UK retailing has been deeply affected by Covid-19 – but the effects are far from uniform and, to an extent, they are accelerating structural changes already happening. Re-opening has seen some reversal of the damage from lockdown, but the long-term direction of the sector remains unclear.

Retailing is one of the largest sectors of the UK economy, with 306,000 shops employing 2.9 million people and with a pre-Covid-19 annual sales volume of £394 billion. The sector takes about 33% of household spending.

Lockdown of retailing on 26 March (28 March in Northern Ireland) was dependent on whether the retail operator or outlet was deemed essential or non-essential. Essential retailing was considered to be food retailing, pharmacies and petrol stations, together with any non-store retailing – that is, internet operations. Essential retailing was allowed to continue to operate, albeit with restrictions such as social distancing; while non-essential retailing was forced to close.

The retail emergence from lockdown varied depending on the jurisdiction within the UK. From 13 July, all retail stores across the UK have been able to operate, subject to specific Covid-19-related operating practices – for example, the mandatory use of face coverings, social distancing and restrictions on numbers and interactions. Shops in England and Northern Ireland were able to open from early June; and in Wales and Scotland, from late June (July for shopping centres in Scotland).

How has lockdown affected the sector?

One of the enduring images of the early weeks of the pandemic was the sight of long queues and vacant shelves in supermarkets. Headlines about panic buying and hoarding generated a sense of crisis around retailing. But as would be seen, these images and headlines masked a much more complex set of effects, both initially and over time.

Food retailing saw a massive increase in demand immediately before and during lockdown, and sales rocketed in this early period. Some of this increase was a transference of sales from the closed food service and hospitality sectors, as people were working and eating mainly at home (Kantar 2020a; Kantar 2020b). Kantar estimate that 503 million more meals per week were created in the home at this time. This caused short-term shocks to some supply chains as demand peaks outstripped supply systems, including for flour, pasta, yeast, some tinned goods and, perhaps more bizarrely, toilet paper.

While food retailing saw demand increase, non-food retailing (having been defined as non-essential retailing) was closed unless these businesses had an online presence. Primark, for example, went from monthly sales of £650 million to zero. Some retailers struggled to operate internet sales and home delivery due to initial concerns about safe operation of their warehouses and distribution centres. Next, the clothing retailer, opened online operations but had to pause them to sort out safe operations.

Many other smaller non-food retailers had no option but to shut down. Store closures, both temporary and permanent, have impacts on employment in retailing. Shedding labour (which typically comprises young, female and part-time categories of employees) and the use of furlough schemes were immediate responses, although in food retailing, additional (often temporary) workers were needed to meet increased operational requirements and demand. Food retail workers were recognised as ‘key workers’ for their role in keeping food supply systems operating.

Even with food retailing, different locations and types of operation had different experiences. Local stores and local convenience retailers (often independents and cooperatives) did very well as travel restrictions under lockdown encouraged local dependency and a sense of community. Stores in city centres where visitors and workers were absent were much more badly affected.

Due to the restrictions, there was a major effort by food retailers (and many non-food retailers) to expand the scale of their internet operations. Home delivery and ‘click and collect’ slots (plus some products) had become scarce or unavailable, as people shopped from home in lockdown. Major retailers expanded such services, with Tesco doubling their home delivery slots over a period of a month. Local stores and community groups added home delivery to their operations, and smaller retailers (and wholesalers and producers) opened an online offer.

In non-food, Amazon and other established online retailers, expanded sales further and online sales grew quickly to compensate for closed stores and the lack of physical customers. Online sales have been the major beneficiary of the shift of channel.

As lockdown has eased, retailing has opened up again, but slowly, carefully and differentially. Non-food retailing has re-opened, but it is dependent in many places on footfall from residents, visitors and workers. With restrictions on tourism and hospitality, as well as continued working from home, sales impacts are often quite specific to locations. For example, the recent ‘firebreak lockdown’ in Wales has seen non-essential stores ordered to close again.

What longer-term risks does the crisis pose for the retail sector?

