on this question?

- Guto Ifan, Wales Governance Centre, University of Cardiff

- Cian Siôn, Wales Governance Centre, University of Cardiff

- Jesús Rodríguez, Wales Governance Centre, University of Cardiff

- David Phillips, Institute for Fiscal Studies (IFS)