The headlines have shifted from empty shelves and panic buying in the early stages of the pandemic to store closures and job losses. Hardly a day goes by without a headline about another major retail chain closing stores or of a restructuring that costs jobs both at head office and in stores. For many large retailers, such restructuring and closures pre-dated the pandemic, and it is difficult to disentangle the pre-pandemic trends and the impact of pandemic. Most commentators agree that the pandemic has accelerated these trends and sector restructuring.

Two particular dimensions of the pre-existing restructuring have been exacerbated by the pandemic. First, the growth of internet retailing during the pandemic is marked and reinforces a shift already underway.

Second, the costs of retailing from large units in city and town centres have outweighed the returns for many over a number of years. The pandemic has reinforced this (despite a year-long rates holiday for retail from March), with visitor and commuter numbers to many cities and larger towns having fallen and out-of-town retail centres being perceived as easier and possibly safer to access. Thus, despite overall sales recovery, there are concerns about the future of retailing in city and larger town centres.

These impacts have led to a constant stream of headlines around the ‘death of the high street’ and a retail sector in crisis. These trends pre-dated the pandemic, but they have also been exacerbated by it. Store closures, particularly by national chains, and the associated job losses are likely to continue.

Less visible, however, are a set of changes at a more local level. Local stores, especially in food, have maintained their pandemic gains. In some towns, there has been a growth of independent retailing, building on a sense of community and place, and on working from town/homes rather than commuting to cities.

Local stores have collaborated to provide online a broader place-based offer. Producers, both in food and non-food, have moved sales direct to the consumer. With the issues early in lockdown over the supply of products, more interest has been generated in local supply chains, farm shops and localism generally.

Prior to the pandemic, there were national concerns about food insecurity, and the presence and use of food banks had risen sharply. Inequalities in access to food have been exacerbated by lockdown and there are concerns over impacts on diet and health. A redesign and rebalancing of the food system may be needed.

Groups such as the elderly have been particularly affected through, for example, the replacement of cash by contactless card payments in many stores. Disabled groups feel that retailers and councils have not considered their needs within the new operating restrictions for shops and towns. Disadvantages may have been extended or expanded.

What does the evidence tell us about the risks?

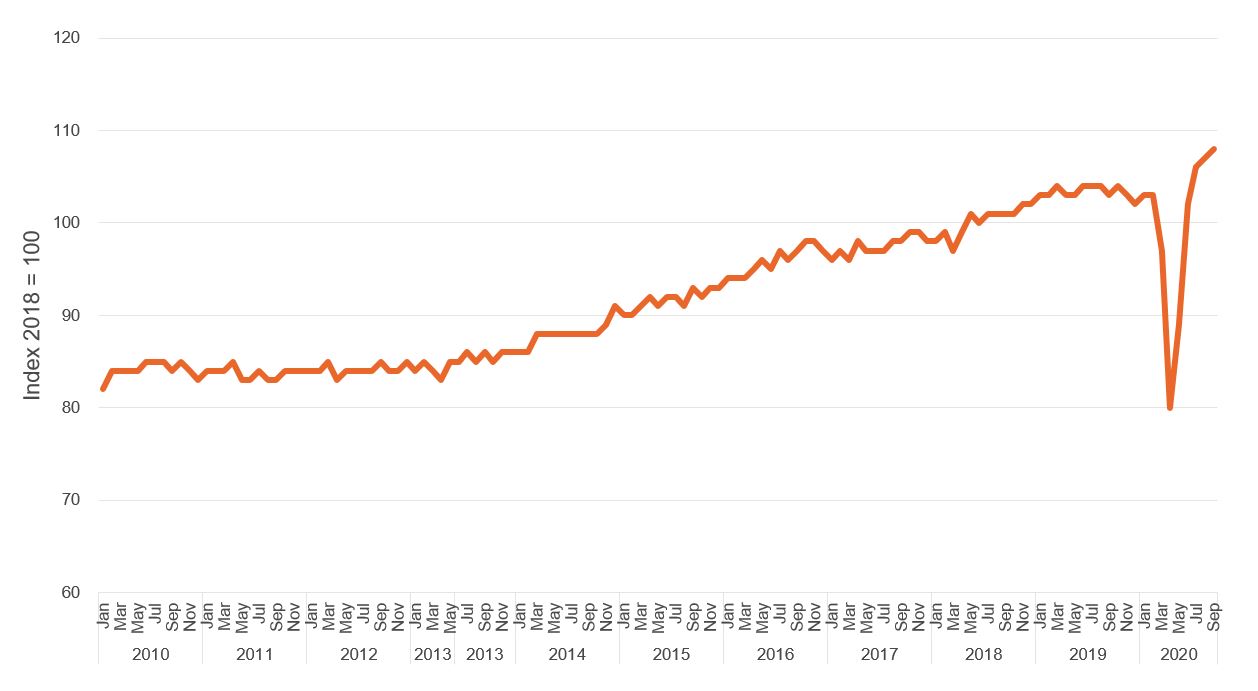

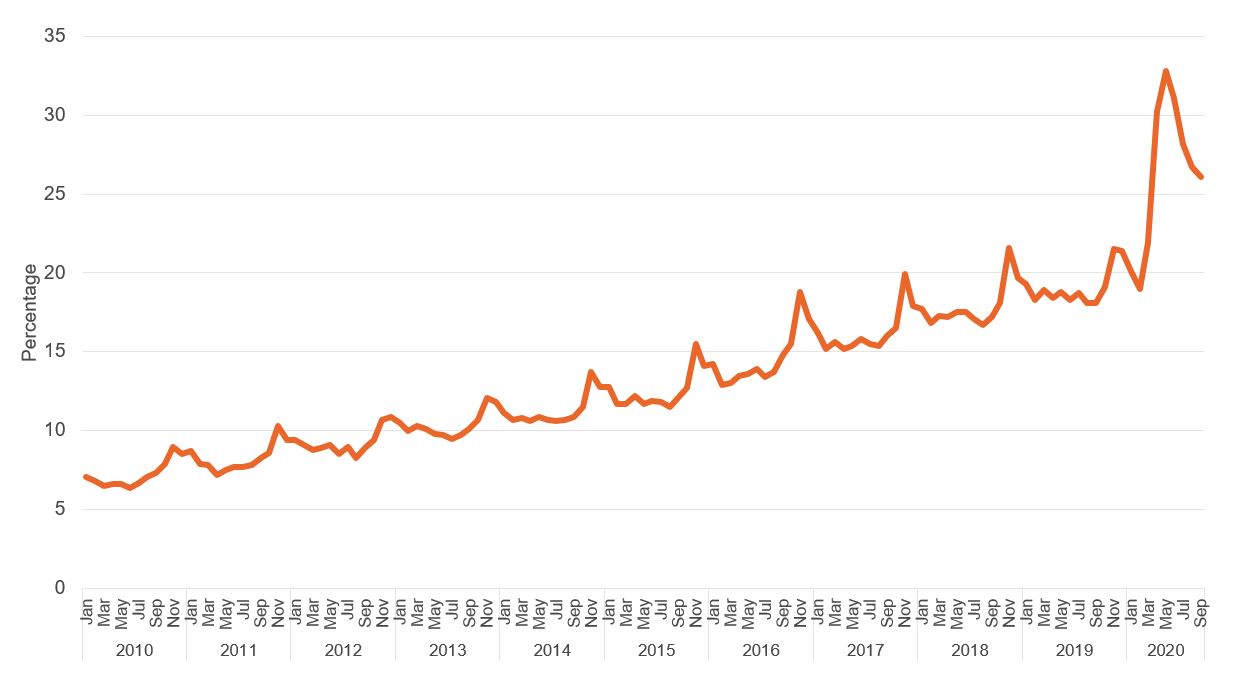

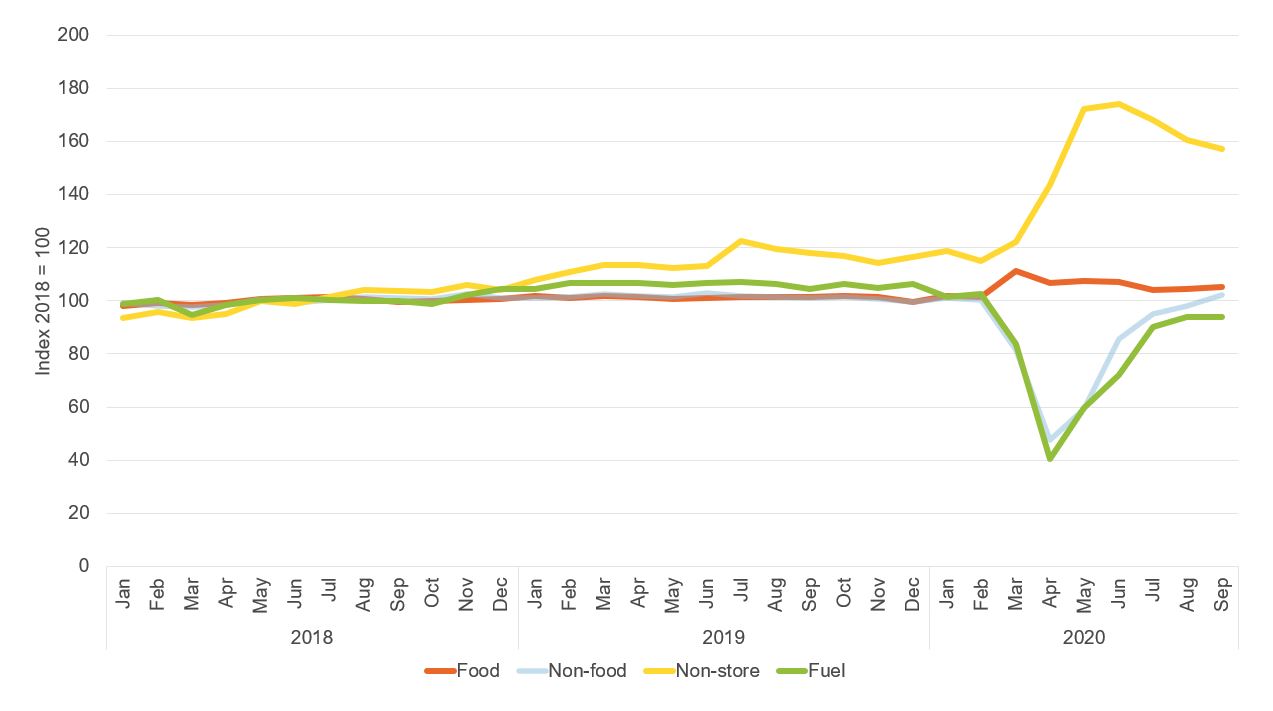

The main source of data on retail sales is the Office for National Statistics (ONS). The monthly data on sales through stores and via the internet show the unprecedented impact of the pandemic (see Figures 1 and 2), as well as the differential between food and non-food retailing, and between online and store sales (see Figure 3). The reduction in fuel sales also points to the reduction in movement over this period.

Figure 1: Retail sales, volume index, seasonally adjusted

Source: Office for National Statistics

Figure 2: Internet sales as a percentage of total retail sales

Source: Office for National Statistics

Figure 3: Retail sales, volume index, seasonally adjusted

Source: Office for National Statistics

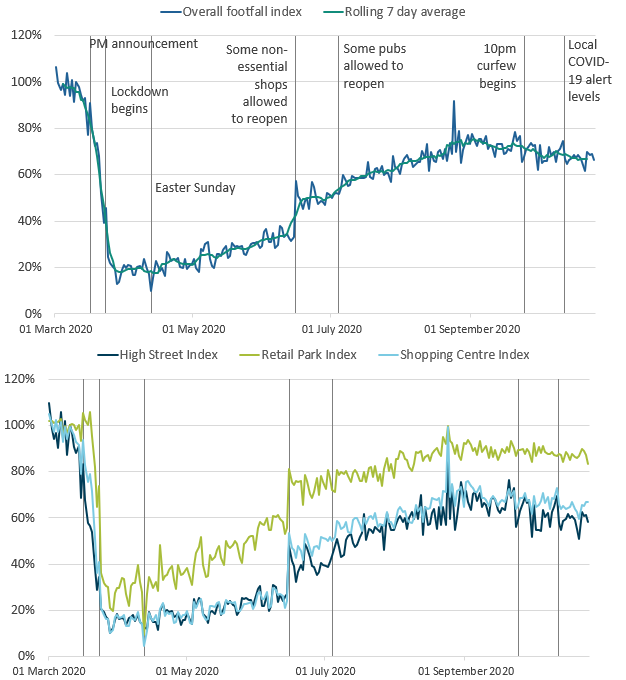

A second area of focus is footfall. One of the main providers is Springboard. Footfall data likewise show the impact of lockdown and its easing, and the differential between physical retail locations (see Figure 4).

Figure 4: Footfall data (volume of footfall, percentage change from the same day the previous year, UK, 1 March to 25 October 2020)

Source: Springboard and the Department for Business, Energy and Industrial Strategy (downloaded from Office for National Statistics)

Interest in the pace and dimensions of retail recovery has generated some new data sets and analysis. Some of this is partial, but it is nonetheless interesting in demonstrating both the differential impact and recovery, but also the future potential for new sets of data (often in combination) to help inform our understanding of the sector:

- Data from the Local Data Company published in the Guardian show store locations and lockdown openings in selected towns.

- The Ordnance Survey and the ONS have been developing longitudinal data on high streets across the country.

- The Centre for Cities has focused on tracking city-level recovery.

- The Oxford Covid-19 government response tracker has a range of data associated with lockdown and impacts.

- The Centre for Economic Policy Research publication Covid Research: Vetted and Real-Time Papers contains studies with novel transactional data sets to examine consumer behaviour in various countries.

- Commercial firms such as CACI provide data on a range of activities and measures, including customer movement, as for example in their weekly report.

How reliable is the evidence?

There are issues with the data available, although the broad trends they highlight can be considered reliable. Where concerns arise, it is often in terms of disaggregation and interpretation.

Sales data attribution to place (whether physical or virtual) is not that clear and may be inconsistent – for example, what actually comprises an internet sale? Knowing how towns were performing in sales terms would enable a more local understanding and response. The same would be true with shop numbers and jobs data, but here some commentators and aggregators ignore small store and independent changes. There are few widely available sales data on consumer spending across and in retail stores and disaggregated by place and product.

With footfall data, there are issues with consistency and comparability as well as coverage. The relationship between footfall and sales is unclear at a local level. During the pandemic and the easing of lockdown, comparisons of activity year-on-year make headlines but they are arguably not informative. The move to working from home, differential openings of shops and sectors in places, and the restrictions on tourists and public transport all make footfall a secondary rather than a primary indicator.

What further evidence is needed?

The biggest gap is at the level of place. Retailing is often a local activity and people relate to local stores, places and towns. Our data at this level are lacking or inconsistent. Some place managers try to collect data but these are often partial and inconsistent. If we could link sales data to place and consumers, then we would have a much better understanding of behaviour at an operational level.

The rise of the internet has also raised issues of its scale and scope. Many businesses are multi-channel, and sales and returns are place-independent. The rise of the internet has also created employment, as, for example, with delivery drivers and companies, but this is not necessarily captured in retail data, although it may be recorded in other sectors. What comprises retailing, and how and where we measure it are important questions.

Where can I find out more?

The links in the section above on data contain details of work in progress in a range of settings and related to the impact of Covid-19 on retailing. Specific items of interest might include:

- Consumer spending responses to the COVID-19 pandemic: An assessment of Great Britain: An Enterprise Research Centre report by Dimitris Chronopoulos and colleagues

- COVID-19: Impact on the urban retail food system, diet and health inequalities in the UK: Study by Steven Cummins and colleagues.

- Household spending in lockdown: Blog by Dawn Holland at the National Institute of Economic and Social Research.

- Competing during a pandemic? Retailers’ ups and downs during the COVID-19 outbreak: Eleonora Pantano and colleagues in the Journal of Business Research.

- How Covid-19 has exposed inequalities in the UK food system: The case of UK food and poverty: Study by Madeleine Power and colleagues.

- Impact of Covid-19 on consumer behavior: Will the old habits return or die?: Journal of Business Research study by Jagdish Sheth.

- Consumption in the time of Covid-19: Evidence from UK transaction data: CEPR study by Paolo Surico, Sinem Haciouglu and Diego Kaenzig.

Who are experts on this question?

- The Consumer Data Research Centre (CRDC) comprises an extensive partnership of researchers and companies and other organisations working on data and consumer behaviour, including in retailing.

- At the University of Stirling, Leigh Sparks and colleagues are working on aspects of retail change and policy.